Government data is painting a suspiciously weird picture…

Late on Friday afternoon (after the journalists had knocked off for the weekend..?) APRA, the Australian Prudential Regulator, the body that is charged with the seemingly impossible task of keeping the banks on the straight and narrow, released their monthly credit data.

I’m not sure if anyone’s noticed, but it’s a farce.

Apparently they went back and had a look at some of the forms and realised they weren’t collecting data in quite the right way.

And it turns out the banks have been doing a lot more lending to property investors than we thought.

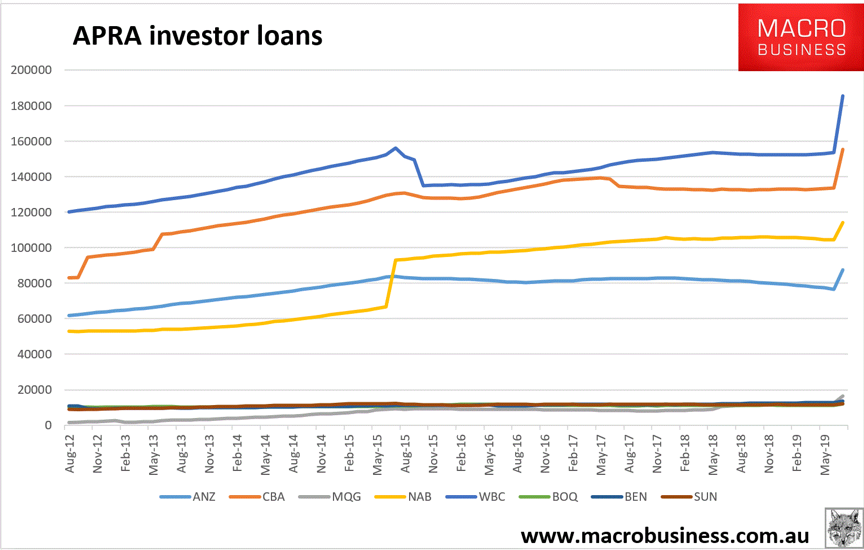

Take a look at what APRA reckons happened to the investor loan book at the big banks this month.

Boing! Seriously, wtf is up with that last spike?

There’s no conceivable way that turnaround occurred in a single month, so it’s all down to the way APRA is collecting and working with the data.

But the thing is that suddenly, the property market looks a heckavva lot different.

Remember APRA introduced restrictions in 2015 because they were worried about investor lending getting out of hand.

And those restrictions worked. Or at least we thought they worked.

We thought the share of mortgage lending going to investors fell from about 39% down to 33%.

Good job boys. Go grab a beer.

But wait, hang on. With the new data, it looks like the investor market share only fell from 39% to… wait for it… 38%… over three and a half years.

Ummmm… that’s not looking so great now fellas…

Man, this makes me angry. We rely on the data from the government to understand the market. We trust that it’s an accurate reflection of reality.

And this matters. I was looking at this chart and thinking, “Wow, investors are really getting smashed. This downturn could be worse than we think. Better be careful.”

But no, turns out investors weren’t getting smashed all that much at all… which kind helps explain why the strength of the current recovery has taken everyone by surprise.

So we have to rethink exactly where we’re at in the cycle right now.

But we also have to rethink where we’re going.

Because the APRA restrictions have been one of the most dominant trends in the property market in recent years.

But recently, APRA have been saying that they’re happy with what they’ve accomplished, and they’ve started to ease off on things.

Now where do we stand? It’s not looking so “Mission Accomplished” anymore.

So are the APRA restrictions coming back?

Who knows? Seriously, who knows? This is a farce. I’ve got absolutely no idea how they’re going to play this one.

Maybe they just sweep it under the carpet and hope that everyone forgets about it?

Or maybe they’ll be embarrassed into taking tougher action on the banks?

Or maybe the banks are just calling the shots – because now it doesn’t look like they changed their lending practices at all, even though the APRA data was making them look good.

Incompetence? Corruption? Who knows?

I’ll keep digging. Watch this space.

DB