Suddenly Brisbane is looking the goods

Some property experts reckon Brisbane is now the pick of the capital city bunch. They reckon it has the best prospects going forward.

What do I think about that?

It comes from a survey of 40 experts and economists (no idea why I don’t get invited to these things, I really don’t) conducted by Finder.com

Buying a house in Brisbane is the safest investment option of all capital cities, according to a new survey of experts, though their take on units is a kick to the gut for some investors.

The Finder Survey of 40 experts and economists, released this morning, had a dire outlook for the unit market which they saw as more than three times as risky in some capital cities than houses.

Brisbane emerged with best confidence level for houses among the 40 experts and economists with 14 per cent seeing it as risky. The highest risk for houses according to the experts was Perth (30 per cent), followed by Melbourne (24 per cent), Sydney (23 per cent) and Adelaide (15 per cent).

But Brisbane also tied with Melbourne for the dubious honour of having the highest percentage of experts who believed units were risky investments (68 per cent).

Sydney’s units were seen as risky by 61 per cent of those surveyed, while Perth came in at 60 per cent and Adelaide 53 per cent.

I think this is about right. What I would note is that units are always a riskier proposition than houses.

And that’s simply because there often isn’t all that much you can do with a unit. If you’re unit is similar to a whole bunch of stock on the market, then you’re really stuck with whatever the market is doing.

As an investor, detached housing normally gives you a lot more options. There are more things you can do to differentiate yourself from other houses on the market, and there are more ways to engineer a bigger rental return.

You can’t add a granny flat to a high-rise unit.

That’s why I’m not such a fan of high-rise. Sure, sometimes the numbers will stack up, but they need to stack up in a big way for me to compensate for the reduced flexibility.

So yeah, we can take it as given that units are going to be riskier.

But what about Brisbane outperforming the country?

I actually think it’s pretty likely.

Brisbane isn’t as dependent on immigration as Sydney and Melbourne are, so the closed borders aren’t going to be such a drag.

At the same time, a lot of people having been living the big cities in search of better lifestyle.

Brisbane is a big city, but in some ways, it still feels like a big country town. I reckon it’s going to keep attracting inter-city migration flows. You can see here on this table that it has the strongest positive internal migration numbers:

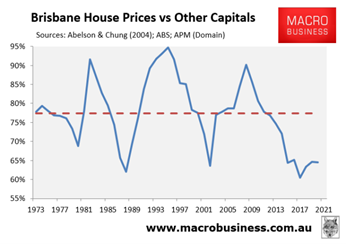

Brisbane is also attractive when you realise that it’s very cheap relative to its cousins.

Relative to the other capitals, Brisbane is the most affordable it’s ever been!

And Brisbane is going to benefit from the same cheap-money frenzy that the rest of the country is too.

Mortgage demand is already through the roof, and that strongly suggests that prices will go astronomical in the near future.

So yeah, what’s not to like?

You get all the benefits of the national interest rates settings, plus it’s a very attractive destination relative to its peers.

It’s going to be a very strong year for Brisbane.

This is one of those cases where the experts are right.

DB.