I gave you three reasons why 2022 will be big for property. Here’s two more.

So I flagged a couple of days ago that I thought there were five reasons (at least!) why property prices were going to continue to boom in to 2022. The first three were record low interest rates, massive money printing and booming rental markets.

Now lets talk about the remaining two – household savings and infrastructure.

4. Massive Household Warchests

Another interesting phenomenon we saw emerge in Covid was a massive increase in household savings.

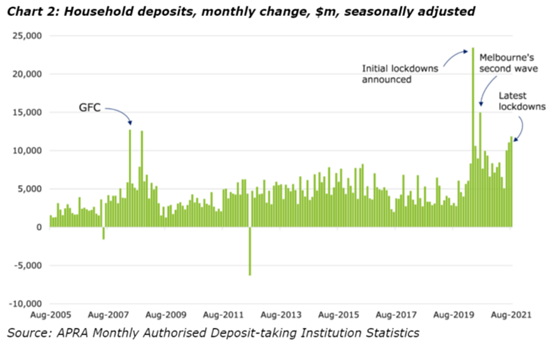

Savings ratios boomed as government support payments held incomes up, but people were stuck at home and unable to spend anything. Banks saw household deposits boom.

Interestingly, this had a demographic dimension, with younger people saving relatively more than older people (as a percentage increase). This is because younger people have a higher propensity to consume, and so were affected more by the lockdowns.

What this leaves us with is a household sector sitting on a massive warchest of money. Young people – and prime home-buying age groups – are particularly flush.

The big question is what do they go and do with this money. Do they spend it on consumer goods, or do they invest it.

My bet is that a lot of it becomes deposits for homes and investment properties, driving up property demand.

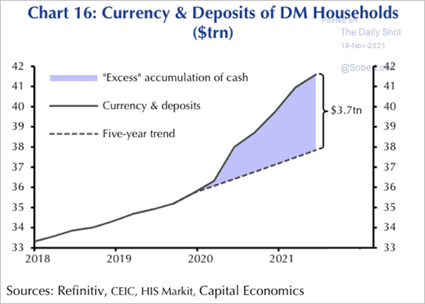

Interestingly, this is a global phenomenon. Household deposits in developed markets have exploded by $3.7 trillion dollars!

The world is awash with “excess savings”.

That’s a nice problem to have.

5. An Infrastructure Boom

The final factor to watch for is a boom in infrastructure spending.

One of the things the government did during Covid was open up the wallet and pour money into worthwhile infrastructure projects.

When you look at the infrastructure pipeline, you can see its one of the biggest infrastructure booms on record.

This changes the value of land.

When a new road goes in for example, it makes new land more accessible, which pushes up its price.

So a boom in infrastructure will drive a boom in property prices.

It will be a little patchy, depending on where the projects are happening, but it is still good for the market overall.

There you have it

That’s the five reasons why I’m banking on the current boom continuing well into 2022, perhaps even beyond.

And I’m not even talking about the snap-back economic rebound, record low unemployment rates, booming corporate profits or a big-spending Federal Election.

I could go on.

But make no mistake. The stars are aligned. 2022 is going to be big.

DB.