Another rate cut this week. Almost looks irresponsible.

So the RBA cut rates again this week.

They followed up cuts in June and July with another one this month, taking rates to an almost comical 0.75%

Seriously. 0.75%. It even looks funny on the screen.

When I got into the game of property, I never imagined in a million years we’d be looking at an official cash rate with a zero in front of it!

But here we are. 0.75%. Wild.

Now what’s interesting about this latest rate cut is that it comes at a time when the property market is well and truly on the way up.

When they cut in June and July, we were seeing the first green shoots of an improvement in the property market. But it was still pretty tentative. Just the first signs of life.

Now, however, prices are actually growing strongly, and the RBA is cutting rates into a property market that is accelerating quickly. The RBA is leaning into the boom.

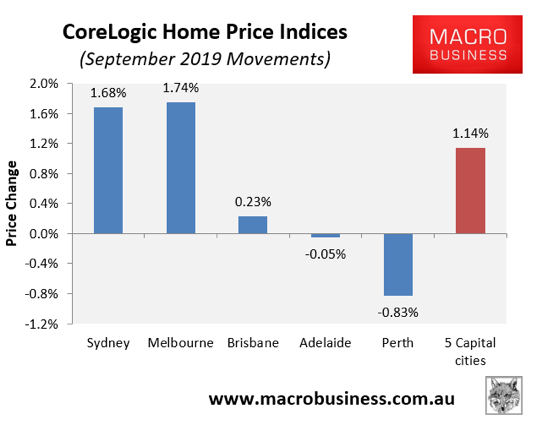

Take the latest monthly data from CoreLogic, for example. It shows that national house prices grew 1.1% in the month.

If the market kept up that kind of pace, we’d be looking at an annual growth rate of something north of 12%!

And look at Melbourne! Barrelling along at 1.7% in the month, or at a clip of over 20% per annum.

If that’s not a boom I don’t know what is.

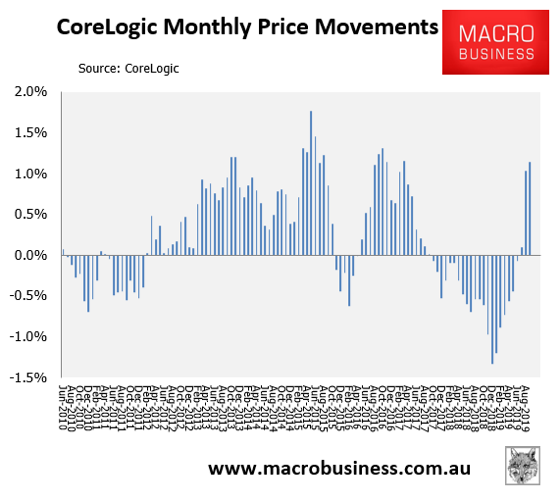

It is still early days in the recovery, and it’s not unusual for prices to bounce back quickly off their lows.

Still, when you put the past few months in context, you can see the property cycle laid out very clearly, and you can see that the current recovery had already taken solid root, well before the RBA decided to throw another rate cut into the mix.

And to be fair, we are still seeing a fair bit of discrepancy across the capitals. Prices are up in Sydney, Melbourne and Brisbane in the September quarter. But they were down in Adelaide, and prices in Perth are still falling.

So there’s still a bit of nuance here that we need to flesh out.

But the point still stands. The RBA is cutting rates into a property cycle that has well and truly turned. They’re throwing fuel on a fire that’s already raging.

Expect prices to kick even higher from here.

DB