Can you guess where the money is flowing right now?

So on Monday I started looking at the five big property market winners of 2021 (according to Proptrack’s Paul Ryan anyway), and telling you whether I thought they would continue on into 2022.

We saw how 2021 saw a surge in first home buyer activity, and that probably now swings on what sweeteners we see in the run up to the election.

We also saw how unit prices had lagged detached housing prices, and how that probably now swings on how quickly the borders open up to immigration again.

So what are the three other winners.

Well, the third is people looking to buy high-end apartments.

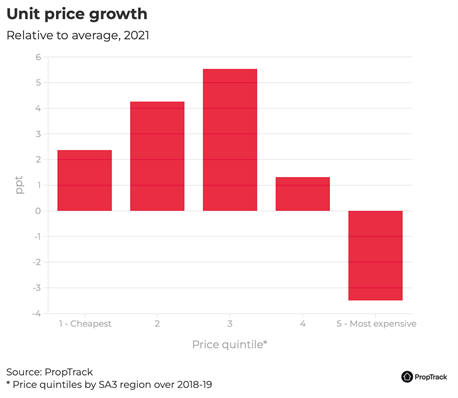

We noted that unit prices growth had underperformed (I mean, median unit prices nationally still grew 15% through 2021, so let’s not be too harsh).

But when you break down that price growth, we can see that it was really the top end of town – the most expensive 20% of properties – that really held the market back.

Now some of this is about location. The most expensive apartments are going to be located in Sydney and Melbourne, since they’re the most expensive markets.

And we know that Sydney and Melbourne high-rise has been struggling with a lack of immigration and the CBD’s having been turned into ghost-towns.

But still, It’s typically the case that we get bigger swings in our more expensive property markets. In tough times, people treat luxury items like, well… luxuries.

But still, if you’re hunting for a high-end apartment, it’s good times for you.

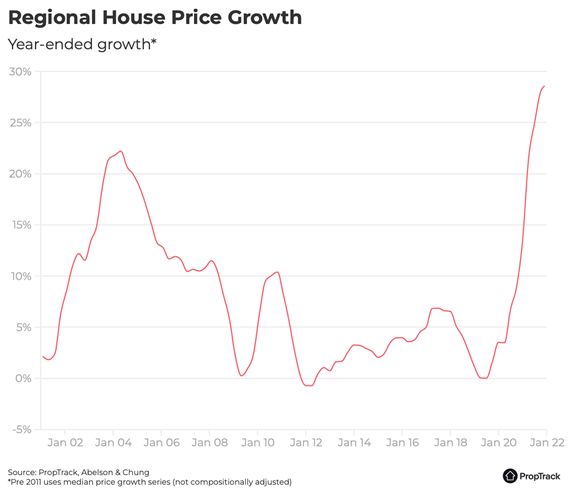

The fourth winner Ryan identified was the regions.

Our regional property markets probably had their best year ever, with property prices growing close to 30%.

That’s at the same time as their rental markets boomed.

Now it’s important to remember is that a lot of this is driven by Covid migration flows. That’s not so much about people fleeing the capitals, as much as the newspapers want you to believe that, though it is part of it.

It’s more about people staying put, and not packing up stumps and heading for the big cities.

Our capitals haven’t had their normal pulling power lately, what with the imminent threat of lockdown and potential death.

As a result, outflows out of our regional centres dried up, and the property markets tightened significantly.

At some point this might start to unwind, as the capitals regain their lure. But it won’t be this year. Work from Home will remain a thing, and our regional markets will remain tight.

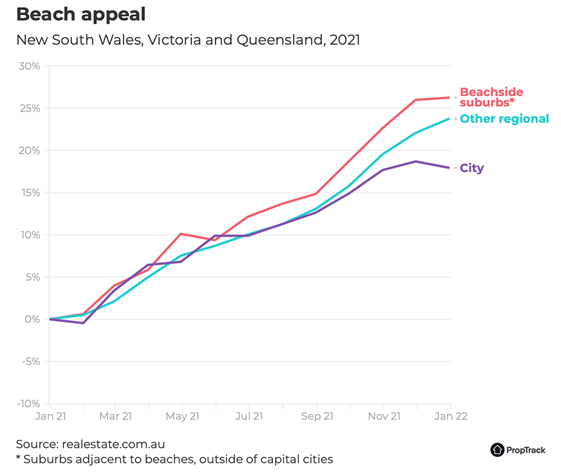

The last winner Ryan points to, and it’s kind of connected to the above, was the outperformance of beachside suburbs.

That’s a substantial difference.

I think lockdown has a big impact on this. I can tell you, when the whole world is locked down, it’s awesome to have the beach or the bush on your doorstep.

Lockdowns might officially be behind us, but many people are choosing to live like they’re in lockdown anyway.

This might start to come off a little late in the year, but it will be slow.

Beaches are still the business.

So there you have it.

On the whole, a lot of the trends that dominated 2021 will continue on into most of this year.

There remains a tonne of opportunity on offer for people who know what they’re about, know what they want, and are ready to take action.

Are you one of them?

DB.