It’s not going to be massive, but there’s a little good news for property prices here.

It’s a tough time to be a builder.

That seem to be going bankrupt left, right and centre.

We’ve had a few big names go under in recent months, guys like Porter Davis Homes, Mahercorp and Urbanedge Homes, alongside scores of smaller players.

And the people who have been in the industry reckon things are going to get worse. That there’s “a lot more pain” on the way.

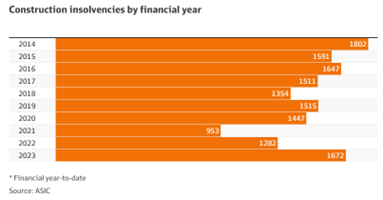

So far this financial year, insolvencies in the construction industry – the number of construction firms going bankrupt – is at a decade high, and there’s still months in the year left!

Australia’s construction industry is headed for “a lot more pain” as tearaway inflation in materials, labour and rain delays worsen devastating losses on fixed-price contracts, just as the pipeline of new work dries up and competition intensifies.

Builders behind more than 5200 homes, worth at least a collective $2.2 billion, have collapsed since 2021 and the official insolvency figures released on Tuesday show failures in construction have hit a nine-year high, just short of the decade record of 1802.

The financial-year-to-date figure is the highest since 1802 in 2014 and a 43% jump on the 2021 total of 953 construction insolvencies:

Industry insiders are worried. It looks grim:

“It’s the grimmest I’ve ever seen in 45-odd years in the industry,” said veteran home builder Robert Lynch, executive chairman of ASX-listed builder Tamawood.

“It’s going to be a very tough 18 months to two years. We’re going to see a lot more pain. They’ve been so slow to build they’re finishing off a lot of houses now that are going to lose a lot of money. I see that being a huge problem.”

Homebuilders were caught in a perfect storm.

They took on a stack of new work, as the governments home-builder program tried to fill an expected hole by incentivising new construction. Only the hole never happened, and the builders extended themselves.

That would have been fine, but then Covid threw supply chains completely out of whack, and the price of construction materials exploded.

Since home-builders had signed fixed-price contracts, materials inflation ate into their margins until there were no margins left.

At that point, they were losing money. They’ve been raising prices on new contracts, but the industry on average is still losing money:

And now we have an insolvency crisis, as various support programs come to an end. One insolvency expert is calling it an ‘insolvency armageddon’:

Scott Taylor, partner at insolvency and reconstruction law firm Taylor David Lawyers, said that nearly 5000 firms had avoided insolvency because of government support programs including JobKeeper.

Taylor described the situation as an “insolvency armageddon”.

“The situation is dire. We’re seeing industries across the board starting to feel the pinch of the economic headwinds,” he said.

And this is happening at the same time as demand is falling, thanks to rising costs and rising interest rates. New housing approvals have fallen to a 2½ year low.

New dwelling approvals in the 12 months through March fell 15 per cent to 180,893 from the year-earlier period, the Australian Bureau of Statistics said on Monday. It was the weakest yearly result since October 2020, when approvals totalled 180,165.

The sharp decline, which the industry warned will worsen the affordability and rental crises, is crimping the pipeline for new housing.

They’re not wrong.

With demand and immigration rising, we’ve got an epic housing shortage brewing.

You can forget about affordability improving.

DB.