Feeling like you’re falling behind? You probably are.

Can you hear that sound?

That’s the sound of your lifestyle going to the drain.

Gurgle-gurgle-gurgle.

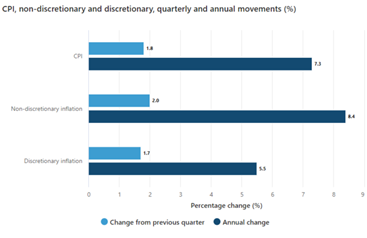

Inflation seems well and truly off the leash now. Headline inflation is running at over 7% annually.

It’s been so long since we’ve had inflation in Australia that I’m not sure people really understand what it means.

Yes, it means that the prices of things is 7 percent more expensive than a year ago.

But it also means that you money is worth less. It buys less stuff than it used to.

Another way to think about it is that if you had $100 a year ago, that $100 is now worth only $93.

Inflation is a tax on your cash.

And there’s no escaping it. The inflation of non-discretionary items (a fancy term for stuff you can’t get away from no matter what – like food and shelter) is actually scorching. It’s running at 8.4%.

Now, that all might not be so bad if wages were keeping up.

If inflation is running at 7%, you can sort of keep your head above water if wages are also growing at 7%. That keeps you even, and often higher inflation goes hand in hand with higher wages growth.

But that’s not happening. Wages are not keeping pace with inflation. Not even close.

We are seeing some wages growth, but nothing like 7%.

And since they’re not keeping pace, real wages are actually falling.

Since 2019, real wages have fallen 3%.

By the middle of the next year, they’ll have fallen 5%.

From there, things start to pick up a little, if you believe the forecasts presented in the recent budget, real wages will still be 3% lower than they were in 2019.

That is, your real wages will be about where they were in 2011.

And that’s based on the government’s assumptions, which historically have a tendency to be, well, heroic.

And so that’s a full decade lost. There’s no getting ahead in this story.

Even if your wages are growing, unless they growing more than the average, in 2026, you’ll be exactly where you were in 2011.

So much for getting ahead.

And so this is where we’re at. There’s a tax on your cash and your real wages are going backwards.

And still I see so many people just happy to put their heads down and bums up, and just keep chipping away at the 9-5 story, hoping that it frees them from the rat race at some point.

It won’t.

In fact, you can lose an entire decade in less than a year.

This should be a rally call. This should light a fire under your bum and inspire you to take charge of your financial story.

If it doesn’t, you’re not paying attention to history.

DB.