Here’s a quick look at the next generation of investors.

There’s a new kid on the investing block.

Kinda literally actually. The kids are growing up and they’re investing.

The investing landscape has changed quite a lot recently. Trading apps have made the stock market more accessible. Bitcoin and the various crypto currencies are a piece of cake for tech-savvy younger folks.

And they’re certainly not going to be happy tucking their money away in a term deposit earning three tenths of sod-all.

They know they’ve got to be proactive with their money if they’re going to get ahead.

And all power too them. I know a lot of people like to rag on ‘millennials’ or whatever. But in my experience, they’re the hungriest generation I’ve ever met.

And so I’m watching pretty closely what they’re investing in.

So far, I don’t know they’re taking all that much interest in property. The entry hurdles into property are substantial (if you do it the traditional way!), and so it’s not something most 20 years olds are aspiring to.

(Although, there are a lot of ways to get into the market, even if you don’t have a lot of money to work with. I’ve got a stack of no-money-down strategies. Hit me up, kids.)

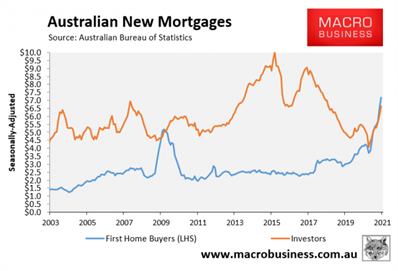

That said, right now, we are seeing a boom in first home buyers getting into the market, which is fantastic.

For the first time in over a decade, first home buyers outnumber investors.

Beyond property, many young folks are getting into the share market. There are new trading apps on the market every day.

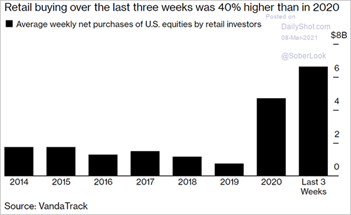

I don’t have data for Australia, but in the US retail flows (i.e from mum and dad investors) are booming. Weekly average inflows are up 40% on 2020 levels.

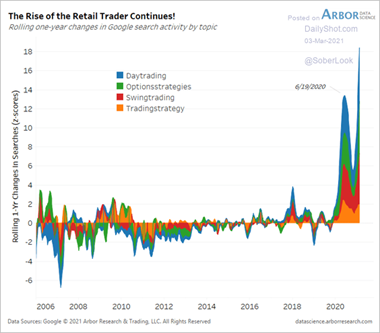

Google searches for trading related terms are accelerating:

Trading activity on the most popular American apps continues to grow…

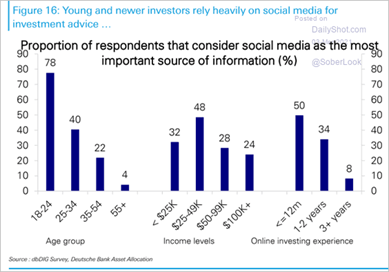

A little worryingly, retail investors do seem to be relying on social media for their trading advice. But then, the system hasn’t served them all that well, so why not try some alternatives.

The other place we know that young investors are going is into crypto-currencies. We know that inflows have accelerated into 2021:

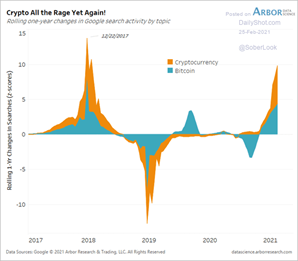

And crypto-related search terms are booming… again!

And look, I get it. When you’re trying to save up for a deposit, or just get ahead, the gains on offer through crypto investing are incredibly juicy. They’ve been phenomenal over the past twelve months.

Again, all power to them.

The crypto revolution is here to say.

That’s not to say all coins are going to be here in six to twelve months’ time, and the only thing I would say is that a bull-market like we’re in now makes everyone look good.

It’s when things get rocky – that’s when you know who has done their homework, and who has invested in themselves and their strategies.

But hey, if you’re willing to do that work, why not. Go for it.

So watch this space.

This is the decade of the retail investor.

And these kids are hungry as anything.

DB.