Immigration is going to drag on prices in the near term… but the picture is complex.

One of the reasons why this crisis is so interesting in terms of its impact on prices is because so many of the variables have been hit by temporary factors.

Temporary factors that could reverse pretty quickly on the other side.

Take immigration for example.

Immigration is one of the key factors driving the growth of housing demand.

The out-performance of our capital city markets in recent years has been partly due to the fact that Australia runs a strong immigration program, and migrants overwhelmingly head towards the major centres.

But now, with the Corona virus effectively putting the whole world in lockdown and with Australia’s borders firmly closed, immigration has come to a screeching halt.

Big negative for property prices, right?

Well, yes and no.

Yes, it’s definitely a hit to housing demand in the short run.

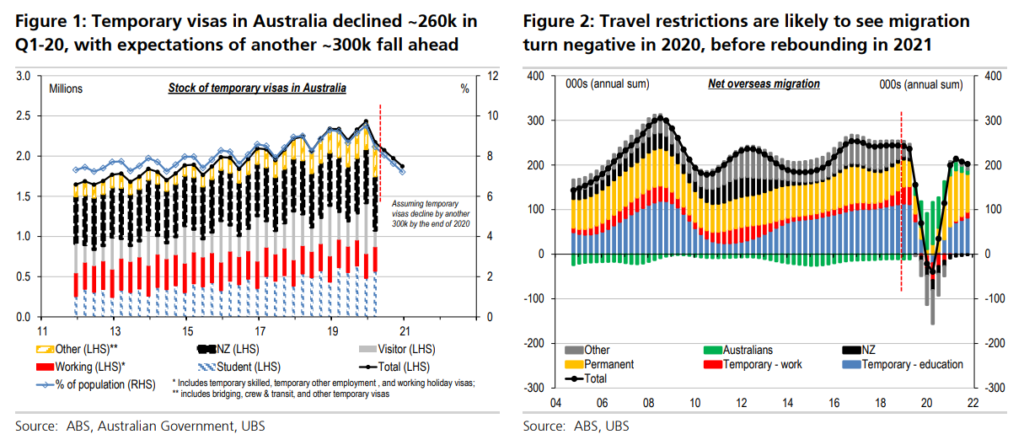

Investment bank UBS has crunched the numbers and they reckon we’re now looking at 330,000 less migrants than expected over the next 18 months.

With reports suggesting over 300k tourists and temporary residents had already departed Australia by mid-April, and expectations that perhaps another 300k may leave by the end of 2020, a collapse in Australian net overseas migration (NOM) and visitor arrivals is inevitable.

Indeed the Government’s own expectation is NOM declines very sharply, from the FY19 level of 240k, by more than 30% in FY20, with an 85% fall in FY21. Compared with the 2019 Commonwealth Budget assumption, this would represent a shortfall of ~330k (or 1.3% of the total population).

With that, they reckon that Australia is looking at the slowest rate of population growth since 1916!

This would see population growth slow from a strong ~1½% y/y in recent years, to just ~0.5% y/y in 2020 – the lowest since 1916; before lifting to ~1.3% y/y by the end of 2021.

With population growth bouncing back to 1.3% by the end of 2021 – a figure which is partly limited by throttled air travel capacity – we’re talking about a very quick reversal of immigration flows.

And that would mean any drag that decreased immigration has on housing demand will be temporary and quickly reversed.

And this is what I’ve been saying for a while. In the short term I think we can expect to see some sharp movements in both directions.

Prices will fall sharply in the short term, as the crisis bites and the sentiment cycle drives the market.

However, on the other end of that, confidence usually returns very quickly and the existing fundamentals are solid, which means prices could bounce back very strongly.

The other thing to note here is that it’s not one-way traffic.

Because while Covid is impacting on housing demand, it’s also impacting supply.

As UBS note, housing starts could fall even further than housing demand, and the undersupply of housing will remain a feature of the Australian housing market.

Lower migration adds to the downward pressure on rents from the slump in short-term visitors. But, we see housing undersupply re-emerging next year, and assuming more direct housing stimulus policy, we see a recovery in commencements to ~170k in 2021.

Which is another reason why house prices could bounce back much more quickly than people realise.

As I keep saying, every crisis creates opportunities, but those windows of opportunity might be short.

The time to prepare is now.

DB.