The IMF shows us just why we can be relaxed about the current market

There’s a curious air of panic about the place.

Not everybody is freaking out. But a few folks are losing their heads.

You’d think this was the first property price downturn they’d ever seen.

Oh… it probably is.

I’m an industry veteran. I’ve seen it all. I know for certain that the market will go up and then it will go down.

(… and then it will go up again.)

But most people haven’t been in the game as long as I have. Most people have known nothing but good times.

That’s kind of true for Australia as a nation. We’ve been the lucky country. 20-odd years without a recession. Probably as long without serious property price corrections.

Young investors don’t know how good they’ve had it. They’ve never known anything but sunny weather.

I mean, when I was a young investor, we had to endure three property price consolidations before breakfast, and then bring the cows in for milking.

I’m mucking around, but there is some comfort to be taken from history, even if you can’t take it from old hats like me.

The IMF was making this point a few weeks ago. With people worrying that Australia’s housing price downturn might translate into something more serious, they went out of their way to talk it down.

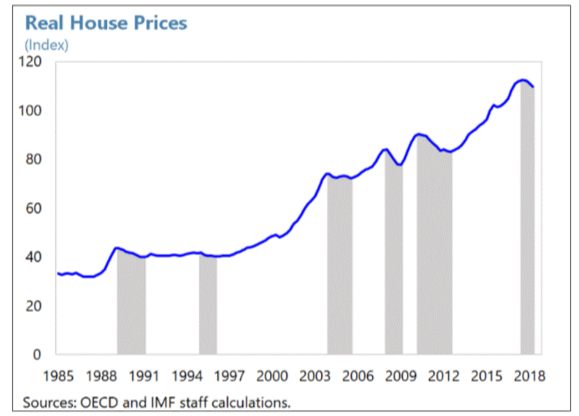

As they note, and despite popular belief to the contrary, Australia has had five major market downturns in the past thirty years.

The five downturns were:

The corrections in 1995 and 2004/05 were pretty minor, but prices fell more than 5% in all of the others (right now, national prices are down about 7%).

You can probably get a better sense of the swings-and-roundabouts nature of the market by looking at the chart of annual price growth.

As you can see, price falls tend to follow periods of strong price growth. In the most recent cycle, price growth never got crazy – we never got to 30% per annum like we did in 1988! But the strong growth we had was sustained for a decent amount of time.

A consolidation was always inevitable.

I want you to take a good look at these charts and let it sink in.

Because there’s an important lesson in investor psychology here.

Because young investors – those investors who have never known nothing but sunshine – they’re getting jumpy.

And they might be thinking that now is not a good time to invest in property. They might be thinking that now is a good time to sell out and cash in. They might be thinking it’s a good time to buy tinned food and ammunition and head bush.

But go back to any other point in the cycle.

Go back to the 1991 recession. Go back to the GFC. Go back to the end of the mining boom. If it’s a bad time to invest now, it was a worse time then.

And was it a bad time to invest? If you invested in property then, do you regret it now?

Of course not. Because the market moves in cycles. What goes up, must go down.

And what goes down, must go up.

This is just the way the market works. Take it from an old hat like me.