I mean, who doesn’t love Aussie property?

I don’t know if you were in the market during the last cycle, but around 2016 one of the big themes in Aussie property was the influence of foreign buyers.

Back then, regulation seemed a bit lax – actually, I shouldn’t say that. The laws were there. But they weren’t being enforced.

And the law says that basically, foreigners aren’t allowed to buy existing property.

We’re ok with them buying new property because that expands the housing stock and we like that.

But we had the headline grabbing stories about people who couldn’t speak English showing up at Auction with suitcases full of cash. Russian and Chinese oligarchs were buying harbourside mansions, and no one was really doing anything about it.

But then there was a review, and the ATO and the government took more of an interest in the issue, and the foreign purchases of existing property mostly dried up.

I say mostly because according to the NAB survey of foreign buying, foreigners still account for about 2.5% of property sales. Naughty naughty.

And 2.5% isn’t massive. It’s not the 8-10% we saw in 2015, but it’s still substantial. And it’s lifting ever so slightly now.

But what should really jump out at you in that chart is the surge in new buying. That’s lifted from 2% to 8%.

That’s a big jump.

The other interesting thing with this is the state by state break down. When you look at it, you can see that this lift has mostly come from just NSW and Western Australia.

I don’t know why that is. But it’s interesting.

And what it is showing is that foreign buyers are coming back to Australia.

Personally, I’m surprised its taken them this long.

Because what we had last cycle was what they call ‘safehaven flows’.

That is, when there’s a lot of money in the system, but things are looking a bit shaky, all that money starts looking for a safe haven to call home.

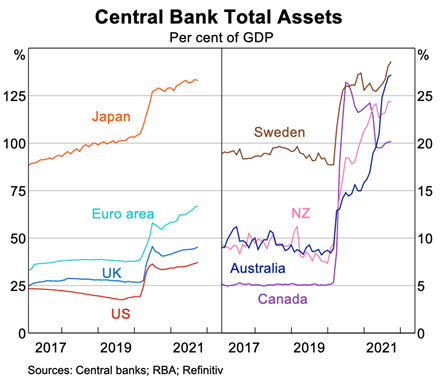

And there is a lot of money in the system right now. Central Banks the world over when on massive money printing sprees, and there’s cash everywhere.

And these are still uncertain times. There’s a sell-off in tech sector stocks, there’s a lot of uncertainty. No one really knows if the war in Russia is going to go nuclear.

So of course all that money is looking for a safehaven.

And in that context, Aussie property is an excellent option. Even if it doesn’t keep storming upwards in price, it’s not going to fall. And the Aussie dollar is stable so it’s not going to collapse.

And so what you have is an excellent place to park your money to keep it safe.

And so I would expect these foreign buying numbers to keep pushing up, as we get more and more safehaven flows.

And that, in turn, will push Aussie prices higher.

Who doesn’t love Aussie property?

DB.