The market has bailed out a bunch of investors. They got lucky.

A good market makes a bad strategy look good.

This is how I think about negative gearing.

I actually think the market, which has only really gone in one direction over the last decade or so, has stopped people realising what a mistake they’ve made by buying a negatively geared investment property.

And that’s not to say you should never buy a property where the interest expenses are more than the rent. Sometimes you might be totally convinced that the property is going to go up in value and the rental loss is a price worth paying (sometimes that’s true.)

Or you might have a clear idea about what you’re going to do with that property – renovate to increase the rental value, or create more rentable doora, or sub-divide and sell off or whatever. In that case, wearing a rental loss for a while might make good sense.

What drives me totally bananas though is those accountants who recommend that people go out and find a property that is losing money – and make sure that it is losing money because that’s the point – and buy that property just so they can save a bit on income tax.

This is totally putting the cart before the horse, and I don’t think most people have any idea of how bad and dangerous a strategy it actually is.

If the economy turns and you lose your job, suddenly that property is a mill stone around your neck. You can’t offset the losses against income if there’s no income!

In the end though, the market has saved these negatively geared investors from ever facing that reckoning.

Interest rates (and interest expenses) have gone down, and rents have gone up. This dynamic should have turned most properties positive in recent years.

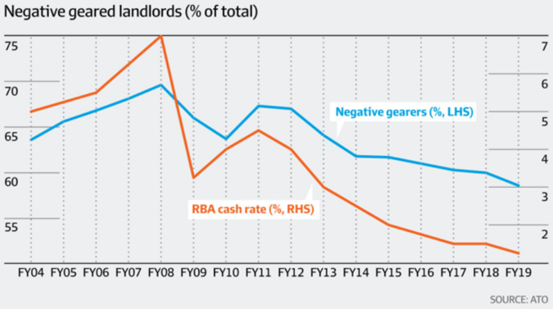

You can see this in the data too. The AFR has reported that the proportion of landlords negatively gearing rental properties fell to 58.6% in 2018-19 (the latest period we have ATO data for).

This was the lowest level on record and well down on the peak of 69.6% in 2007-08.

There were also 19,113 fewer negatively-geared landlords than in 2017-18, representing the first fall in the number of negatively geared investors in five years.

You can see from the AFR’s chart that the share of negatively geared investors follows the RBA’s cash rate.

The proportion of landlords negatively gearing rental properties has fallen below 60 per cent for the first time on record, reflecting a decline in interest rates.

Of the 2.2 million taxpayers owning at least one rental property, 1.3 million declared a net rental loss in 2018-19, according to new annual data published by the Australian Taxation Office.

… The number of landlords negative gearing at least six properties was 11,226 in 2018-19.

Some 10,935 landlords negative geared five properties, 26,719 owners had four properties claiming a net rental loss, 74,955 property investors had three properties negative geared and 250,035 had two properties claiming a loss.

Almost 1 million people – 931,132 – had one property negatively geared.

Now look, as I said, negative gearing makes sense in some circumstances. And if you are relatively wealthy (like, you own five properties), it can be a tax-efficient way to organise things.

But it’s something I rarely recommend to people at the start of their investing career. You want to be building your working equity and your serviceability. Negative gearing detracts from your serviceability.

And don’t confuse causation with correlation. Just because wealthy people negatively gear, doesn’t mean having a negatively geared investment property will make you wealthy.

Like, being wealthy means you can afford a Tesla. But it doesn’t work the other way. Buying a Tesla won’t make you wealthy.

So stay the course Australia. Leave negative gearing to those people who know what they’re doing.

But if you’re just starting out, there are better ways.

Ask me about them.

DB.