The markets are in total freak-out. It’s completely unheard of.

Let’s step back from the health implications of the Corona Crisis, and take a look at the unfolding financial crisis.

And while Australia has already resigned itself to giving up 50,000 dead to the virus (the government’s current best-case scenario), the implications of the unfolding financial crisis could be with us for decades.

Because this is quickly blowing out into something that’s going to rival the GFC.

And I say that because stock markets are coming apart at a horrific speed. Investment bank, Nomura reckon that the crash in US markets last week was so wild, that it was a one-in-a-160-billion-year event!

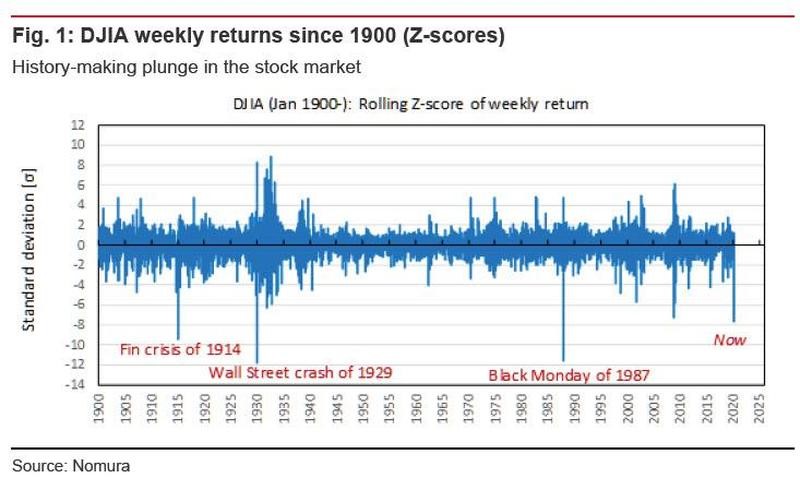

The plunge in US equities yesterday (12 March) pushed weekly returns down to 7.7 standard deviations below the norm. In statistical science, the odds of a greater-than seven-sigma event of this kind are astronomical to the point of being comical (about one such event every 160 billion years).

Looking back at the performance of the Dow Jones Industrial Average since 1900, market shocks have exceeded the current rout in magnitude on only three occasions: in 1914 (when a growing financial crisis caused trading in US equities to be halted), in 1929 (the historic market crash that led to the Great Depression), and in 1987 (the Black Monday event).

And I found this chart comparing the fall in the S&P.

As you can see, this is not the deepest crash on record, but so far, it’s certainly the steepest.

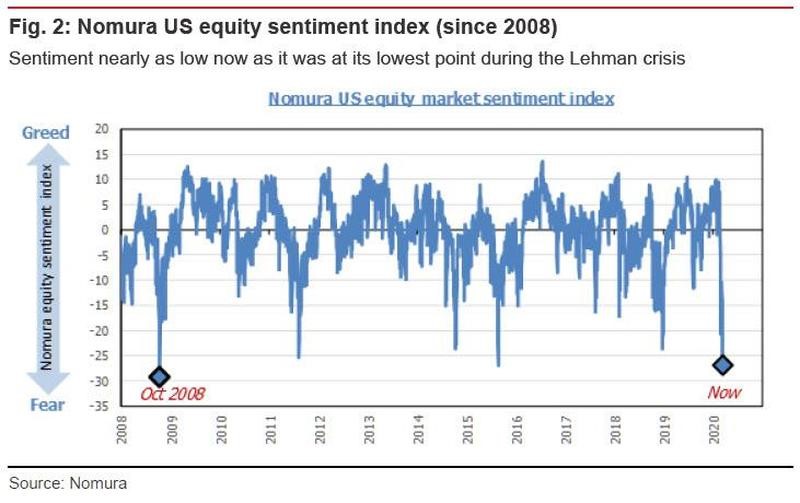

Coming back to Nomura, they say that, not surprisingly, share market sentiment has completely tanked, as investors run for cover.

US stock market sentiment has also seen a jarringly swift collapse, as equity sentiment has now gone beyond the low point marked during the 2015 renminbi shock. In little more than the blink of an eye, the situation has come to look like the 2008 Lehman Brothers crisis all over again.

But we’re no where near done yet, as the big money seems to have given up any hope of a quick recovery, and is starting to unwind longer-term investments:

Domestic Market equities worldwide are in bear markets now. Going by our own data analysis, the pace of the present sell-off has broken all norms. When a downshift in the market is characterized by unusually steep declines, the usual driver is an outflow from longer-term investments.

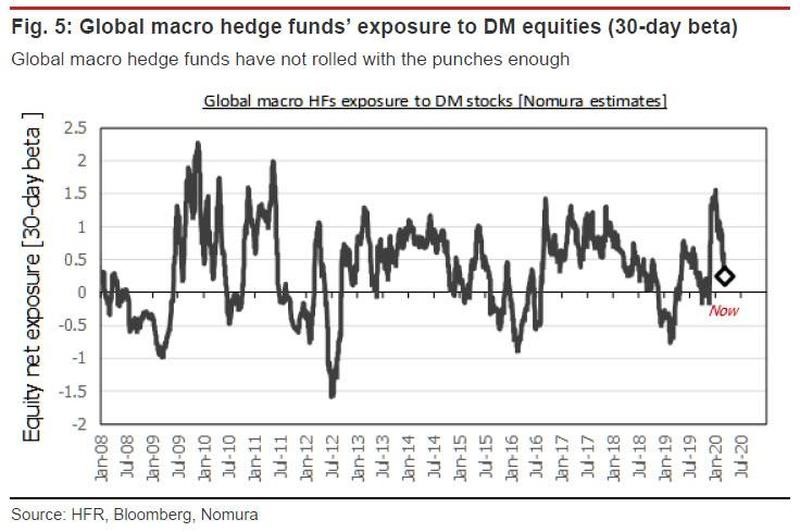

The present market rout is unconventional in that major hedge funds appear to be behind the curve in their selling…

For example, global macro hedge funds’ net exposure to Domestic Market equities (estimated from 30- day rolling beta) is still currently flat or even slightly long. It may be that these investors had been unable to fully imagine a pandemic-driven recession scenario, having no experience in that vein to draw upon.

Global macro hedge funds may have taken this week’s abnormal market movements as their cue to simply offload their long positions in DM equities in their entirety.

…It may be, then, that the market has only just begun staring into the abyss.

I fear they’re probably right. This rout is only getting started, and with Coronavirus keeping the world in lock-down, it’s going to be incredibly hard for global governments to spend their way out of trouble.

So I wanted to make sure that everyone had their eye on this, and that you’re all bunkering down accordingly.

That said, you’ll remember that a lot of people made a lot of money in the last GFC. (I was one of them).

There’s going to be plenty of opportunities here.

Stay tuned.

DB.