Rate hikes are so not happening. Not like this anyway…

Right now, markets are still pricing in a riduclous outlook for interest rates.

Normally, money market pricing gives you a pretty good indication what’s going to happen to interest rates.

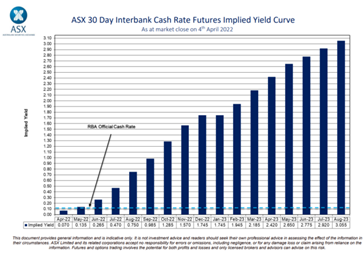

But right now, they’re saying rate hikes are going to do this:

That is, rise by a full 300 basis points. If you had a mortgage at 3.0% right now, it would be 6.0% in 18 months, if you believed markets.

But you shouldn’t believe markets. They’re out of their mind.

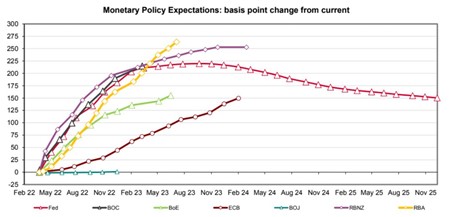

If that were to happen we would have the highest interest rates in the developed world…

At the same time as having the lowest inflation in the developed world.

Nothing about that makes sense. And I think this is another symptom of the money-printing shenanigans we’ve had over the past couple of years. Markets just don’t know how to price things any more.

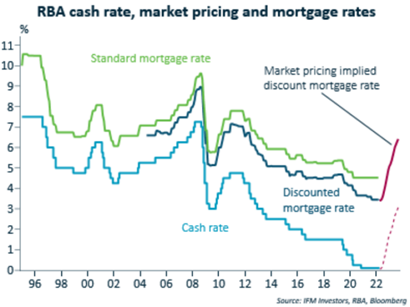

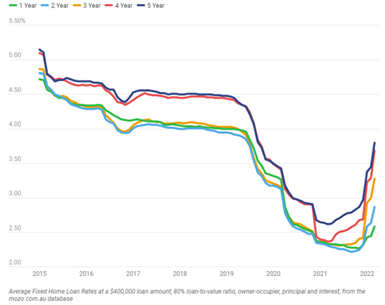

But if we assume it’s true, or something even remotely like it, this chart here shows the massive whiplash it would cause as mortgage rates suddenly surged higher.

That kind of rate hike path would put Australia into recession pretty quickly I reckon.

But don’t worry. It’s not going to happen.

And it’s not going to happen because we have a safety switch.

And that is the lift in fixed rate mortgages.

One of the things that the RBA did during Covid was to crash fixed rate markets through their TFF – Term Funding Facility. That’s why we had such crazy low fixed rate mortgages on offer.

The TFF is a thing of the past now. As a result, fixed rate mortgage rates have risen sharply – that is, they’ve normalised.

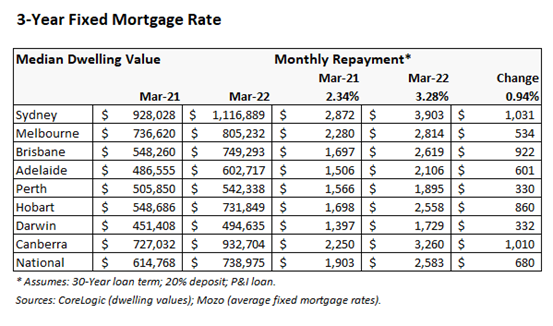

And on average, that increase in fixed rates, as it works its way through the system, costs the average household an extra $680 a month.

Which is another way of saying that the mortgage market has already had a couple of rate hikes.

And as all the fixed rate mortgages that were locked in in 2020 and 2021 revert to variable rates, or fix at higher rates, this will filter through the system.

So the RBA doesn’t even need to hike rates.

The fixed rate market is doing its work for them.

Which is why I think there is just no way in the known universe that the RBA is looking at hiking rates 13 times over the next 18 months.

Absolutely no way.

We might get one or two this year – taking rates from ultra low to super low – but that will be it.

So everyone just needs to relax on rate hikes.

There’s a safety switch here and the RBA knows it.

DB.