The property market keeps serving up winners.

So, here we are 2022. How did that happen?

Now, I hope you’ve hit the ground running. I hope you’ve got clear on your goals, clear on your strategy, and clear on how you’re going to access the support and resources you need.

I am sure this year is going to be an absolute belter.

Now I’m am going to do my absolute level best to keep on brining you analysis and insight that you can keep using to be the best investor you can be. I know there’s a lot of people following me know. (I know, because I see them regurgitating my stuff for their ‘clients’).

That’s ok. As long as its getting out there. That’s why I make this email list free. The more information that’s out there, the better.

So I’ve got a tonne of stuff to share with you, but first I wanted to take a quick look in the rear-view mirror, and see if the trends that defined 2021 will continue to have impact in 2022.

By and large that’s true. We’re still in the middle of a $400bn money printing experiment. Money is still super cheap, and households are still flush with cash.

All of that sets us up for a massive year.

That said, corona virus variants are still playing silly buggers, Canberra seems less keen to throw around the cash than they were in 2020, and global supply chains still remain constipated.

It’s going to be an interesting year, that’s for sure.

Now I did find a piece by Proptrack’s Paul Ryan really interesting. He reckons there were five property market winners in 2021.

The first was first home buyers. The number of first home buyers in the market surged to the highest level in years, spurred on by cheap interest rates and a range of government support measures.

Now, is that going to keep on playing out through 2022. On the face of it, the government support packages are winding down, so you’d expect FHB buying to ease.

Then again, this is an election year, with a government dealing with their fair-share of problems (another Covid recession potentially being one of them), and nothing is ever as politically popular as money for first home buyers.

So this question is live.

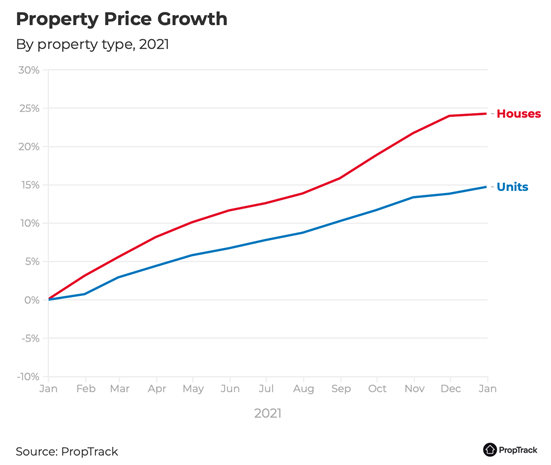

The second winner of 2021 was detached housing over units. Detached house prices clearly out-performed unit prices through the year.

That’s a big difference.

So is that likely to continue?

Good question. My bet is that it swings on immigration, since the general rule is that immigrants start their journey in Australia in a high-rise apartment in Sydney or Melbourne.

If immigration comes back quickly, we could see unit’s play a bit of catch up. If it doesn’t, then I’d expect units to continue to lag.

Now the Housing Industry Association was out there the other day saying that there’s a looming shortage in inner-city high-rise. HIA’s Chief Economist warned that a downturn in construction meant a shortage was imminent.

“We need to build more apartments simply to meet the demand”… Mr Reardon said.

“I expect that after the next federal election, we will see a return to traditional levels of population growth regardless of who wins. That will see a growth particularly in demand for apartments, not so much for detached homes.

“We will also see people starting to be drawn back to cities, back to apartment living, as employment and education opportunities return this year”…

“We’re seeing in Sydney at the moment developers looking through the haze of the pandemic to see there will be very strong demand for apartments when migration returns and … a shortage of other stock coming on to the market,” Mr Reardon said.

“Melbourne is a market we’re watching very closely, we will need to see some changes in demographics before … a return to strong demand for apartments.”

Yeah… maybe. I feel like I’ve heard this before. There is clearly not a shortage of apartments now, and even if immigration rebounds fully – which doesn’t seem like it’s going to happen anytime soon, there’s a big gap to fill.

I’d still be wary of high-rise through 2022. It’s never my favourite investment play – since there’s not all that much you can do to manufacture growth with those cookie-cutter boxes – and I wouldn’t be banking on this promised ‘shortage’ materialising anytime soon.

Ok, that’s two of the five, but I’ve run out of puff and I’ve got a couple of things I need to get on to.

I’ll come back to this on Thursday.

DB.