Investors keep taking hits as budget disappoints.

Ok, a few people have been asking what I made of the budget. Here’s my thoughts:

The Godot Surplus

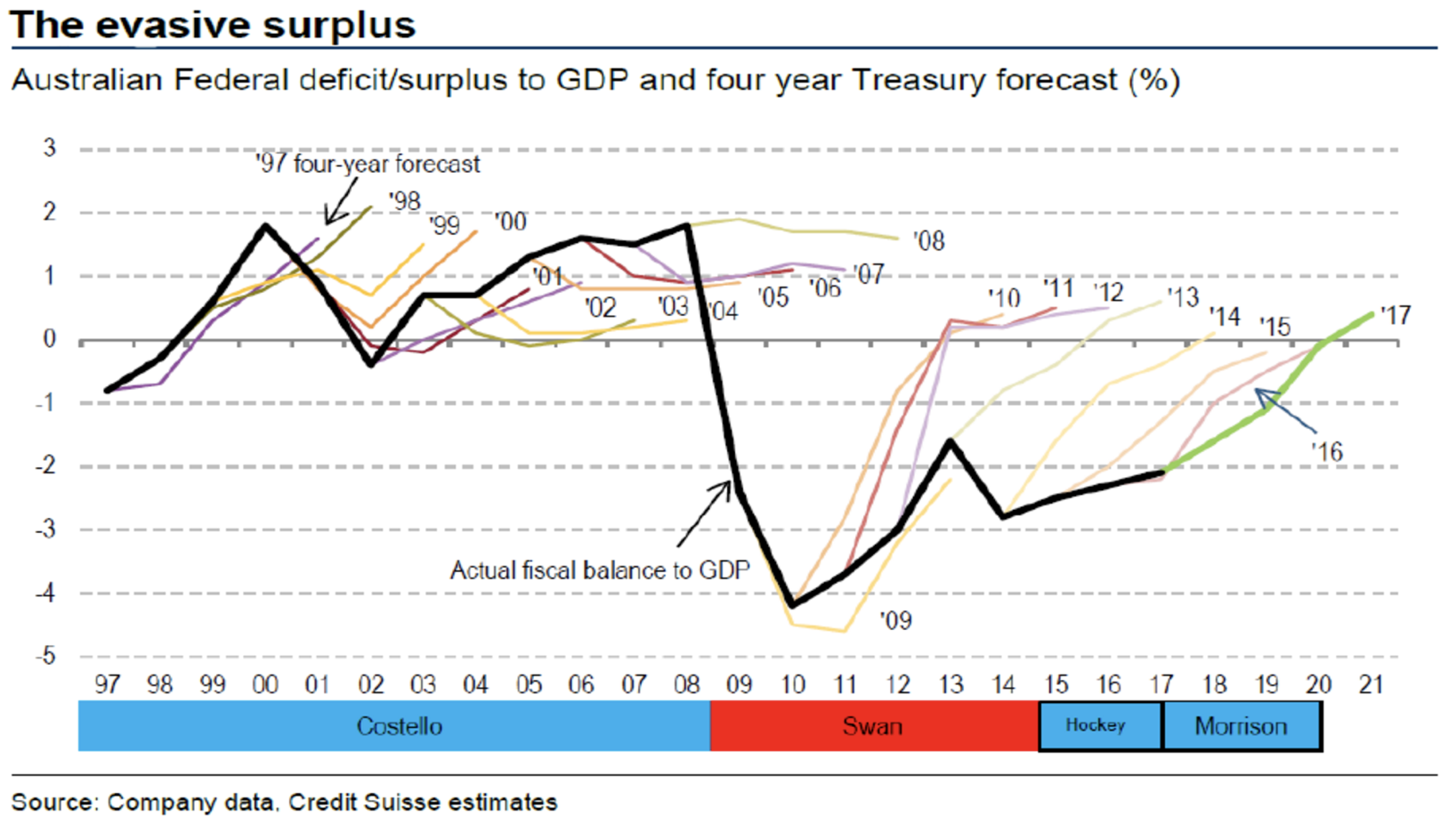

First up, overall, this budget looks like another piece of fiction – like every budget in the past ten years. We see the budget returning to surplus four years from now – on some fairly heroic assumptions, mostly around a surge in wages growth that just comes out of nowhere.

This chart here shows the budget predictions for all of the previous budgets. You can see they consistently miss, and it does make you wonder why we bother.

But that’s ok. As we all know, there’s no reason to fear debt per se. The only question is what you’re doing with it.

But that is another question…

Property – slightly negative

Ok, let’s look at property. There’s a few things here that will have an impact on the property market, but overall the budget is a bit disappointing. And I guess that’s because expectations had really been raised that we were going to see some big-ticket items in this year’s budget.

Affordability had been thrust front and centre, and the government itself was flying ideas up all sorts of flag poles in the run up to the budget. But in the end, it looks like it was all too hard, and they’ve settled with tinkering at the edges.

That said, that could actually be a blessing in disguise. When it comes to government intervention, less is often more, know what I mean?

Bank Levy

Probably the one that’s going to be most interesting to see how it plays out is the new levy on the big 5 banks. It’s set to raise $1.5bn a year. Since the big 5 post profits of about $30bn a year, we’re looking at something like an additional 5% on profits.

It’s not nothing.

However, the way it’s structured (being a tax on their liabilities, not their profits) it actually looks designed to feed straight through into mortgage rates. Their cost of funds has just gone up and they won’t be shy about passing that on to borrowers.

And the ACCC won’t stop them. APRA and the RBA won’t stop them (they’ve actually been pushing for higher rates already).

And since these government agencies have been looking to curb investor lending already, I’d expect to see these two drives combine into higher rates for investors in particular.

So they might call this a bank levy, but you could just as easily call in a property investor levy. (But they wouldn’t, right?)

It’s too early to say how this will feed through just yet. My guess, and it’s just a guess, is that it might be worth about 25-50 basis points.

But since it’s applied only to the Big 5, and not the market overall, it’s a little hard to tell. It depends on how competitive the market is at the time.

So it might not be a huge negative, but at this stage we can definitely say it isn’t good news for investors!

Travel Ban

Going from the bad to the annoying, investors have just lost the ability to claim travel costs as a deduction.

I mean really? FFS

Ok sure, I know some slick marketing agencies on the Gold Coast were selling the ability to claim a Gold Coast holiday on your tax, but all tax rules have problems in implementation.

And that’s what the ATO is there for. To make sure people are playing by the rules.

But they haven’t done that – they haven’t tried to tighten the rules up. They’ve just said, Nope. You can’t claim travel as a deduction anymore.

Now if you’re investing regionally, then obviously this is a legitimate business expense.

And what’s it going to do? It’s going to discourage people from investing regionally. It’s going to divert more money into our “bubbly” cities, and just make problems worse.

And the thing that really ticks me off is that the media is lumping this in with negative gearing. “They didn’t touch negative gearing, but they did remove travel lurks.”

A – it’s not a lurk, it’s a legitimate expense. And B – it’s got nothing to do with negative gearing.

Grrrr.

The Tinkering

The remainder seem to be about tinkering with the market. There’s more sticks for foreign buyers, who are no longer exempt on capital gains on the PPR. Developers will also no longer be able to sell more than 50% of a development to foreigners, and there’s a nationwide Vacancy tax. Again, these aren’t property-positive, but I don’t seem them having a huge impact.

There’s a new “bond-aggregator” scheme to help fund affordable and community housing. This could be interesting for people working with Hi-Res strategies. We’ll have to see.

Finally, there is a scheme that allows first home buyers to salary sacrifice to save for a deposit. However, the incentives don’t seem to be huge and I don’t see this having a big impact on the market either.

The Up-shot

On the whole, there’s not a lot of joy here for investors, and a few troubling signs. The government seems to have enough confidence in the housing market and investors that it’s willing to let us take a few blows.

And there’s isn’t anything too huge in here, or yet. But when you add it on top of APRA’s macro-prudential 2.0, the pressure is starting to build.

It does make you wonder where we’re heading.

And personally, I’m starting to get a little bit tired of being treated like a football.

What do you think? How do you rate the budget?