Have you seen what’s happening in the office segment of the property market?

I know there’s not a lot of my students who invest in the office space, but I thought it’s be interesting to check in there and see what trends are playing out.

So long story short, people left CBD office towers in droves during Covid, as work-from-home became a serious thing. However, office workers are slow to return, as more and more work-places take on more flexible working arrangements.

I thought this was probably going to be a temporary thing. But then again, I also thought Covid was going to be a temporary thing as well!

Turns out, Covid’s not being all that temporary. We’re learning to live with it, but we still have to live with it.

I reckon the longer this drags on, the more likely it is that workplaces “temporary” arrangements and work-from-home strategies will become a permanent fixture.

I don’t think that will means companies won’t want office space. But they will probably want a substantial amount less.

That’s got to be a concerning prospect for office block owners.

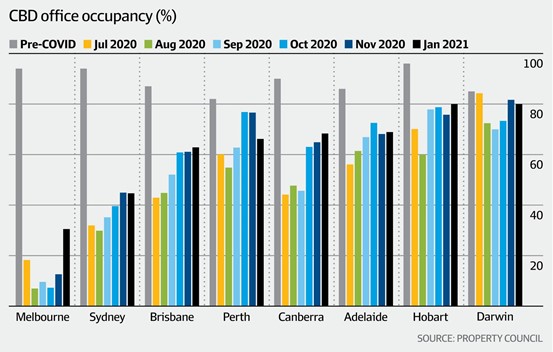

I mean, take a look at the occupancy chart. It’s pretty scary.

So just to be clear, this is based on survey data of actual bums on seats. It’s not about whether the floor space is leased or not. It’s about whether anyone is using it or not.

So we can see occupancy rates are well down across the country. But in our three biggest cities, they’re dramatically lower. It’s still just 31% in Melbourne. That figure would be considered disastrous, if it wasn’t up from 13% in December!!

So it’s good news.

But yeah, 31% in Melbourne, 45% in Sydney and 60% in Brisbane.

Those figures aren’t great.

And I think you can see the impact of prolonged lock-down. In Melbourne, companies had to make more substantial changes, and those changes are going to be slow to reverse.

That might not be a problem if things bounce back quickly, but that seems like a low-probability outcome now.

And so all this is going to put downward pressure on rents, as companies start down-sizing their office requirements.

That in turn will put downward pressure on prices. Office tower prices already looked stretched relative to rents, at least according to this chart from the RBA:

So yeah, I wouldn’t be looking for much capital gain out of office towers in the next couple of years.

The interesting question for us though is that since there’s a winner for every loser in this economic system of ours, who wins in this story?

Well, where are all these workers working now?

The regions are already booming. We know that. And an exodus of office workers is probably helping to fuel that.

It is also probably putting pressure on the residential market, since workers have to work somewhere, and many are working at home.

This is interesting to think about it. Maybe homes with a dedicated home-office will start to attract a premium.

But working from home isn’t for everyone. Not everyone has the space.

At some point, I expect you might be able to get more return out of turning your granny flat into a co-working space than as a residential rental.

Of course, that subtracts from the rental pool which puts upward pressure on rents and therefore prices.

It’s hard to know how big these effects are going to be. It still depends on how companies react.

But for now, I expect that at the margin, offices’ loss is residential’s gain.

DB.