Regional markets have had a blinder. Can it continue?

So the regional property markets have had an incredible couple of years. Some of them have grown by 30%.

And that’s at the same time as rents are growing at 10% plus too.

If you owned regional property at the start of 2020, you’ve done spectacularly well.

But is it true that all good things must come to an end?

Corelogic and the Australian Financial Review were asking themselves that question last week, and wondered if our regional markets might be about to top out.

Regional house prices have accelerated over the past three months, notching up 6.3 per cent growth, more than twice as fast as the state capitals, after the last round of lockdowns in Sydney, Melbourne and Canberra fuelled renewed demand for homes in the regions.

But the latest surge in regional house prices is unlikely to be sustained over the medium term as higher interest rates and tighter lending weigh on demand, according to CoreLogic.

“It’s not often that the regional market of Australia and the capital city markets move in opposite directions, so it could be the case that the recent exuberance in regional market performance against a slowdown in capital city growth rates is a temporary phenomenon,” said Eliza Owen, CoreLogic’s head of research.

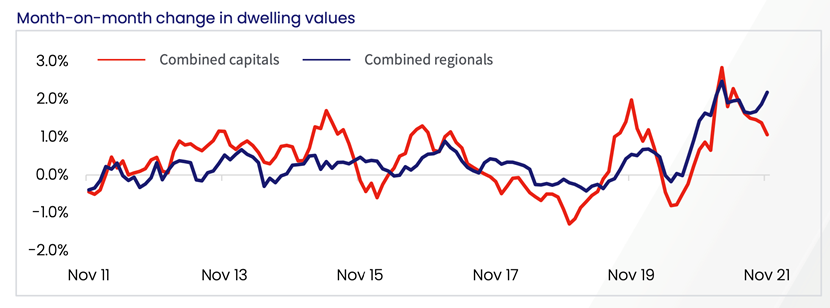

This chart shows you what she’s talking about. This tracks the monthly change in house prices and you can see that while the combined capitals are easing, combined regionals is still lifting. That is an unusual situation.

Owen continues:

“I think a rise in the official cash rate would see a fairly broad-based decline in property markets both regionally and across the capital cities. Despite the recent exuberance, I would expect growth rates in regional Australia to start slowing early this year.”

While the overall selling conditions remain strong across regional Australia, some indicators are already shifting, albeit marginally, CoreLogic data shows.

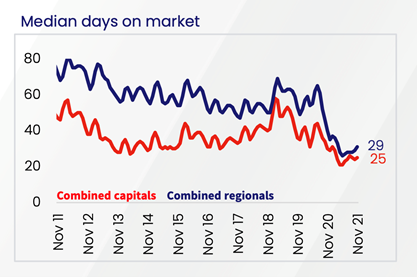

The time it takes to sell a home has dropped seven days to 30 from a year ago, but the metric is up from a recent low of 23 days in the three months to November 2021.

Yeah, ok, but look at the chart on days on market:

Yes, the regional numbers have ticked up slightly to 29 days, but it wasn’t that long ago that they were averaging 80 days! So the regional markets are still incredibly tight.

Anyway, our regional markets will face the same challenges the rest of the country does, according to Owen:

“The regional housing markets are not immune from economic forces,” Ms Owen said.

“Key drivers for performance in the regions will come down to higher interest rates and affordability constraints, the same headwinds capital city markets are facing.

“Regions have an additional factor to contend with and that is the possibility of a return to ‘normality’ and what that means for a potential refocus on cities. Employers may make a return to physical office space a priority in the years ahead, which would necessitate buyers to reconsider housing options closer to a capital city.”

Louis Christopher, SQM Research managing director, said if employers mandated a return to work in the cities, the regions could see an immediate and dramatic slowdown in prices.

“More aggressive demand by employers on a larger scale for staff to come back to work full time could potentially slow the regional housing market sharply,” he said.

“At the moment, I’m not seeing any signs of this happening.”

Yeah, me either.

Remember this is one of the tightest job markets in a generation.

If employers mandated a return to the city, it’s quite likely that people will just find new jobs and new employers who are willing to be more flexible.

So I think we’re jumping at shadows here.

The regions will run hot through the rest of 2022.

That’d be my bet.

DB.