This is a very unusual market. And I just don’t know how this ends…

I think Australian property might be in a boom-loop. A boom-loop doesn’t happen all that often, but when it happens, it locks in years of growing house prices.

Let me talk you through it.

There’s two ingredients you need for a boom loop: rising house prices and falling volumes.

Normally these things don’t go together. Normally when you have a lot of properties changing hands, prices tend to go up. Rising prices get more people excited to sell, and you get a feedback loop that sees volumes and prices marching higher together.

But that’s not what we’ve got right now.

Right now, we’ve got rising prices and falling volumes. Prices are going up, and the number of properties being sold is going down.

This is the boom-loop.

I don’t know why people aren’t selling their homes. I mean, I know why I’m not selling any of my properties. You’ve got a solid asset that’s putting money in your pocket (because I do property investing RIGHT!), and that protects your wealth against all weather.

Why would I sell?

So maybe everyone is on the same page as me now. Hang on to those properties folks.

But this creates an interesting dynamic. Remember the first rule of economics. Prices are set by demand and supply.

Prices rise in markets where demand is strong and/or supply is tight.

Demand is definitely strong. But if nobody is selling, then supply is tight and only getting tighter.

That pushes prices even higher. And around and around we go.

This is the boom loop.

Let’s take a look at the data to see what I mean.

First, property prices are surging, as we can see from CoreLogic’s October chart pack:

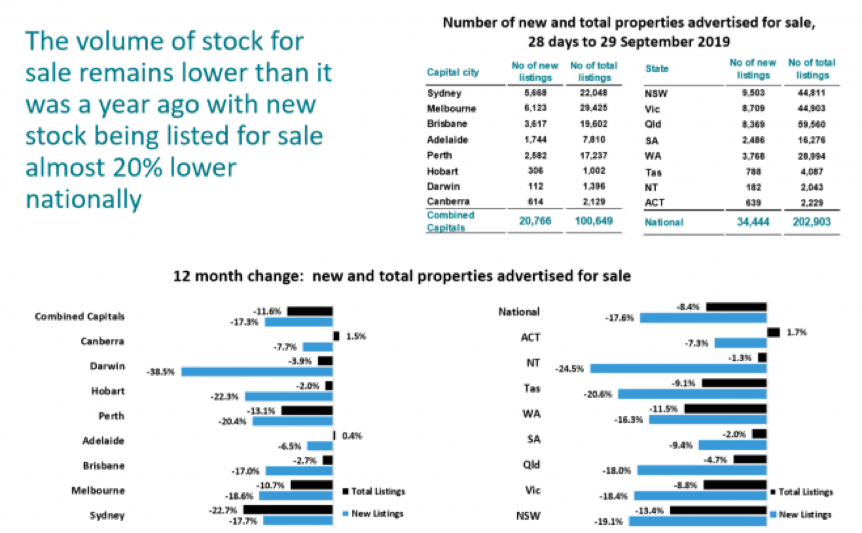

But the number of homes on the market has tanked:

Like, we’re talking about 20% fewer homes on the market than a year ago. That’s a drought.

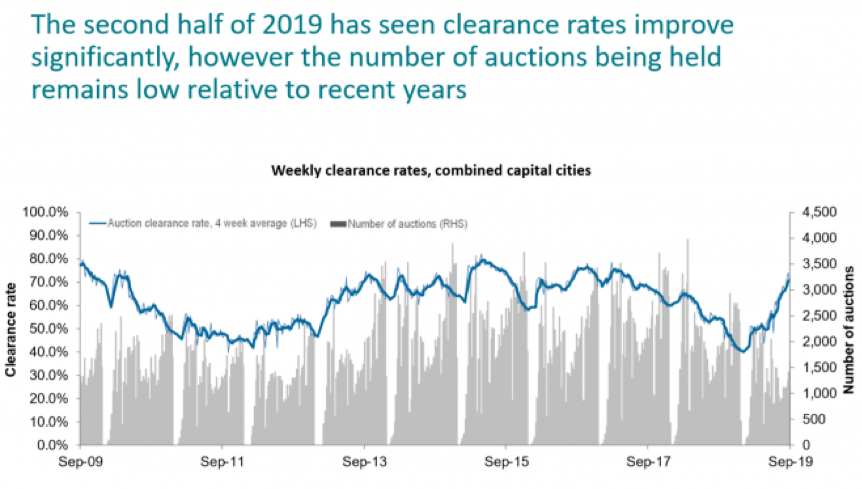

At the same time, auction clearance rates are running at 2017 ‘boom time’ levels, but this is on the back of very thin trade. Auction volumes have gone bust:

And putting it all together transaction volumes – the number of properties bought and sold – have crashed to levels way below the decade average, despite picking up a little in recent months:

So this is the boom-loop. Rising prices will encourage people to hang on to their homes – why would you sell now when if you wait another year you might get another 5,10 or even 20% if things go crazy?

Fewer homes will come on to the market. Supply will get tighter.

Prices will go up.

That means that rising prices will cause prices to rise. That’s the boom loop.

And who knows where it ends.

DB