Free money has set the economy on course to boom.

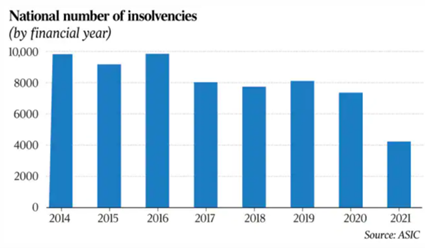

Interesting story last week. So not only have we avoided the ‘tidal wave’ of business bankruptcies that were expected in the early days of Covid, we have managed to get the number of business bankruptcies down to record lows.

So there have been just over 4,000 bankruptcies this year. There were about 7,500 in 2020, and in most normal years, it’s somewhere around 8,000.

So we’ve seen a 50% reduction in bankruptcies this year. That’s massive, especially when you remember that we’ve had rolling lock-downs this year, on the back of a very challenging 2020.

It’s an astounding result really.

And how did we do it?

Free money.

Government support programs have put a floor beneath businesses and helped keep them afloat.

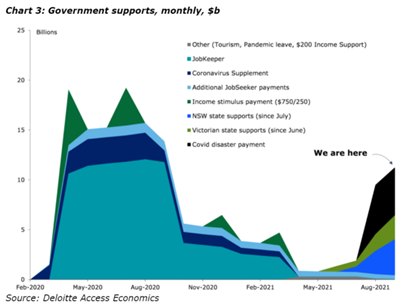

You can see how the free money program played out in this chart. There was a surge in the early days of Covid, before it started to taper out late last year.

But then the economy went into lockdown mid-this year, and the support payments kicked in again – largely coming through state programs rather than federal.

The net result though was that at the peak of lockdown, there was almost as much money flowing into the system as there was at the peak of Covid in 2020.

And when you look at how that’s affected the Federal Budget, you can see that there has been a massive blow out in the budget, with record deficits expected over the next five years.

That’s a lot of money.

But that money has worked. Not only has it kept good businesses afloat and kept people in jobs. It has also, based on these numbers, kept about 4,000 bad businesses afloat – businesses that would have folded in normal times.

And look, I’m not saying this is a bad thing. In the middle of a pandemic it’s impossible to know who is a good business and who is a bad business. The only practical way is to support them all, and that’s the policy we got.

But the fact that we saved 4,000 bad businesses from going under does speak to just how much money has flowed into the system. The government wanted to be on the side of over-spending rather than under-spending (and again, that’s the right attitude to take), and so we got a bigger injection of money that, in hindsight, we probably needed.

But what this creates is a situation where not only has the government money ‘plugged the gaps’ – it’s helped take the economy up a notch.

And we’re not seeing it just yet because we’re still crawling our way out from under lockdown.

But we’re going to see it in 2022.

All that free money is going to juice the economy, juice the jobs and wages market, and juice asset prices.

As sure as night follows day.

I’ve got a feeling that 2022 is going to be huge.

DB.