Could China be this reckless? Yes.

China is just a big knot of tension in the shoulders of the world right now, isn’t it?

Hong Kong is intense. The trade war with the Donald is tense. The South China Sea is intense.

And things in the Central Kingdom are intense too. Growth is now the lowest it’s been in 30 years… if you believe the official statistics and a lot of people don’t.

But what’s interesting right now is that even though growth is barely bumping along the floor, the Chinese Communist Party (CCP) doesn’t seem all that interested in doing all that much about it.

That’s unusual. Normally, they’re more than happy to throw the kitchen sink at the economy if it’s not doing what it’s supposed to.

That’s one of the perks of being a one-party state. You kinda just get to do what you want – juice the banking sector, throwing up entire cities of empty apartments, print money, whatever.

But right now, the CCP isn’t signalling that they’re going to do all that much. From Reuters:

China will step up efforts to boost demand and support the economy, but will not use the property market as a form of short-term stimulus, a top decision-making body of the ruling Communist Party said on Tuesday.

With China’s economic growth slowing to near 30-year lows, investors are waiting to see how much more stimulus Beijing will roll out, and if it will risk easing curbs on property markets to boost construction and investment.

Such a move could drive an even sharper build-up in household debt and risk property bubbles. The central bank reportedly told lenders last month not to lower mortgage rates further, but market watchers believe some cash-strapped local governments may be considering loosening restrictions on home buyers.

And it’s true that there’s nothing coming out of the construction sector. The blue line here is total number of dwellings built. The yellow line is floor-area, and it’s falling year on year.

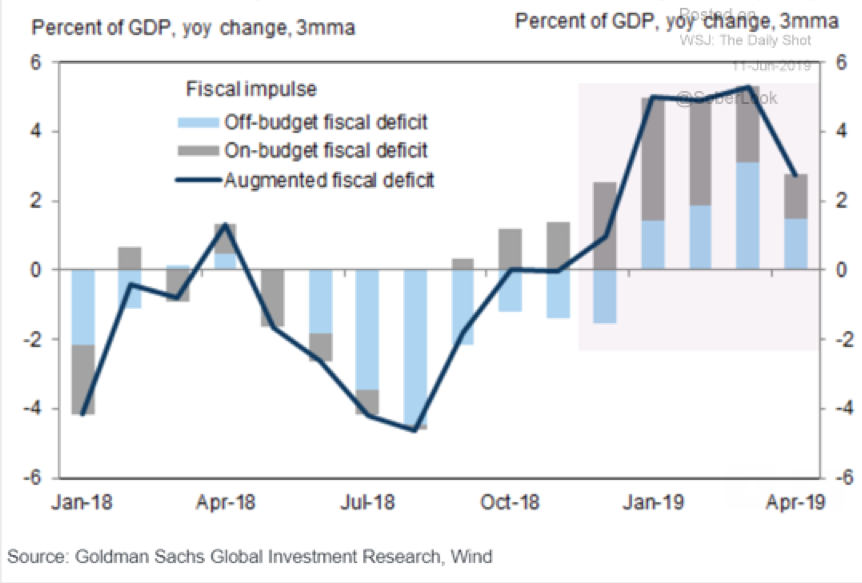

And the fiscal response is looking pretty muted. There’s a bit coming through in the way of tax cuts, but the investment spend you’d expect to see in times like these, is absent.

So what’s China thinking here? Why aren’t they stimulating?

Well, either they can’t or they won’t.

It is definitely possible they can’t, or think they can’t. On some accounts China is already in the middle of a financial crisis. Many banks are looking shaky. Throwing more money and more bad loans at the system to prop up more bad investments isn’t exactly a remedy.

Still, I expect their politicians are like our politicians, and are happy to buy a bit of short-term relief if there’s a chance things might just sort themselves out in the long run.

So I expect that they’re choosing not to.

On that front, I imagine they’re expecting the trade war with the Donald to be long and painful. It could definitely get worse.

If worse did come to worse, then they’ll want to keep their powder dry and have some stimulus left in the tank.

However, they may also be happy to let the economy collapse.

I mean, if you had to have an economic collapse, now would be the perfect time to do it. You could easily point the finger at bully America, and it would probably spur on a surge of nationalism, which is a long run positive for the CCP.

Also, if China did go down, we’d all be in the fall-out zone. That might test the support of America’s allies. They’d be like, “We were with you on the whole trade war thing but now we’re in recession… can’t you guys just kiss and make up?”

And without the short-term pressure of elections, the CCP might just be willing to play the long game, and take the pain that they probably now is heading their way – take it now while there’s a strategic advantage in doing so.

Now, we were all expecting the trade war to be a bumpy ride, but I don’t think anyone’s expecting China might deliberately drive the whole show off the rails.

But the way I look at it, it’s got to be a possibility.

DB