Economists across the board are revising up their expectations for property this year.

Things are accelerating quickly. Are you feeling that?

It’s happening. It’s on. The boom I’ve been telling people about for 9 months is here and its bigger than we thought.

And look, there’s isn’t anybody who doesn’t sit on that side of things any more. Everyone knows the boom is coming. The only question now is how big is it going to be.

(Hint: it’s big.)

CBA laid out the case last week, and to many of my readers the arguments will be familiar, but it’s a good wrap, I reckon, of the state of play.

In their words:

Overview

The Australian housing market is on the cusp of a boom. New lending has lifted sharply. Dwelling prices are rising briskly in most capital cities. And turnover is up significantly on year ago levels (charts 1 & 2).

There’s still a diversity of outcomes across the country. But Perth and Brisbane there are looking like they’re about to go exponential!

And as CBA notes, the market is heating up, with sales volumes rising strongly, although units not so much.

And looking forward, CBA see nothing but green lights:

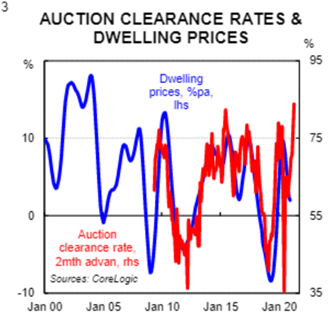

Near term indicators of momentum suggest conditions will further strengthen. Auction clearance rates are sitting at levels consistent with double-digit dwelling price growth (chart 3). And both the CBA home buying measure in our Household Spending Intentions series and the house price expectations index from the WBC/MI Consumer Sentiment survey have surged.

Housing finance is also booming:

So we are go for boom.

But as CBA note, none of this is rocket-medicine.

In many respects it’s a simple story. The boom is being driven by record low mortgage rates coupled with a V-shaped recovery in the labour market. Borrowing rates, which are the single biggest driver of prices in the short run, remain below the rental yield in most markets across Australia. This is an unusual situation and means that property markets across the country need to find an equilibrium. For the bulk of Australia, equilibrium will be achieved via further dwelling price rises.

We expect strong growth in national dwelling prices of ~14% over the next two years (8 capital city basis).

Yup.

And remember this is the national average we’re talking about here, and it’s going to be held down by the high-rise unit market, and Sydney and Melbourne, who will probably drag the chain on lower immigration levels.

So while you’re going to get 14% across the country, you could easily see some segments doing double that.

And that, good friends, is the definition of a boom.

DB.