Australia property isn’t boom. Global property is booming.

I think because we’ve seen house prices in Australia boom so much in recent memory, we tend to think about the current boom as being ‘just something the Australian market does.’

It is true that there are some very Australian dimensions to the current boom. There are a number of factors that are unique to Australia.

Australia is still the lucky country. As the experience of our poor Indian cousins shows us, we have an awful lot to be thankful for here.

And that luck is reflected in our economy, which in turn is reflected in our house prices.

But while there are Australian dimensions to the current boom, this is very much a global phenomenon.

House prices are booming pretty much everywhere.

Like Korea. House prices are out of control in the nation’s capital, Seoul, according to the ABC:

If the rate of Australian home price rises is bringing a tear to your eye, you are unlikely to find much sympathy from South Koreans trying to buy in their country’s capital.

Seoul’s property market is on a tear. Apartment prices in the metropolis of nearly 10 million people rose by an extraordinary 22 per cent in 2020, outstripping all other cities in Asia.

… Seoul residents Park Jong-hui and Oh Hye-jin thought they had set a reasonable budget when they started looking for a place to live with their three-year-old son Park-jay.

Even as the global pandemic hurt the economy and imperilled jobs, demand was outstripping supply and they kept being outbid for every place they were interested in.

After months of disappointment, they have finally managed to secure a place.

But it is much further from Seoul’s centre than they would have liked. In the traffic-plagued city, it means a long commute.

“We have to move outside Seoul,” said Jong-hui.

“It will now take one hour and a half to go to work, which is disappointing.”

Yep. That sucks.

But we are all global citizens now, and we’re all in the same boat.

And the thing that’s driving the boom in Australia is the same thing driving the boom in South Korea: cheap money.

The official cash rate in Korea is 0.5%, which is a bit higher than our 0.1%, but it’s still pretty much nothing.

And like pretty much every developed country on the planet, Korea is printing money. Take a look at this chart of Central Banks’ balance sheets (a proxy for money printing) in the G10 nations:

You can see central banks have printed a staggering amount of money since Covid started.

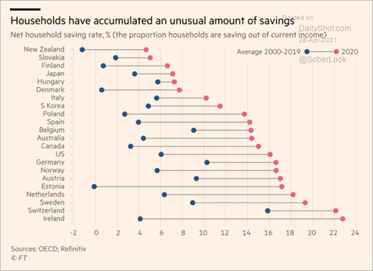

That, in turn, is filtering into the economy, and piling up in citizens bank balances. This chart shows you how much savings rates have increased since Covid, with citizens everywhere pocketing huge amounts of money. (Check out Ireland!)

And so with super low interest rates, serviability has exploded. And with the run up in saving war-chests, deposit power has exploded as well.

Which is why, all over the world, house prices are going ‘through the roof’ as The Economist puts its:

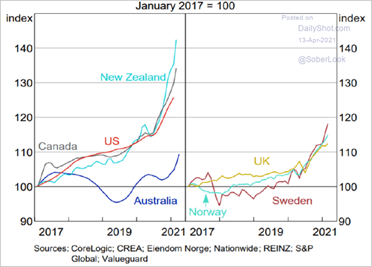

Or another set of countries telling the same story (check out New Zealand):

So this boom has Australian flavours, but it is global in nature.

And it’s why its going to be with us for a long, long time.

DB.