Harry Triguboff knows property, but I’m not buying everything he’s saying.

What does Harry Triguboff make of the current cycle?

As Australia’s richest man, and with the largest property empire in the country, he’s a good man to ask. And that’s what Bloomberg did over the weekend:

Harry Triguboff is remarkably calm about Australia’s worst real estate slump in a generation considering he’s got more at stake than perhaps anyone on the planet.

…“If prices fall, I’ll buy the land cheaper,” Australia’s second-richest person said with a wave of his hand. “As long as you don’t lose your cool. You have to look at things in the longer term.”

…That confidence stems from flexibility in his strategy. Triguboff builds apartments for the sale, rental and short-stay markets, and changes the amount of stock made available based on where demand is strongest.

…Triguboff remains optimistic. “China has more than 1 billion people,” he said. “And they love Australia. I think they love Australia as much as we love Australia. So there will always be enough of them that will buy.”

Hmmm. I’m buying some of this, but I’m not buying all of it.

When it says that he’s relaxed about things, I expect that’s probably true. With his net worth it’s hard to imagine him getting flustered about all that much!

And Harry is a property veteran. He’s seen his fair share of cycles. The market goes up and it goes down.

And it’s a sentiment I’m hearing from a lot of seasoned investors. If property prices fall and it becomes cheap, I’ll just buy more.

If you’ve got deep pockets, and have the patience to ride out the cycle, it makes total sense.

However, when Harry says he’s pinning his hopes on demand from China… well, I’m not sure I believe him. That might just be a bit of sweet fluff served up to his investors.

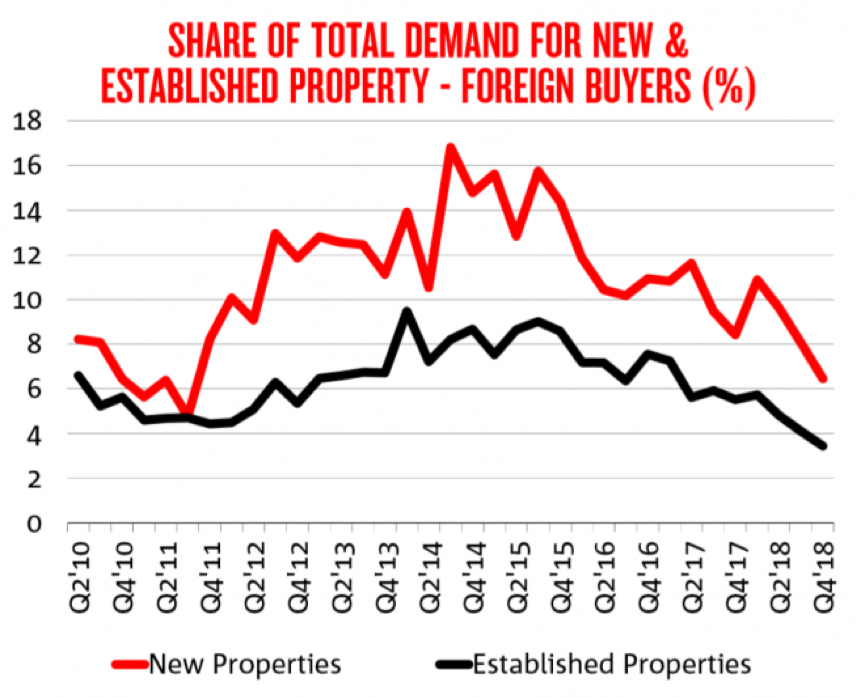

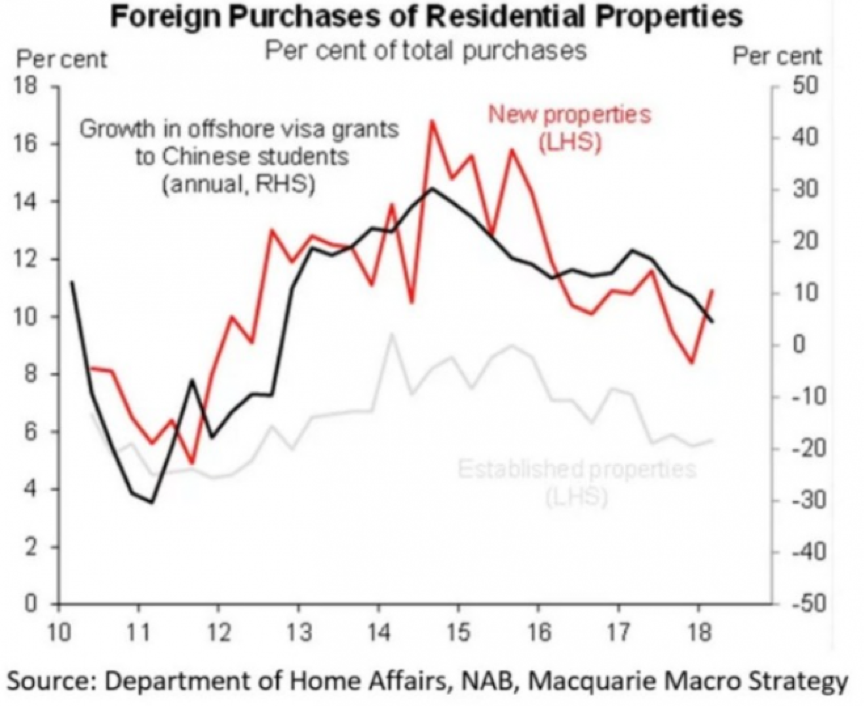

Chinese demand has fallen steadily in recent years, for both new and existing property.

This is data from the NAB survey of real estate professionals. We never had any official data on Chinese demand. But the feel on the ground is Chinese buyers are far from the force they were just a few years ago.

Partly that’s about Australian authorities finally deciding that they had to enforce the rules. (Foreign nationals aren’t allowed to buy existing property – only new ones.)

But it’s also about capital controls in China, where the government is trying to stop money leaving the country.

Last week, those capital controls got even tougher:

China has introduced jail terms for operators of “underground banks” illegally helping tens of thousands of its citizens transfer money out of the country to buy property overseas, in a move developers warn is a big blow to Australia’s real estate market.

China’s Supreme Court quietly introduced stiff penalties for illegal currency exchanges at the start of the month, in a further effort to stop capital from leaving the country. China’s leaders want to prop up the slowing economy, stimulate the local property market and prevent a further sell-off in the domestic stockmarket.

The move, which imposes jail terms of five years or more for offenders, would target the operators of so-called “underground banks” which facilitate illegal foreign exchange and cross-border trading. Tens of thousands of middle class Chinese use the services to funnel billions of dollars out of the country to buy property in Australia, New Zealand, Canada, the United Kingdom and other countries.

At the same time, we’re hearing about withering demand for university places (which is also probably a symptom of tighter capital controls). University students were a key source of property demand.

Putting all that together, it’s hard to see Chinese demand come surging back. Not in the short term. And I reckon Triguboff would know this.

Part of the current consolidation phase is about the withdrawal of Chinese money, and the market transitioning to alternative sources of demand.

That’s something I welcome. The Chinese money was always going to be a bit flighty – it was always at risk of vanishing if the geo-politics changed.

The Australian market is strong and has stood the test of time. We’ll be alright.