If we’re still hot on the heels of NZ, we’re headed for the moon!

Wow. Are you guys watching what’s happening in New Zealand at the moment?

Crazy times.

So I’ve been saying for a while that we should keep a close eye on New Zealand. The NZ property market is dealing with the same confluence of factors that the Aussie property market is.

Namely, super cheap interest rates and a ballooning money supply.

The one advantage that NZ had was that they dodged the lockdowns that put the Victorian economy on ice, which in turn had a chilling effect on the rest of the country.

So New Zealand, therefore, is about 3-6 months ahead of Australia, I reckon.

So if we look into the future, what does the future look like?

This:

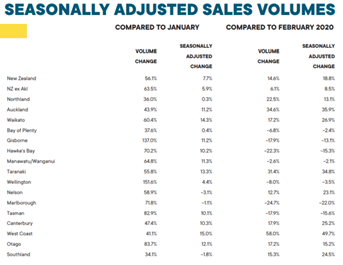

That’s New Zealand property prices going vertical.

Is this normal? Hell no! This is shocking!

The REINZ’s February sales data shocked even seasoned market commentators when it was released on March 11, showing median house prices across the entire country had increased by $50,000 in the month of February, with a $100,000 monthly increase in Auckland.

$100,000 in a single month! Wild.

But it’s not just Auckland. We’re now talking about phenomenal price growth from North to South.

Most regions are growing at 20% year on year. But some areas are even giving 40% a tilt. 40%!

The market is red hot, with sales across the nation booming.

There might be an element of FOMO here. The Reserve Bank of New Zealand is introducing some lending restrictions to try and take some of the heat out of the equation, and some buyers might be trying to get in ahead of that.

REINZ CEO Bindi Norwell attributed some of the turbo-charged growth to home buyers rushing in before loan-to-value ratio (LVR) restrictions came into place in March:

“The unrelenting pace of property sales continued in February, with a 14.6% uplift on sales volumes compared to the same time last year; the highest number of properties sold for the month of February in 14 years”…

“It’s highly likely that some of this uplift can be attributed to both investors and owner-occupiers looking to purchase ahead of the LVR restrictions coming back into effect in March and the slight uplift in listings we’ve seen over the last couple of months”.

Wow.

But it couldn’t happen here, right?

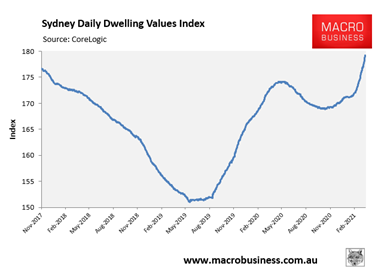

Or could it? Sydney house prices have already grown 4.5% since the start of the year. That’s on track for a 20% annual growth rate.

And the chart’s already gone vertical too.

This is just what cheap money does, no matter what side of the ditch you’re on.

DB.