I tell you what to expect this year

OK, put away the leftover Christmas pudding it’s time to get serious.

What’s the outlook for property in 2024?

I’ll get into the numbers in a separate post, but in this piece I wanted to outline the key themes that are going to drive the property market this year. And if you can’t be bothered reading all the way to the end, the key take away is that all of these themes are strongly price-positive. That sets us up for a bumper year.

Let me run through them.

1. Interest rates

Right now we are at an Inflexion point in the interest rate cycle. After a very aggressive hiking cycle – one of the most aggressive in the world as it happens – pretty much every economist in the country now expects that the next move in interest rates will be down.

The question now is when? Maybe it will be as early as April? Maybe it might be as late as September. It’s hard to say, and to be honest I wouldn’t really stress about it.

In the next cycle falling interest rates will act as a catalyst, unleashing the pent up pressure that has been building in the property market over the past 12 months.

Rate cuts are coming. It doesn’t really matter when.

2. Rental market tightness

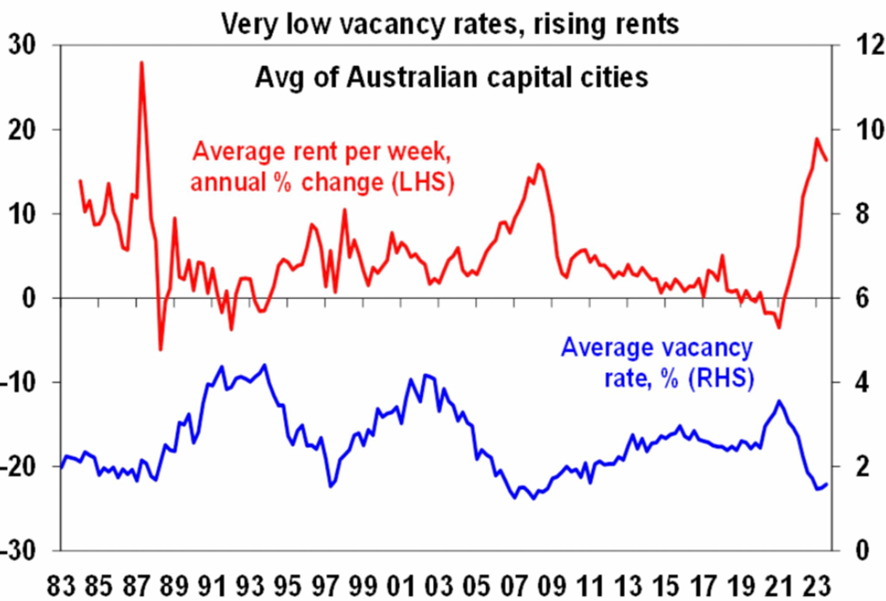

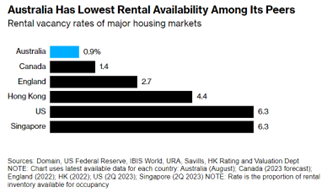

The incredibly tight rental market conditions we’ve seen over the past 12 months will continue for the foreseeable future. Vacancy rates will remain at record lows, and rental prices will push higher and higher.

It’s worth remembering that Australia currently has the tightest rental market in the world.

Rising rents feeds directly into rising prices.

3. Housing shortage

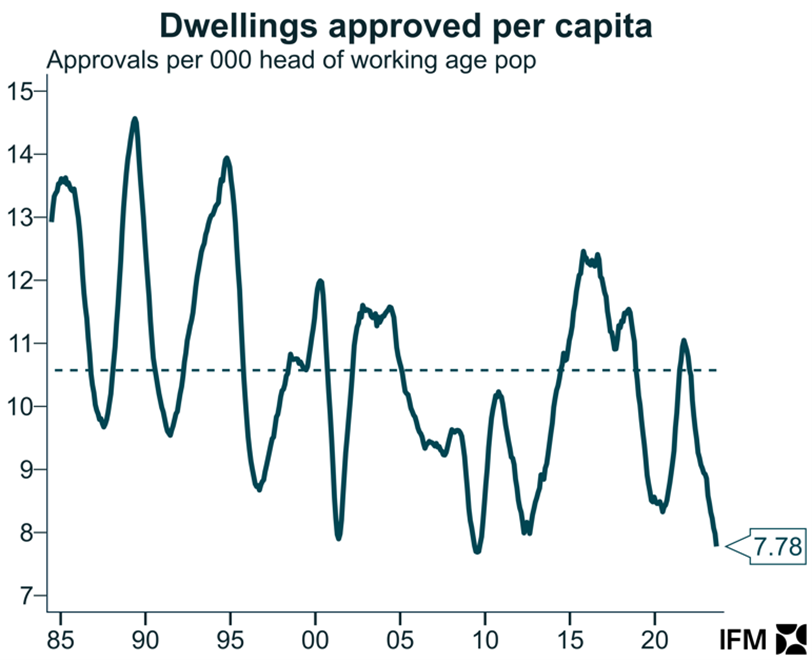

In 2024 Australia will continue to struggle to build enough houses. Terms of dwelling approvals per capita we have one the worst run rate in 50 years. The housing shortage is going to get worse not better.

4. Low stock on market

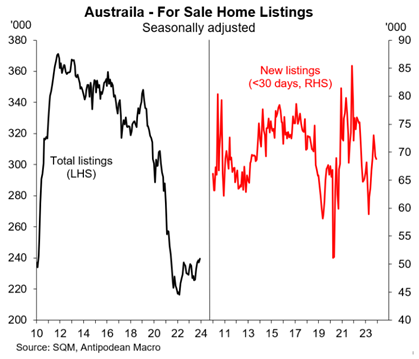

At the same time as we’re building too few houses, there is a real shortage of available stock on the market.

When you look at total listings here you can see they collapsed in 2018 and never recovered.

With demand rising with population growth this shortage of stock will translate into upward pressure on prices.

5. The return of investors

As interest rates began to rise, many investors sat it out on the sidelines, since investors are much more sensitive to interest rates than owner occupiers.

However now that interest rates have stabilised and are expected to fall, investors should return to a market right with opportunities. The lift in Google searches for ‘investment property’ reflects this.

6. The Return of Overseas Buyers

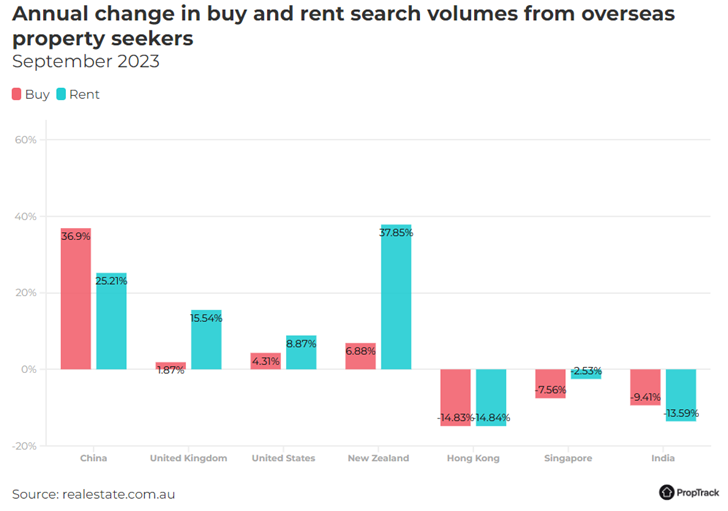

At the end of last year we also saw a resurgence in interest from overseas buyers, particularly out of China. This will continue into 2024.

When you put it all together you can see that all the ducks are lining up for a very strong year in the Australian property market.

Don’t miss out.

DB