Some people are now saying Perth will boom. Are they right?

What do I think about Perth?

A few weeks back I noted that government policies to support new construction were probably coming at the wrong time, and risked choking off a nascent recovery in the Perth property market.

I want to dig into that a little bit more, because there’s a bit of a buzz building around Perth right now.

Especially now that the Western Capital has just posted its first price gains in over 18 months, according to Corelogic.

And Louis Christopher from SQM research, one of the leading property experts in the country, recently said:

“As far as I am concerned, the Perth housing market is currently offering the best value out of all the capital cities and some of the best prospects. Yes, there is risk. I can’t tell you how long this new mining upturn will last. But I do think Perth is offering the best reward for risk. If the new mining upturn continues on over the medium term, Perth housing will have some very good years.”

So let’s do a quick whip around the Perth data. Even if you’re not currently interested in the Perth market (maybe you should be?), this might give you a sense of how I piece the macro picture together.

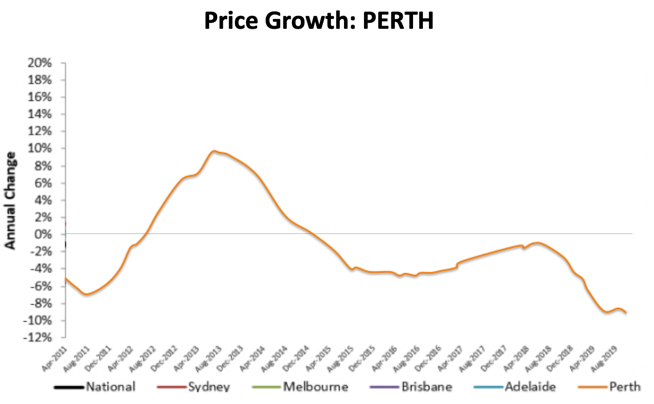

Ok, first, let’s recap where we’re at with prices.

Now, as everybody knows, Perth property prices have been falling for a while now. We’ve had five years of continuous decline, property prices are now 20% lower than their most recent peak, and are lower than they were 10 years ago.

Yup. Those stats are pretty grim.

If you look at this next chart, which tracks annual price growth, you can see the chart turned negative in 2014, and has remained in negative territory since.

There were signs of a recover in late 2017 / early 2018, but that got cut off by a down turn in the national market.

This bit is important. The Perth cycle was naturally turning. The market was on its way back to growth, but then the APRA restrictions and a cooling national market gave Perth another thump.

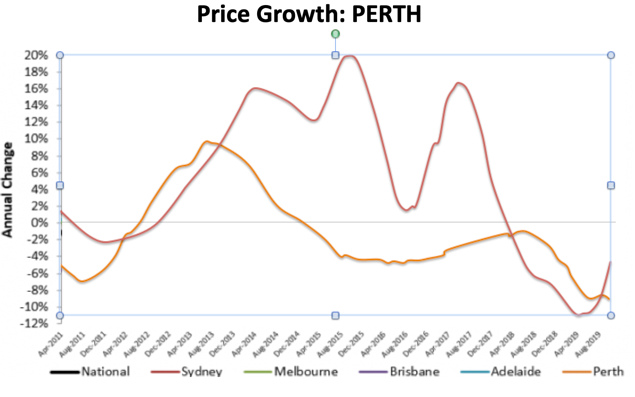

I mean, compare Perth’s growth to Sydney’s:

You can see that price growth in Perth took that sharp downward leg about exactly the same time as prices started falling in Sydney.

So this is how I think about Perth. It is a market that was naturally entering an upswing phase, but got dragged down by national factors.

So there’s potential there waiting to be unlocked.

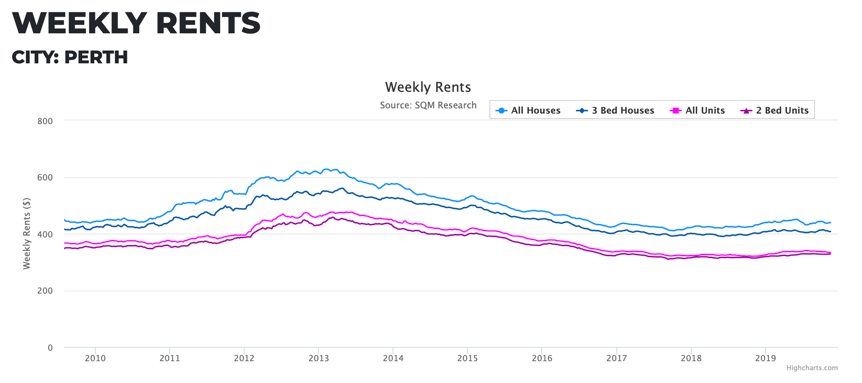

The key to that potential is probably in the rental market.

You can see in this next chart that rents in Perth peaked with the market in 2013/14. However, they have since stabilised and have posted some modest gains in recent times.

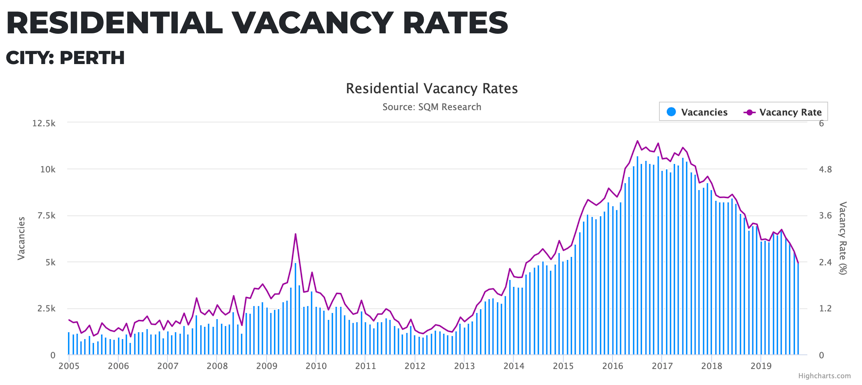

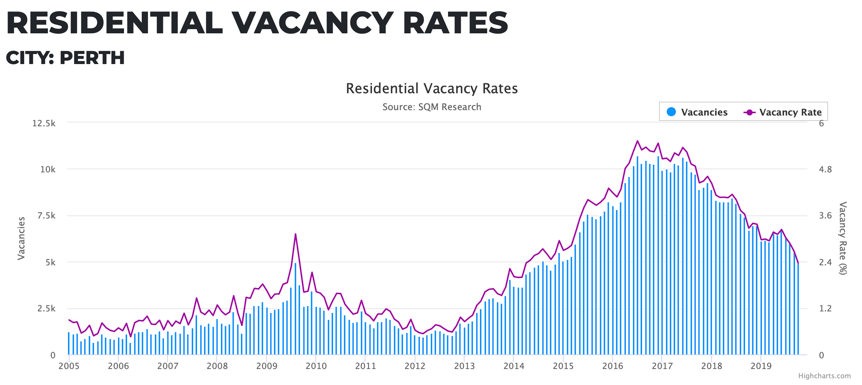

That’s largely on the back of an improvement in vacancy rates. With a bit of a mining-bust driven population exodus, Perth’s vacancy rate spiked and peaked out at 5.2% in 2017.

However, since then the rental market has tightened considerably, and the current vacancy rate of 2.4% is consistent with rising rents and rising prices.

So that’s what I mean when I say Perth is poised for growth. The fundamentals are there. It it is contingent to some degree on that vacancy rate remaining low, which is why I say a government program to try and create a boom in construction and a surge in housing supply is perhaps a little misguided.

It’s probably also worth noting that after several years of price declines, Perth now has the most affordable capital city housing market in the country (on a Price:Income basis).

When the tighter vacancy rate feeds through into higher rents, I expect we will see many renters start to weigh up their options. They’ll notice that prices are actually pretty cheap, and that should encourage more first home buyers into the market.

But I think the rental market needs tot turn first.

So yes, lot’s of potential. There’s upside potential waiting to be unlocked.

The key to that potential is the rental market, which has clearly turned and is tightening.

Unless that gets derailed by something (another mining bust?), then 2020 should be a strong year for Perth.

I’m not sure I’m ready to say that Perth will be the best capital city market in the country next year, although that perhaps reflects how bullish I am about the other capitals.

Never the less, 2020 should, in all likelihood, be a great year for Perth.

DB