Another cracker weekend for the auction market. I tell you how to make sense of it.

So another weekend, another hot set of auctions.

Across the country, the auction market is lighting up right now.

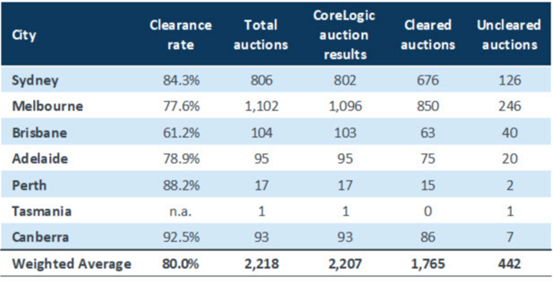

Last weekend, the auction clearance rate hit a flat 80.0%.

It’s been holding around that 80% mark for a few weeks now. It’s clear that we’re in the middle of a buying frenzy.

Remember an auction clearance is when a property successfully sells at auction. This means the seller got the price they were looking for, if not more.

And you’re always going to have some sellers who are just not being realistic, so you’re never going to hit 100%.

But at 80%, it means 4 out of 5 sellers are getting more than what they were willing to settle for. That’s a strong signal that is a seller’s market and prices are rising quickly.

And at 80%, that really is about as good as it gets.

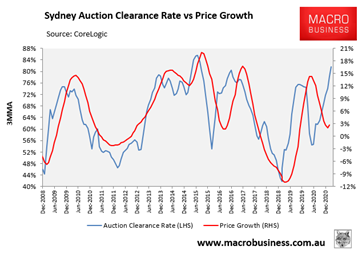

This is how it charts out:

The auction markets are strong in every capital city, with city level clearance rates hovering around record levels, though auctions are more popular in some cities than others.

None of this is too surprising. We know that demand is pumping, and finance is through the roof.

This chart here is from CBA’s loan book for February. It gives us a more timely indicator of the finance data, and it shows that while lending eases a little in February, it remains at very strong levels.

And together, finance and the auction clearance rate gives us a good indicator of just how hot our property markets are, and how much demand is actually out there.

(There’s a lot.)

And they’re both very good indicators of where prices are going in the short to medium term.

You can see that in Sydney, the auction clearance rate lines up very well with price growth. And right now, it’s pointing to price growth somewhere around 15% per annum.

That might sound like a lot (and it is), but it’s not unreasonable. You’ll know I’ve been saying for a while the market is running red hot right now. 15% is easily on the cards.

Same story when we line up Melbourne. Again, that’s point for a sharp move north in the near term, and price growth somewhere around the 15% mark. Easily doable.

People might be wondering how this is possible. They might be still wondering if prices are going to crash like we were told they would.

They’re not, and higher prices are locked in.

Interest rates continue to slide (thanks to the RBA’s Term Funding Facility which is giving the banks access to lots of cheap capital).

Mortgages below 2% are abundant in the market right now.

That’s super cheap money. Incredibly cheap money.

So of course house prices are boom.

The property market isn’t as complex as most people think it is.

DB.