Some data is suggesting the market has turned… but can we trust it.

Has the market turned already?

Auction clearance rates are up. Consumer sentiment is up (off the floor). Some price indicators are improving. The headline unemployment rate was better than people expected.

Is the worst behind us?

Look, I’ve made this point a few times that in the early phase of a crisis, you can get some pretty wacky results.

The market is adjusting. The shock is working its way through the system. Things are going to get weird for a while.

That’s why you’ve got to be looking at the market as a whole. Don’t put too much emphasis on any one indicator. Look through the noise and try to draw out the themes.

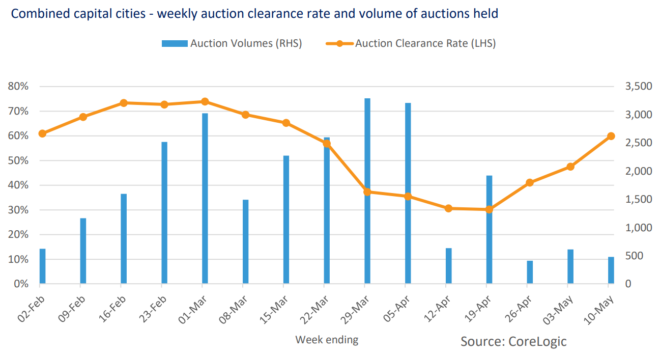

Now, normally, auction clearance rates are one of the most popular indicators we have. They tend to anticipate price movements very well, through all phases of the cycle, and because we get the data just days after it happens, it’s the closest thing we have in the market to a real-time indicator.

And normally, if auction clearance rates were to jump from 47.5% to 59.9%, like they did last week, and up from 30.2% just a few weeks ago, that’d be a bullish sign for prices. That would be pointing to decent price growth in the months ahead.

But these are not normal times.

The thing to note here is that while the clearance rate improved and a bigger share of auctions were delivering a successful sale, volumes had collapsed. The number of properties going to auction has fallen to dramatically low levels.

In fact, the number of auctions last week was 80% lower than before the corona crisis started!

So there’s a selection bias. Auctions only went ahead where sellers were determined to sell or where they felt they had a good chance of getting the price they wanted.

So it’s that selection bias that’s driving the improvement in clearance rates. It’s not coming from any emerging strength in the market.

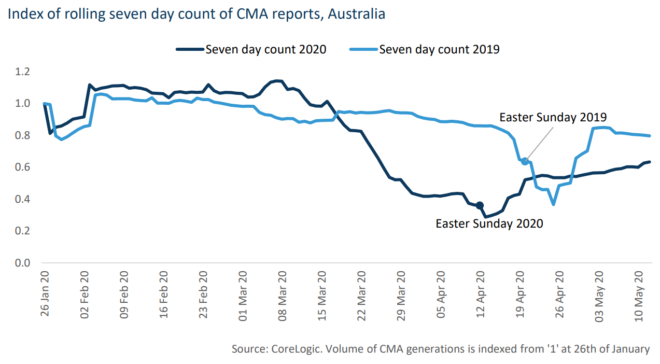

It’s a similar story when you look at CoreLogics data on market reports. A market report is what happens when a real-estate agent asks RP Data and Corelogic to prepare a market report, in order to inform prospective vendors.

As such, it’s a good leading indicator of how much stock is about to come on to the market.

And that data is showing that the number of reports being generated is up 6% over the week to May 10.

Again, in normal times, that would be a bullish sign. Prices tend to rise in hot markets when a large number of properties are changing hands.

However, again, these are not normal times, and there might be a bit of a turning-point affect here.

That is, since most people think we’re at a bit of a turning point for prices, there will be people looking to cash out now rather than ride the bumps, or they’re simply scared about being forced into a sale later.

So I think an increased interest in selling right now probably has more to do with the fact that the market is coming to grips with the reality that we’re at a turning point.

It’s very hard to imagine that it’s because the market is improving and the cycle has turned already.

So be careful over the next couple of months.

The data is going to get a little wacky because these are just wacky times.

Look through the noise and keep your eye on the bigger picture.

And if you don’t have time for that, follow someone who does.

Like me.

😉

DB.