If money printing creates inflation, how do we make money?

Ok, let’s imagine that the huge amount of money printing that’s going on right now does actually lead to inflation, or hyper inflation.

How do we make money off of that?

This isn’t an academic exercise. Money printing is literally off the charts right now, all over the world.

In the past, that kind of money printing has often led to extreme inflation, or hyper inflation.

That is, money becomes more and more worthless, and you need more and more of it to buy anything.

As I said on Monday, in 1922, in the German Weimar Republic, a loaf of bread cost 160 marks. By 1923, after some hefty money printing had caused some epic hyper-inflation, that same loaf of bread would cost you 200,000,000,000 (200 billion) marks.

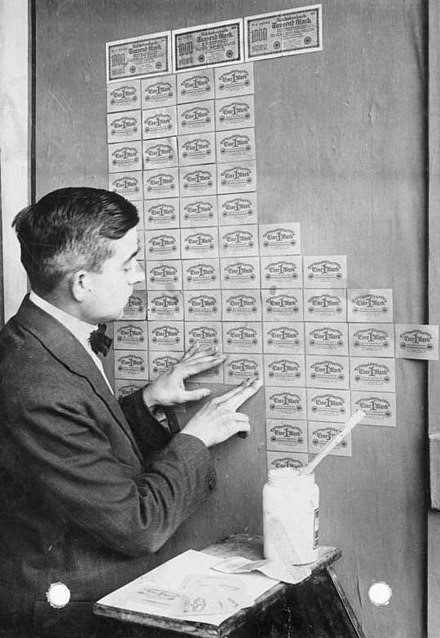

Money had become so worthless, that the newspapers were running stories about people using money to wall-paper their houses! That’s what this guy is doing:

But think about this for a sec. Who says, “You know the look I’m going for? Economic ruin. I want my interior design elements to remind me that we’re living in the middle of economic and social collapse. And these worthless banknotes are just so darn attractive.”

Nobody says that. Nobody. I betcha that this picture was staged just to sell newspapers.

Fake news! Sad!

Anyway, with the reminder that some things never change, lets imagine that you knew that hyper-inflation was coming. How would you make money off it?

Well the thing to remember about hyper-inflation is that while absolute prices are changing, relative prices are not.

So a loaf of bread costs you 200 billion marks. But a day’s labour probably earnt you 2 trillion marks.

What hyper inflation messes with is money’s ability to act as a “store of value.” So you make a loaf of bread and sell it for money. A month later you can use that money to buy cloth.

Money allows you to carry the value of the loaf of bread over time, and cash that value in when you need it. It’s one of the most important things that money does.

But when money is losing value by the day, it’s no longer able to act like a store of value.

Inflation messes with the relationship between time and money.

But if we’re talking about time and money, what else are we talking about?

Debt.

So think about it like this. Imagine that modern relativities are in play, and if a loaf of bread costs 160 marks, a house would cost 300,000 times that much, or about 48 million marks.

So what do you do?

Well, let’s say you decide to buy 4,000 properties at 100% leverage.

You know owe the banks 200 billion marks.

Then what do you do? You wait a year, bake a single loaf of bread, sell it, and clear all of your debts.

Bam. You just traded a loaf of bread for 4,000 properties.

Now this assumes that the banks don’t see this coming and don’t charge you crazy interest rates to offset the falling value of the currency.

But the point is, if you knew that inflation was coming, before anyone else did, you would pile everything you could into hard assets.

And this is what happens in inflationary periods – there’s a rush towards hard assets – to places that preserve wealth. Could be factories. Could be gold.

It’s definitely property.

Now, as I said on Monday, I don’t think we’re heading toward hyper-inflation in Australia. There’s some important differences.

But still, money printing the world over is causing the value of money to fall. That in turn is causing a rush towards hard assets. Stock markets have already started booming.

But we’re only getting started.

The more money they print, the more demand there is for property and other hard assets.

And given how much money is flowing into the system right now, we’re at the very early stages of an epic boom in asset prices.

Are you ready?

DB.