Australia, New Zealand, America… this boom has gone global.

I had some great response to the piece I did on New Zealand last Thursday, so I thought I’d take a quick look at what’s happening in the US today.

And the point is that the boom that is launching in the Australian property market right now… can we still say launching? It’s well and truly launched! But the boom we’re witnessing in Australian property is a global phenomenon.

And that’s because super-low interest rates and fire-hoses full of cash have the same affect wherever you are – whether that’s Sydney, Auckland or New York.

So Australia’s booming. New Zealand’s booming. Is the US?

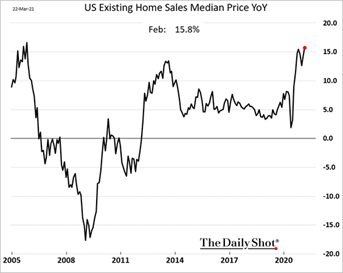

Yep. House prices are already growing at 16% year on year.

Prices didn’t even slip during the Covid lockdown – which was nowhere near as clean as it was here. It was a total mess.

And yet, house prices kept growing through it all.

And now they’re up 16% year on year.

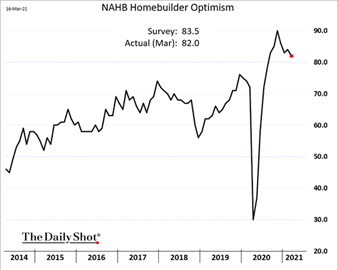

Homebuilder optimism is up at record levels, thanks to all the stimulus support that’s been thrown at housing and construction.

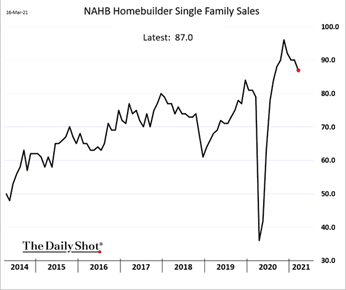

As new home sales boom…

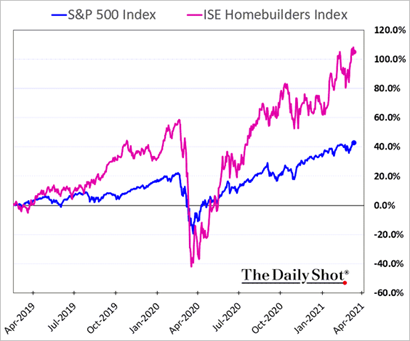

And as a result, the share prices of homebuilders are outperforming the market:

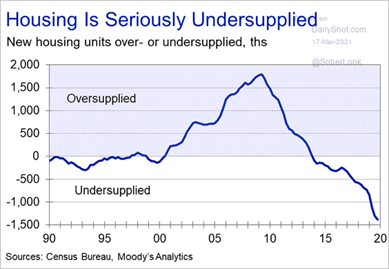

And despite the pick-up in new home sales, the US market remains “seriously under-supplied”.

It’s actually one of the escalating factors driving house prices higher. As property and land becomes more expensive, it becomes harder and more expensive to bring new housing supply to the market. This slows the supply flow down, further exacerbating demand/supply imbalances, which pushes prices higher, and around we go again.

We’ve got the same story here in Australia. We’ve been complaining about how expensive housing is in Australia for years, but it hasn’t done anything to accelerate the construction of new homes.

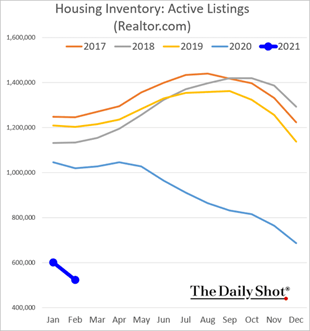

At the same time as there’s a lack of supply in the pipeline, there’s also a massive shortage of existing homes for sale too… The “housing inventory” – the number of homes on the market – has fallen to record lows:

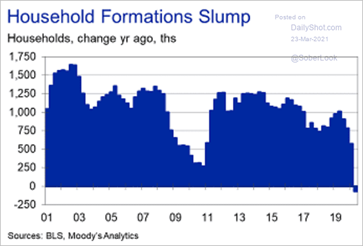

That’s obviously driving prices higher, but it could have been a lot worse. If household formation – the number of new households being created – had held up at normal levels, demand would have been much stronger, and prices would be growing even more quickly.

As it is, household formation has actually gone backwards – kids moving back in with their parents I guess…

To me this suggests that there’s actually a lot of pent-up demand, which will have to be unleashed at some point.

And that suggests that the rapid acceleration in property prices isn’t going to be a short term thing. It’s going to take a while to play out.

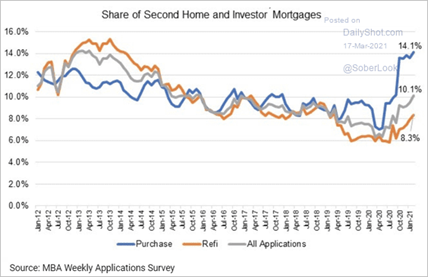

But this outlook, in turn, is attracting investors back into the market. The share of mortgages going to investors has surged since Covid started a year ago.

And with that outlook for prices, why wouldn’t you?

So this is what’s going on in America.

But the interesting thing I think is that you could pretty much tell the exact same story about Australia – about almost any developed nation really.

It’s a global story now. House prices are booming on a global-scale tsunami of cash.

And there’s absolutely nothing surprising about that.

DB.