Want to know why CBA is backing a boom?

What does CBA know that we don’t?

I noted last week that CBA have upgraded their outlook for the property market.

They’re now expecting a peak-to-trough decline of a piffling 5%. Given we’re already at 2.4%, that means we’re pretty much there already. They’re kinda just saying the only way from here is up.

And they’re also saying, given the rate cuts we’ve had, that the way up is going to be steep and sudden.

Now, this is slowly becoming the consensus view, but CBA was the first horse out of the gate…

Did they know something we didn’t?

Yes. They did.

Remember CBA is a bank – a bank with the largest mortgage book in the country. They’re still Australia’s biggest home-loan lender.

That means they have access to a treasure trove of data, which gives them a real-time insight into where the property market might be heading.

And we’re now seeing some of that data for ourselves.

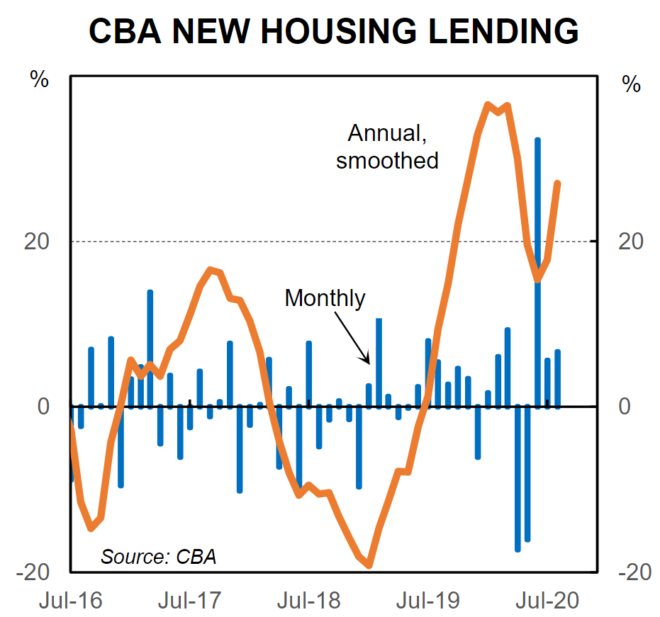

The most important piece of the puzzle is a pick up in new lending. CBA is writing new home loans at a considerable rate:

New lending for housing rose again in August. A recovery in lending is one factor behind our view that dwelling prices will fall only modestly over the next 6months. And we expect dwelling prices to rise solidly in H2 21 (see here).

So new lending is a sign that the mortgage market is picking up, and activity is increasing.

That might not be a good thing if we’re talking about a flood of panic sales coming on to the market at reduced prices.

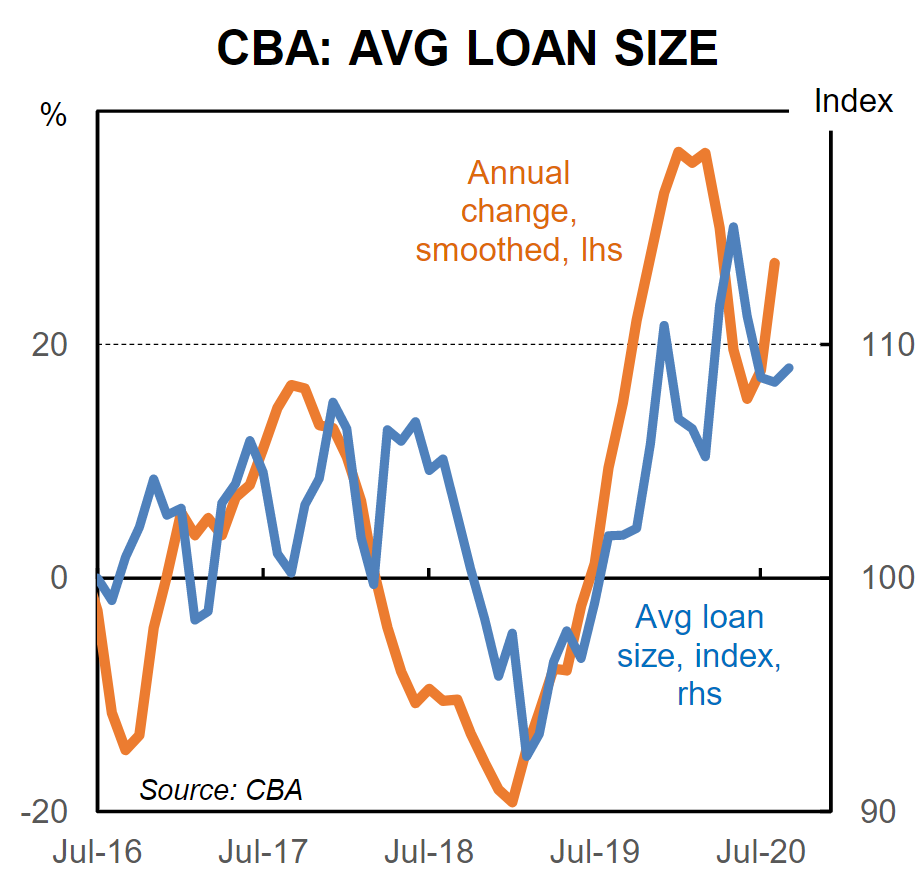

But CBA isn’t seeing that. Average loan size is steady, which is indicative of stable prices:

The average loan size was steady in August. The average loan size is higher than a year ago as lower mortgage rates mean that people are able to service a higher level of debt for a given level of income.

So this is why CBA thinks that the property market has pretty much stabilised, and there’s only minimal falls in the months ahead.

Once we get to the turning point, in early 2021, house prices should grow quickly.

Why?

Interest rates.

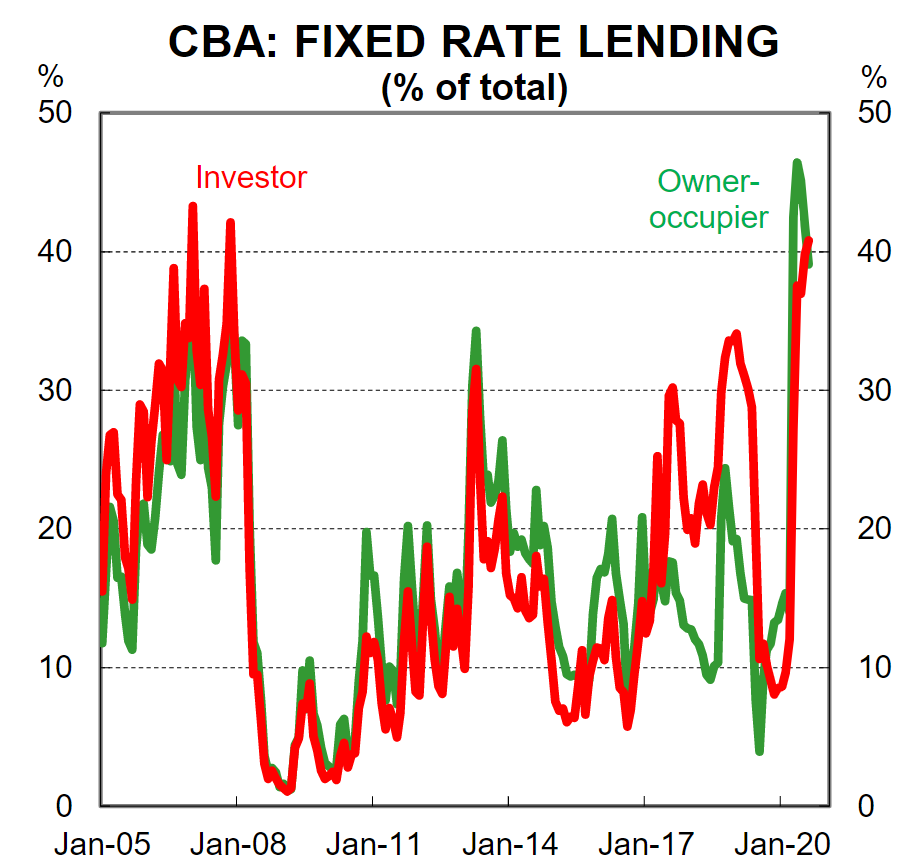

Interest rates have fallen substantially. Fixed rates in particular are about one and a half percentage points lower than they were pre-Covid, and there’s been a solid increase in the share of the market going on to fixed rates:

The share of fixed rate lending remained at a high level in August. The share of fixed rate lending has lifted for both owner-occupiers and investors. Fixed mortgage rates are generally lower than variable rates at present.

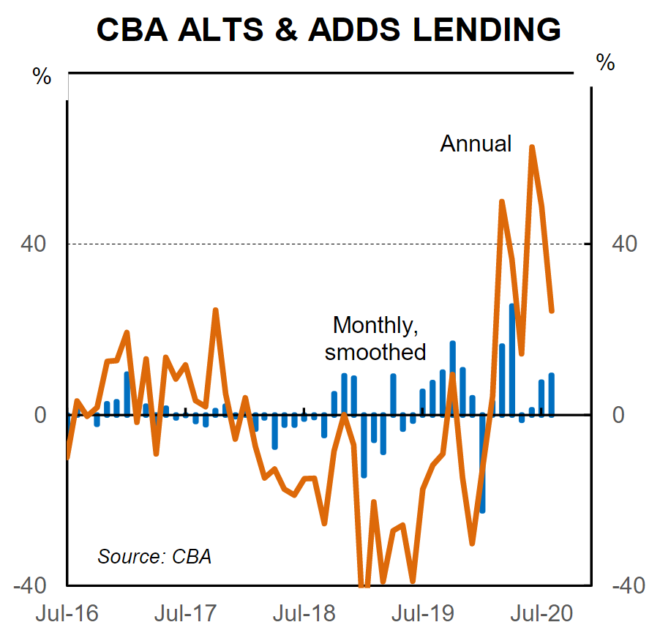

As a side-note, CBA are reporting that lending for reno’s is up, suggesting that people are generally more confident in the outlook and their cashflow position.

Lending for renovations is growing at a solid pace. Many people are undertaking home renovation work while spending more time at home. That said, stage 4 restrictions are currently limiting renovation activity in Melbourne.

So all told, the insight we’re getting from CBA’s internal data is pretty bullish.

And it’s why CBA know expects the market to recover, and recover quickly.

And now watch as the rest of the country starts to cotton-on to what’s happening.

DB.