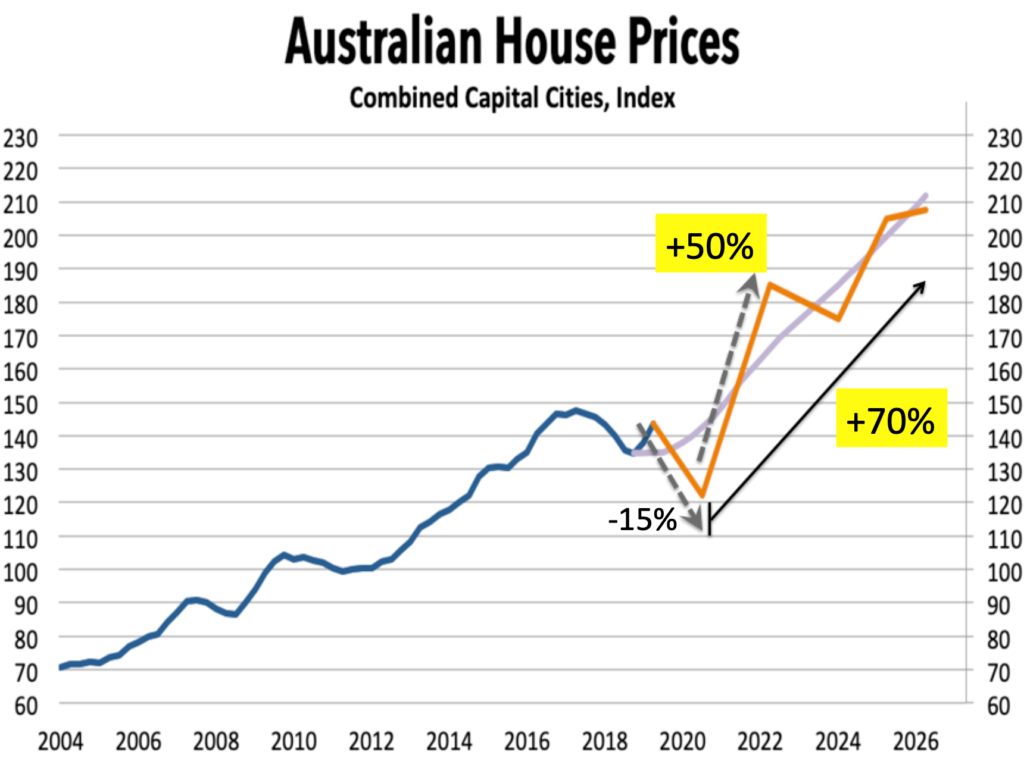

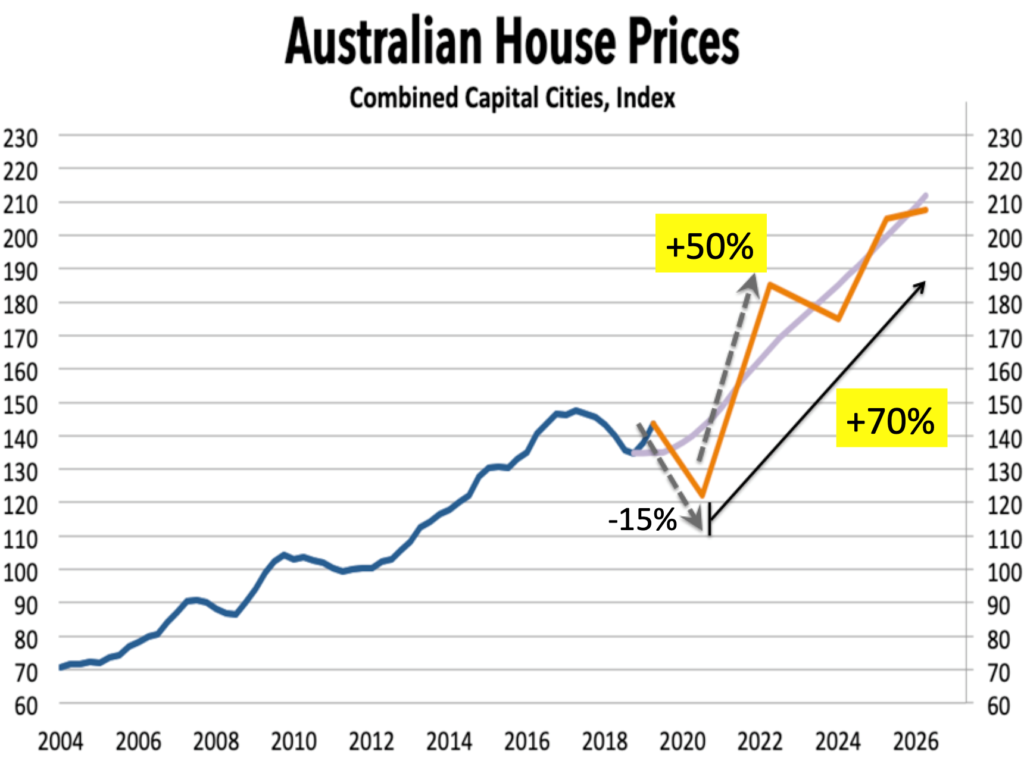

These projections map out what might be possible in the next 5 years

What happens if the GFC repeats? What happens to property prices?

I thought I’d share with you now some modelling I did for my inner circle.

The exercise here is to try and imagine what’s going to happen to property prices in Australia if we see the same dynamics play out that we saw during the GFC.

From where I sit, that looks like a certainty. The same factors are in play. The same government responses are active.

The only question is around timing and size. There’s still too much uncertainty about how the virus is going to play out to offer anything definitive – to offer forecasts. But we can offer projections to imagine what might be possible.

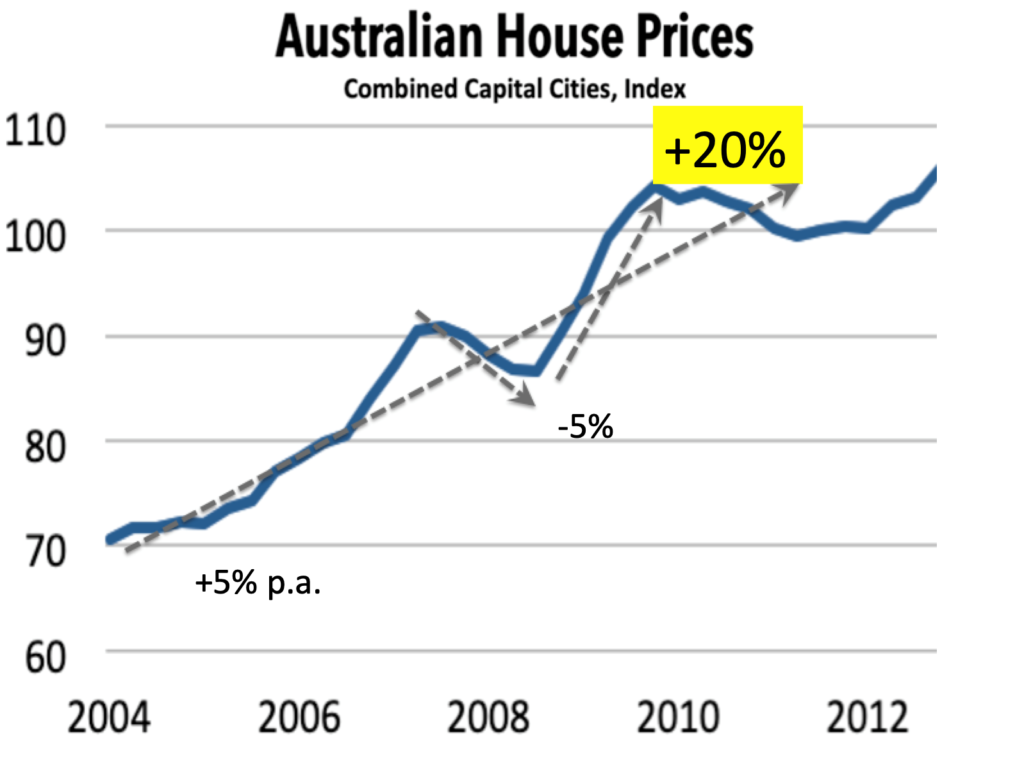

So just to recap, this is what we saw during the GFC – for a full discussion, see in here and then here.

But the basic idea is that the first phase was a classic sentiment cycle, where prices fell 5% and then rebounded 20% in a short period of time.

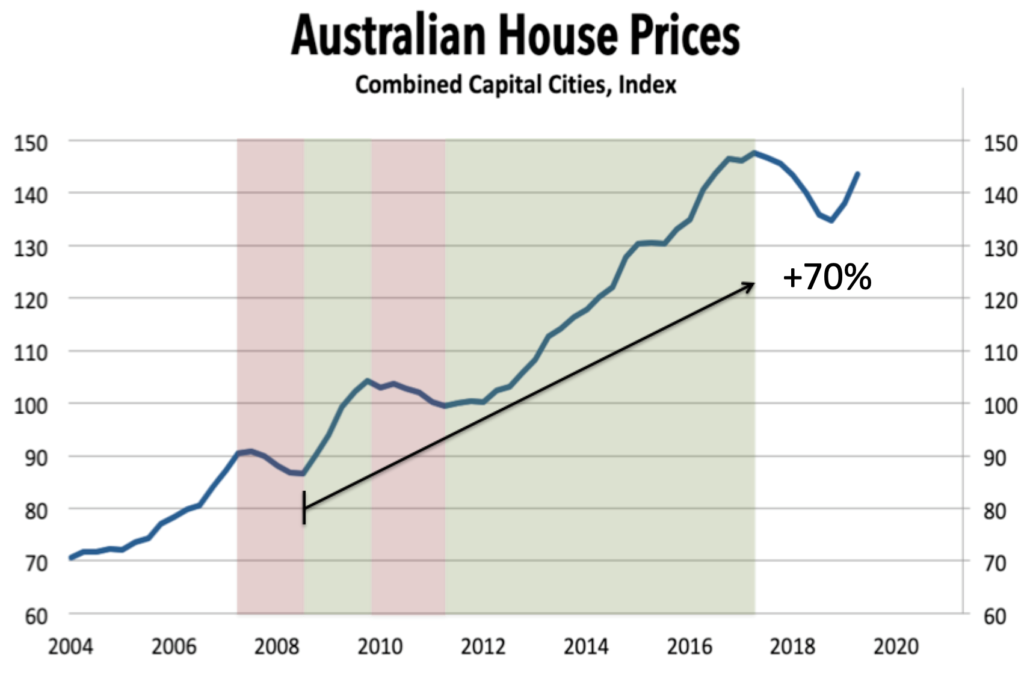

After that, the cheap money flowing into the system started to take effect, and prices went on to post a 70% gain.

So what happens to our picture if something similar plays out this time around?

So, the first phase is the sentiment cycle. During the GFC we saw prices fall 5%. Since the economic impact of the corona virus is shaping up to be a fair sight worse, I think falls of 10-15% are a good base-line.

If we see the same dynamics play out again, there will then be a rebound as the market returns to trend.

Given the larger falls in the first phase, the rebound in the sentiment cycle could easily be 50%. That’s huge.

Again, this is not a forecast. It’s just an exercise in trying to learn from history.

Ok. So after the sentiment cycle come the fundamentals.

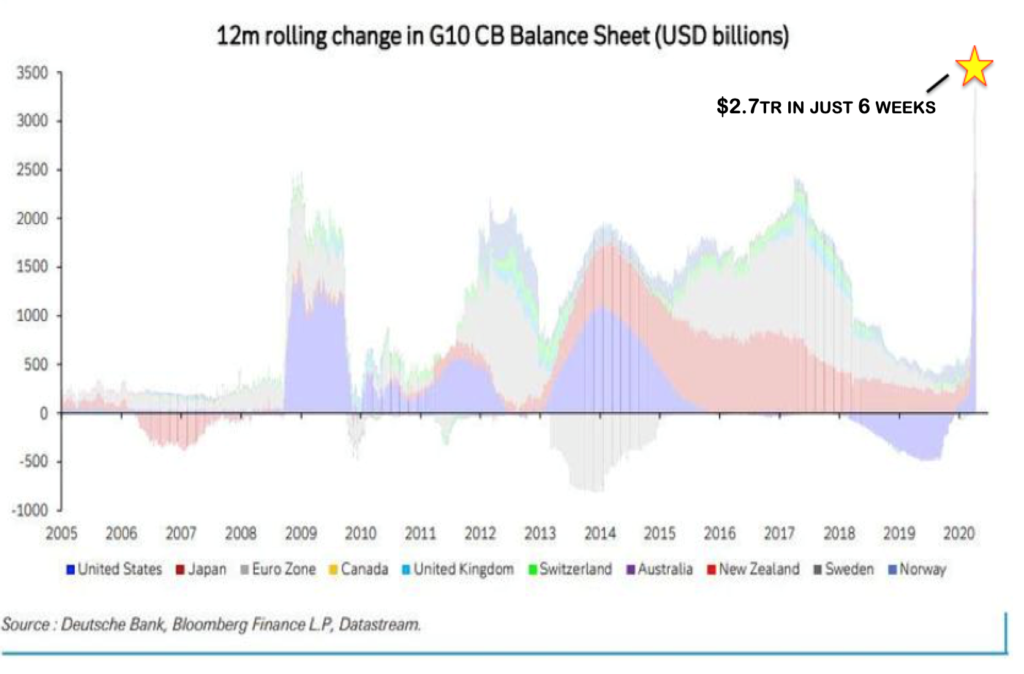

As we know, the fundamentals are cheap money and massive money printing.

That’s already happening. Take a look at this chart here. This is money printing in the G10 – the world’s ten largest economies.

The money printing machines are pumping out the cash again – at a much faster rate than they did during the GFC.

The world is awash with cash.

That will land, sooner or later, in our property markets.

And it’s not hard to imagine that the kinds of gains we saw immediately following the GFC are going to be repeated. That would see prices rising 70% over the following 5 or so years.

If that were to play out, you average house in Sydney, worth about $1m, would be worth $1.7 by the time the cycle was done – a capital gain of $700,000.

Again, these aren’t forecasts. This is just a modelling exercise to try and get a sense of what we’re looking at if history repeats.

Of course, history doesn’t repeat exactly.

But it does rhyme.

The measures that drove the property market post-GFC are active again. Your starting assumption has to be that similar dynamics will play out again.

I’m seeing a lot of opportunity.

So the question then becomes, how do we get ready?

Well… how do you?

DB.