I’ve been getting a great response to this series so far.

A lot of young people have told me how refreshing it is that someone finally understands how hard it is to buy a house these days (which I proved in PART 1), and my analysis of The Big Five really opened their eyes to the factors driving property prices over the past twenty years (PART 2).

Sometimes it’s a relief just to know that there is some reason to it all. A lot of kids were starting to wonder if maybe they were just soft…

But the key question I keep getting, again and again, is “what can we do about it?”

How do we solve the affordability crisis in Australia?

How can I buy a house?

I going to take a quick look at some of the strategies on offer. (I’ve only got so much space here, but if you want some real life examples of young people killing it in the property market, take a look at our series The Property Games.)

Some of these strategies show promise. But others are just duds.

Let’s start with the biggest dud of all.

I’ve heard a lot of people saying they’ll wait for the property bubble to burst – for prices to get back to normal – before they get in to the market.

(I know someone who’s been saying that for 13 years now!)

This is a dud strategy if ever I saw one.

First up, a market is a bubble if there is no justification for current valuations. However, in Part 2 I gave you five very good reasons for why prices are where they’re at. Those reasons might reflect some deeper problems, they might be a pain in the arse, but to me, current prices make perfect sense in light of these events.

There’s no bubble, darling.

The second point is, guess who else is praying for a house-price crash?

Investors.

A lot of investors are very bullish about property in the long run (like myself). If prices crash, they have a war-chest ready to go to snaffle up some bargains (I do. It has a little pink lock on it).

Now, think about what happens in a crash. House prices fall, and we’re probably in a pretty deep recession.

At this point, the banks are feeling a lot of pain. Their customers aren’t making their repayments, and they’re having to foreclose on properties (an expensive process), often at a loss.

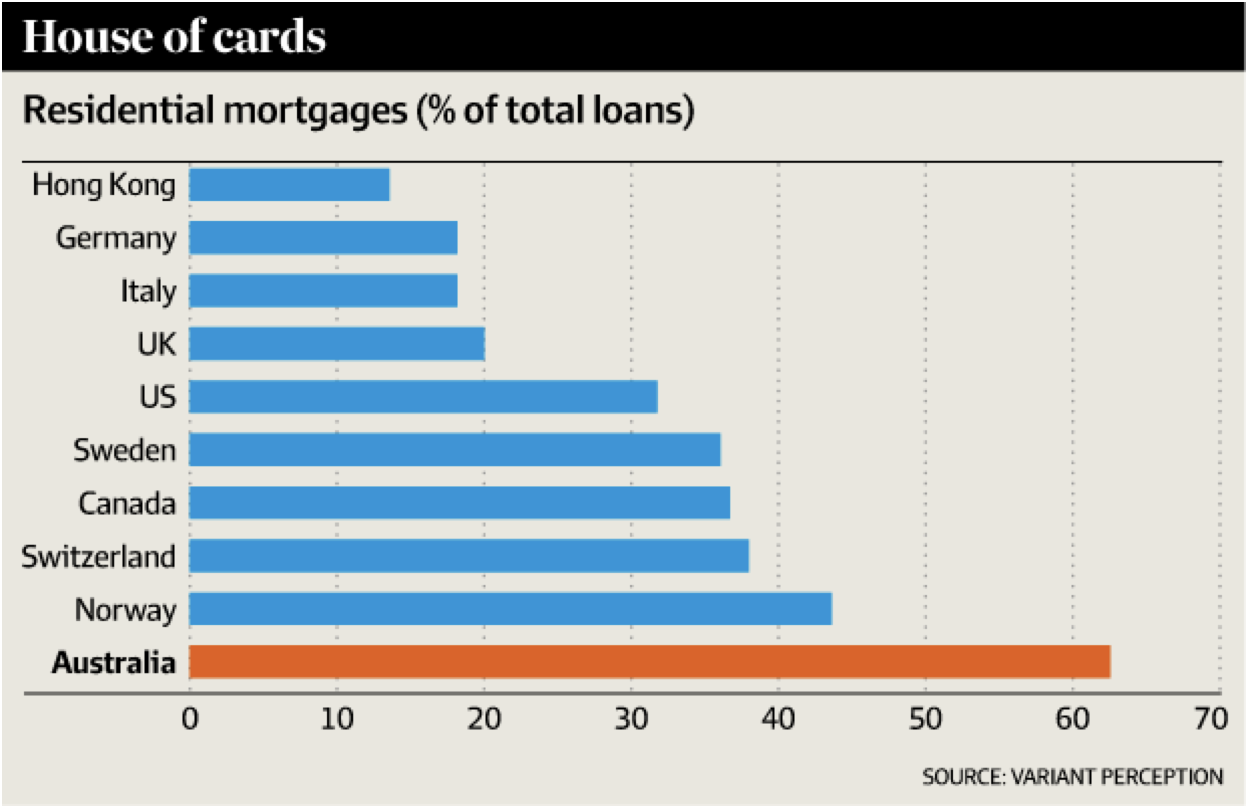

Also remember, Australian banks are some of the most heavily mortgage-dependent banks in the world. We have more money tied up in mortgages than any other country.

So, we’re probably talking a fully-blown financial crisis. Many banks could go to the wall.

Now, imagine that in the middle of this financial crisis (if you’re lucky enough to still have a job!) you go to the bank and try to get a loan.

They’ll have every gear in reverse trying to unwind their exposure to the riskier tail of the housing market.

That probably means you. They are not going to be very excited to see you.

However, if I go in there with a portfolio of collateral, income streams and a history of successful investments behind me, it’s going to be much easier.

It’s still going to be tough, I’ll probably pay much higher rates than I would now, but I guarantee it’s going to be easier for me than it will for you.

A crash hurts poor folks more than it hurts rich folks.

(It’s almost like it’s engineered that way.)

So, once the market bottoms, only rich folks and investors will have access to credit for a while. They’ll snaffle up all the bargains until the market prices get driven back up again.

By the time you’re finally able to get finance, the bargain bin is empty.

And we start all over again.

If you want proof of this dynamic, look at what happened in America after the GFC.

This chart here shows home-ownership rates up until the financial crisis. In 2007, about 69% of Americans owned their own home.

Then the GFC hit, and many property markets saw 20, 30 even 40% falls.

At this point, young and disadvantaged home-buyers stormed in and snaffled up the bargains, right?

Nope. Dead wrong. It was investors all the way.

As a result, home-ownership rates fell off a cliff.

By 2015 – by the time prices finally regained their falls across the board – home-ownership rates had fallen below 64%. They were lower than they were 20 years ago.

(I’m surprised Americans aren’t angrier about this.)

Long story short, don’t go wishing for a property crash.

You just might get it.

So, if this is such a hot-button BBQ stopper, why don’t politicians do something about it? I mean, who would argue against anything that made houses more affordable

The thing to remember is that ‘affordable’ is just another word for ‘cheaper’, and not everyone wants their house – often their most important asset – to be worth less.

People want other houses to be cheaper, not theirs.

And consider this. Currently about eight million Australians own their own homes. Each year, about 100,000 people enter the housing market for the first time.

So, in any given year, there are about 100,000 people who’d like houses to be worth less, while there are eight million who wouldn’t.

That’s a ratio of 80:1.

No politician is backing those odds.

Sorry kids. The grey-heads aren’t going to save you from this one.

I’m not going to lie. It’s not easy. Affordability is a wicked problem. There are no magic bullets, but here’s a couple of ideas that could get us moving in the right direction. I’ll look at Australia as a whole first, and then take a look at what you can do as an individual.

We have one of the largest ministries in recent times, and yet there is no Minister for Housing. As I’ve outlined, affordability is a particularly curly problem, and it involves coordinating Federal, State and Local Government levels.

Getting the cats in for shearing would be easier. Having someone specially dedicated to the job would be a big help.

State Governments have been increasingly treating property transactions as a cash-cow. Stamp duties in particular are a tough pill to swallow for first home buyers. Removing stamp duties and streamlining developer fees and charges is something well worth doing anyways, but it would particularly help first home buyers.

At the very least, tax discounts could be targeted to certain sections of the market in certain geographic areas. This is not too difficult to do.

As outlined above, the CGT discount has allowed negative gearing to distort the market and elevate prices. Either pare it back to something like 25% or return to inflation indexing.

This one is well past its use-by date.

I didn’t have time to go into it here, but if you look at the rise of house prices in Australia, it’s all about land. Construction costs haven’t really changed.

That being the case, we should be looking for ways to make smarter use of our land. That doesn’t necessarily mean apartment high-rises, but between the detached house and the high-rise, there are a lot of options. Clustered co-housing models could also help the story here.

There’s scope here for people and local councils to get more creative with the housing stock they are bringing to market, and we shouldn’t make it more difficult for developers who think outside the box.

Our tradition of using 25 and 30-year loans comes from a time when working lives and life expectancies were shorter.

Perhaps younger people could be offered longer loan terms, which would reduce the weekly payments required. This doesn’t help with the deposit hurdle, but it does ease the mortgage burden for young people.

My fear is that so many people have grown up knowing nothing but endless price gains that they have no idea that markets can go up and down. They believe that prices double every seven years, without question.

With houses being arguably the most important asset we ever purchase and with such huge sums of money now involved, I would love to see Property Economics taught in schools. Help people understand the basics of leverage, mortgages, and the factors that drive markets. Help them understand how to calculate the fair value of a home or investment.

Tell me this is less important than algebra.

I’d also love to see subsidies for property self-education or at least tax deductibility. If everyone had a better idea of how the property market worked, prices would be better aligned with fundamentals, and we wouldn’t be putting the less-savvy buyers at risk.

As I outlined in Part 1, it is the deposit that is the biggest hurdle to property ownership. In this context, we need to make building a deposit our biggest priority. In part, that means savings – maybe that doesn’t mean living like a Soviet peasant, but it does mean watching your pennies closely and being clear about the financial decisions you’re making.

However, savings is only one side of the equation. Earnings is the other. Are there ways you can comfortably build more income streams into your life? Are there financial strategies that you understand that can build wealth at a decent clip? There are a few strategies I recommend to my students, but you need to know what you’re doing.

In a market that’s moving quickly, it can pay to stake out a position somewhere that keeps you in the game. More and more young people are choosing to make their first property purchase an investment.

Remember that building a deposit is the name of the game. When you buy property, you put in a fraction of the house price as a deposit, but you keep all of the capital gain. This leveraging can allow you to build a deposit surprisingly quickly.

If this is your strategy, you need to know how to read markets and buy for growth. You also need to know how to manufacture your own growth if you need to (the strategy just doesn’t work without growth). These are exactly the kinds of things I teach my students.

This deposit ladder strategy has worked well for people in recent years, but the property market is always changing. Trends evolve and dissipate. It’s too big a decision just to just jump in blind and hope for the best.

I know a lot of young buyers are leaning on their parents for help with a deposit these days. That’s awesome if your parents have a lazy $80K just lying around (sure kids, just rifle through the Benz and see what loose change is in there.) However, many people nearing retirement don’t have that kind of wiggle room in their financial plan.

An alternative may be to partner up with your parents on an investment property or portfolio. Many students come to me without a brass razoo to their name. However, after they’ve mastered the materials, they’re in a position to become what we call a “knowledge partner”.

(This is exactly how Naomi built created almost half a million dollars profit for her and her father in The Property Games.)

Knowledge partners pair up with other investors in our network who have capital and/or borrowing capacity. They then go and find a deal together and share in the profits.

I’ve seen this strategy work time and time again, and I’ve seen it work well in families where some members are asset rich but time poor, and other family members have the time and capacity to skill up and master the materials.

Rather than taking a large chunk of your parents retirement plan and ploughing into the house of your dreams – where the equity could be stuck for years – financially speaking, it can be a much better idea to keep renting and grow your wealth together.

Your parents will end up with an even better standard of retirement, you’ll quickly build the deposit you need, and it’s champagne and prawns for Christmas.

If you want to see some real-life examples of young people starting with nothing (or less than nothing), and forging a path in property, take a look at our Property Games series. The results are amazing.

I think they offer definitive proof that millennials are not soft. They not just sitting around waiting for a hand-out. They are creative, resilient and driven.

But I might say that. I love those kids.

Whatever path you take – whether it’s one of these or some other strategy – there’s one essential ingredient: knowledge.

People will tell you that property investing is easy. I don’t think it’s that they’re deliberately trying to mislead you. I think they genuinely believe it’s easy because for almost 20 years it has been an easy market.

The five disruptions I outlined above have given us one of the greatest bull runs in modern history, but people don’t recognise that. They just think prices went up because “that’s what they do.”

Even without getting into the trends that shape markets, there are many ways to be a better investor – knowing how to structure joint ventures, knowing how to optimise your tax, knowing how to firewall your assets.

The trends are important too, and they are constantly evolving. It’s this knowledge of market dynamics that separates the A-grade investors from the pack.

A little knowledge goes a long, long way.

I know some of you will find this stuff a bit overwhelming. I know a lot of people were just hoping that the property market would go “back to normal” at some point, and they’d be able to get a house without selling organs.

I get that, and it’s a bugger.

However, now you know why the market is what it is. Now you have a sense of the scale and scope of the problem.

That’s the first step towards finding a solution.

It’s not going to be easy. It’s going to involve some sacrifice. It’s going to involve some ingenuity and some creativity. But I believe in Australia’s future. I believe in the courage and creativity of our kids. If anyone can do it, you can.

And if people are willing to help themselves, I’m willing to help them. My training programs are open to people of all ages from all walks of life.

If you knew how amazing it is to watch someone go from nothing to complete financial independence, you’d understand why I do what I do.

I genuinely hope that it might be you one day too.

So that’s it folks. I trust that you’ve made good value of the information I’ve laid out for you here. Feel free to share it around so we can improve the average savviness of the Australian market.

And whatever road you take, I’m wishing you all the very best.

x

Dymphna.

P.S. – if you need more inspiration, make sure you check out The Property Games. The results will get you excited.