New Zealand shows us just what we can expect on the other side of Covid.

It seems that New Zealand is different.

What happens in New Zealand doesn’t need an explanation. It’s just what happens in New Zealand.

And that’s why I think the media and people have missed what I think is one of the most important pieces of the Covid puzzle.

New Zealand house prices are booming.

Say what?

Yep. House prices are booming.

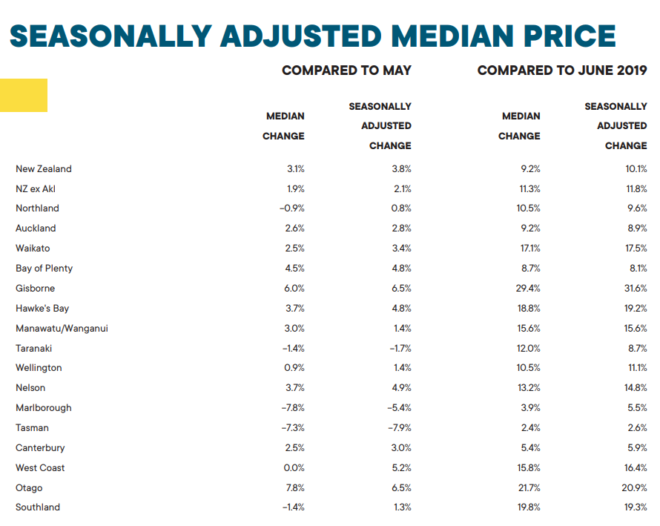

According to the latest data, house prices grew 10.1% over the year to June.

It was the 105th consecutive month of year-on-year price increases.

But what on earth is going on there? New Zealand is posting double-digit price growth in the middle of a global pandemic?

But wait. It’s even crazier than that. Because a lot of that growth is thanks to an acceleration in price growth in recent months.

Prices grew 3.8% in June alone.

If NZ kept up that kind of pace, you’re talking about an annual growth rate north of 40%pa!!!

But of course that couldn’t happen… could it?

No. Probably not. That would actually be crazy.

But it’s hard to know what the upside might possibly be here.

Because remember what’s going on. New Zealand is probably having the best run of things of any nation on earth.

They locked down hard and got on top of the virus. They closed all schools and non-essential businesses, including butchers and large retailers.

They went hard but it worked. Now they’re effectively Covid free.

They’re where we hope to be sometime before the year is out… if we can just get on top of things in Victoria!

But while they’ve done well, they’ve also introduced the same stimulus packages that we’ve seen here. They’ve had wage subsidies and super cheap money.

Maybe they might have stimulated a bit too much?

Bindi Norwell, Chief Executive at REINZ, reckons the stimulus is clearly behind the recent explosion in prices:

“Earlier this year, there were a number of predictions that house prices would fall post-COVID. However, we are yet to see evidence of that happening, with every region in the country seeing an uplift from the same time last year, and 10 out of 16 regions seeing an uplift from May.

“With wage subsidies and mortgage ‘holidays’ still firmly in place, and demand for good property exceeding supply, we wouldn’t be so bold as to say there won’t be an easing of pricing in the coming months when these support mechanisms come to an end. But right now, Kiwis’ love affair with property continues unabated – especially with the low interest rates we currently have in the market.”

The same thing will happen here.

At some point we’ll get on top of the virus. Once that happens, all that money gushing into the economy combined with record low interest rates will see asset prices – and particularly property prices – boom.

You can lock it in.

The only question is when.

Over to you, Victoria…

DB.