New Zealand continues to show us what to expect.

I’ve been making the case for a few months now that the Kiwi property market is blazing a trail, and where New Zealand goes, Australia is sure to follow.

In many ways, we can think about New Zealand as being like a state of Australia. (Am I right, Kiwi-friends?)

But seriously, we can think about it like that because New Zealand has had the exact same policy response that Australia has had (large government spending, super-cheap rates), but New Zealand has had very limited exposure to Covid.

While we had the Victorian lock-down, and then a spate of smaller restrictions, New Zealand had done pretty well.

And in that sense, I think you can think about New Zealand being about three months ahead of Australia.

And I’m not the only one holding that view. ANZ Research has just released a new report on the New Zealand property market, which claims that a “perfect storm” has developed, driving “unprecedented gains”:

House prices rose 2.9% in December, following similar stellar rises in October and November. This saw a quarterly gain of 7.7% for Q4 (figure 1) – the biggest quarterly gain on record (based on data from 1992).

Look at that lockdown ‘blip’! Blip barely cuts it. It wasn’t even a stumble.

But after just two months of a pause, prices accelerated quickly.

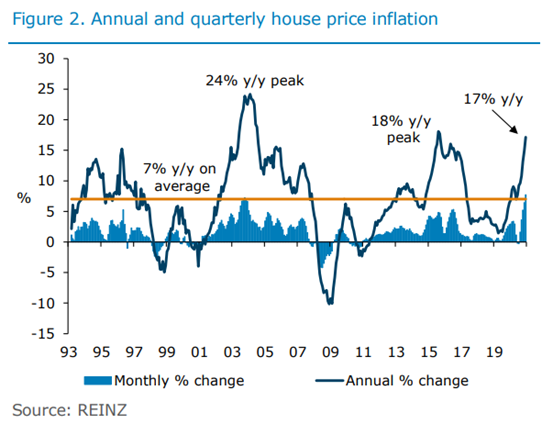

Since the lockdown-induced declines seen in April and May, house prices have risen 16%. This has seen annual house price inflation rise to 17% (figure 2).

Annual house price inflation is still below the peak seen in February 2004 (24% y/y), which followed a year of solid monthly gains (1.8% m/m on average). The upturn this time has been shorter but sharper, with price rises of 2.1% m/m on average since May.

ANZ also reckon that despite the broader economic headwinds that still remain, momentum is with the New Zealand property market, and prices will continue to grow.

We do expect to see some continued momentum in the market over the next few months, with the housing market very tight. Days to sell reduced further in December to just 31 days, compared with a historical average of 39 days. Listings are not coming onto the market fast enough to meet demand, with inventory hitting new all-time lows. This speaks to further upwards pressure on prices, reinforced by the fact that house price expectations have increased as the housing market has strengthened (figure 3).

… It has been a perfect storm: fear of missing out (FOMO), scarcity of properties and expectations that house prices will get further out of reach, at a time when interest rates have been falling and bank funding has been readily available. This dynamic is expected to contribute to further price gains in the short term at least.

All of the above applies to the Australian market too – low interest rates, a lack of properties on the market, and a growing sense of FOMO.

It’s why the RBA’s prediction of a house price boom somewhere in the vicinity of 30% looks more than reasonable.

Keep leading the way, Kiwi-land.

DB.