The Kiwi government is worried about the boom… about 18 months too late.

There’s a bit of a funny situation unfolding across the ditch in New Zealand.

(A funny sitch across the ditch?)

Basically, house prices are in the middle of an economic boom, and policy makers are tying to walk it back…

… even though they’re the ones responsible!

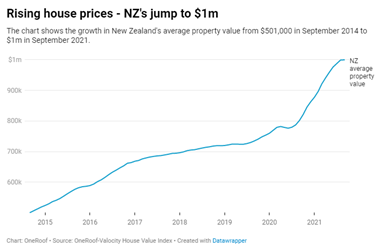

Let me show you what I mean. So house prices in NZ are going ballistic. Median prices have just topped $1m!

(Which means that given our currencies aren’t too far off each other, the median Australian house is only worth about 2/3rds of the median kiwi house.

(No, I’ve looked. They’re not that much nicer.)

But a lot of that price action has occurred post Covid. Prices are currently growing an astounding 30% across the country. That’s massive.

And it’s hot in the big cities, but there are towns across both islands growing at 30-plus percent right now.

It’s getting a bit out of hand.

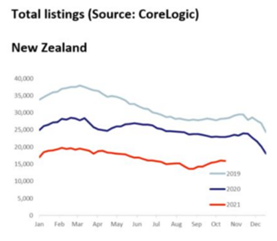

Partly it’s about a shortage of homes on the market. Demand is so hot that supply is well below normal levels:

And that’s seeing prices accelerate further. But in a way it’s really a demand story. The reason why there are so few homes on the market is because they are selling like hot cakes.

Anyway, policy makers are now looking at the whole thing and scratching their heads. And then last week, Adrian Orr, the Governor of the Reserve Bank of New Zealand came out and tried to settle people down, telling them not to put all their eggs in one basket.

And maybe that’s fair enough.

But if we’re honest, Adrian and the RBNZ started this mess.

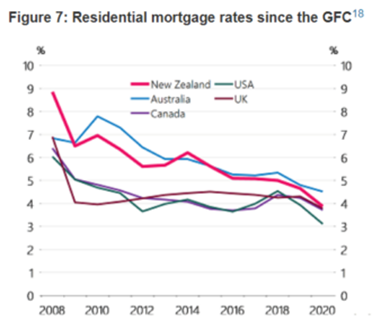

It began with record low interest rates, which collapsed in NZ when Covid took hold (as they did around the world).

But that was quickly followed up with massive money printing. The pink line here shows New Zealand joining the money-printing party, gushing cash into the system.

And what happens when you have record low interest rates and a huge amount of money gushing into the system?

House prices boom.

Duh.

I mean, it’s not rocket science.

And we know it’s true because house prices across the OECD are growing at a record clip:

It’s just economics. Cheap money and lots of it causes asset prices to boom.

And so Adrian is trying to calm the farm, but if he was serious, he’d raise rates or turn off the printing presses.

But he’s not.

None of the world’s central banks are. Housing booms are the least of their problems.

And the boom rolls on.

And given we’re working with the exact same dynamics here in Australia, it’s wouldn’t surprise me if price growth tops out somewhere near 30% before this cycle is done.

DB.