Triguboff made his fortune following a simple rule, even when it meant going against the grain.

The Business Review Weekly have released their rich list for 2016. Coming in at number one, with an estimated personal wealth of over $10bn, is Meriton founder Harry Triguboff.

Congratulations to Harry. You know I love a rags to riches story, and Harry’s is one of the best.

Triguboff was actually born in China, after he’s Jewish parents fled Russia with the rise of Lenin. But then as Communism started to take off, his parents saw the writing on the wall and sent young Harry and his brother to Australia.

Triguboff tried his hand at a number of things early in his career – he drove a taxi and owned a milk round in Chatswood. Property was never a focus, but in the end, the property bug found him.

He’d bought some land in Rosewood to build his own house, but his builder repeatedly let him down (some things never change). So in the end he said, sod it, I’m going to build it myself. And he did.

Triguboff learnt a lot along the way, and found that he enjoyed the game. He then bought a second block of land in 1963, this time at Tempe in Smith Street and began building a block of eight units with a partner. He made a nice profit, which led to a second development in 1968 at Meriton Street in Gladesville, (where the company takes its name). He built 18 units there and the rest is history. Today, Meriton builds about 1500 units a year!

I love this story because so many of my students start out exactly the same way. They never planned to become ‘developers’ – they were just looking for a way to manufacture a bit of growth and improve their cashflow.

But once you get a taste for it, and you see the wealth potential there is in property, it’s easy to get hooked.

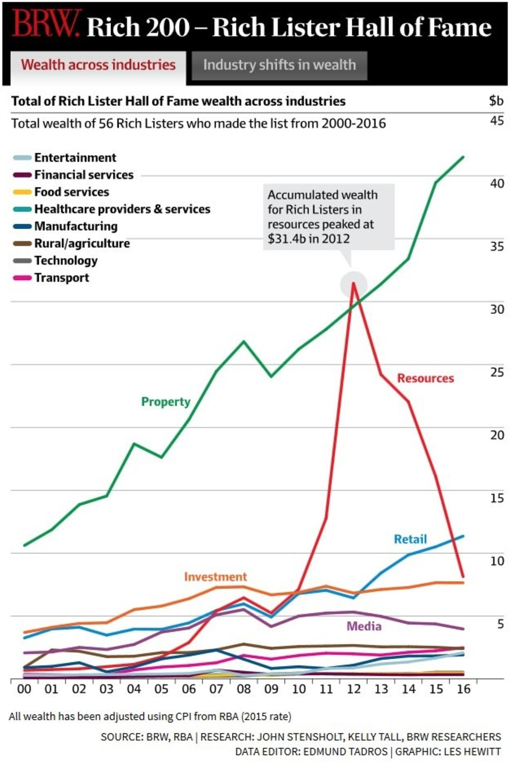

At the wealth potential tied up in property is evident in the BRW rich list. If you look at the breakdown of their Top 200 by industry, property is a clear winner.

You can see the massive spike and drop in Resources-related wealth here in this chart. Property on the other hand continues to be a solid performer.

I remember Robert Kiyosaki saying something like this. “I made money in business, I made money in investments, but nothing beats property.” This rich list is proof of the pudding.

But back to High-rise Harry. His story isn’t just an inspiring feel-good story. There’s also important lesson for property investors – at any scale.

“Give the people what they want.”

We forget that Triguboff pretty much introduced affordable high-rise living to Australia. Before that, it was almost unheard of.

“I am proud that when we started it was all in a very small way,” he said a few years ago.

“I looked at Bondi Beach. Bronze bodies. Unbelievable. I looked at the red roofs. No flats, just cottages everywhere.”

Two storeys was what we built. Four storeys required a lift so we didn’t do those. Three storeys, people preferred with a lift. So we didn’t do those either. We did two stories.

But I guessed correctly, there was a big demand for them.”

Triguboff’s success is built on going against the grain and giving people what they want.

“I watched people and I tried to understand what made sense.”

So I saw these young women here when I started to build and they had very low wages, and I understood that the only way they could figure out security was to have a home.”

I could see it in their eyes.”

So Triguboff started building apartments that were cheaper than cottages or houses, and were closer to the city.

“So I backed the winners, I backed the women and they bought the units. I’ve tried all my life to make housing affordable. The more affordable the house, the more money I make.”

But it wasn’t always smooth sailing. A lot of people resisted these changes to the urban landscape.

“The newspapers were always against me in the beginning because they thought I was depriving people of what they wanted.

“But if a person pays everything he has and borrows everything he can to have an apartment, then I was correct and they were wrong.”

So this is the take-home lesson for me. You can’t go wrong giving people what they want. As an investor you always have to keep rent-ability and sell-ability in mind. You need to meet where the market is at.

And that might not be what you’d like to do with a particular property. You might think it needs Edwardian eves and a Greco-Roman sculpture garden. But how many people agree with you?

And it might not be what people are telling you should happen with a property. People might tell you that young couples want a quarter acre block and that they want to spend Saturday morning mowing lawns. They’re probably wrong.

At the end of the day, the only metric that matters is whether it suits what people are looking for, and what people are willing to pay good money for.

“Give the people what they want.”

Triguboff saw that people wanted affordable places to live (they still do) and he’s made his fortune by giving people exactly what they want.

The road to wealth can be as simple and as straight forward as that.

Bravo Harry, Bravo.

See any other lessons in the Harry Triguboff story?