The property market isn’t what it was 20 years ago, but a lot of newbie investors are still investing like it’s 1999. Unless they understand this one simple fact, they’re going to get burned.

At the risk of sounding like an old fart, the property market ain’t what it used to be.

Houses are still houses (plus few mod cons) but the property investing game has changed, and I don’t think a lot of people have woken up to the new reality.

Especially newbie investors. Maybe they’ve been watching their friends get ahead in life and have finally decided for themselves to jump in the pond. Or maybe they’re following their parents’ advice, and are now ready to try out their own wings.

But if they follow the strategies that worked for their parents, or worked for their friends 20 years ago, they’re going to get burned.

Because In the olden days, a lot of people took what I would call a pretty passive approach to investing. Just pick somewhere nice, lay down your money, and then just wait for the property train to carry you gently into a comfortable retirement.

And there’s nothing wrong with that. It worked. It worked well.

But the property market was a lot more stable then, and dare I say it, more predictable.

Residex has done some interesting work looking at the spread of returns in Sydney, 20 years ago and today.

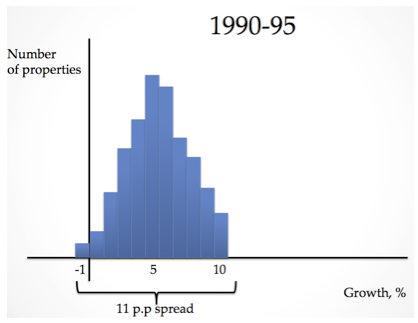

They reckon that between 1990 and 1995, the best performing houses in Sydney grew at a rate of 10% per annum. The worst performing houses fell by 1% per annum.

That’s a spread of 11 percentage points.

I don’t have the exact figures to hand, but we can chart what that probably looks like here:

Here, some properties are growing at 10%, some at -1%, but most clustered around an average of 5 or 6%.

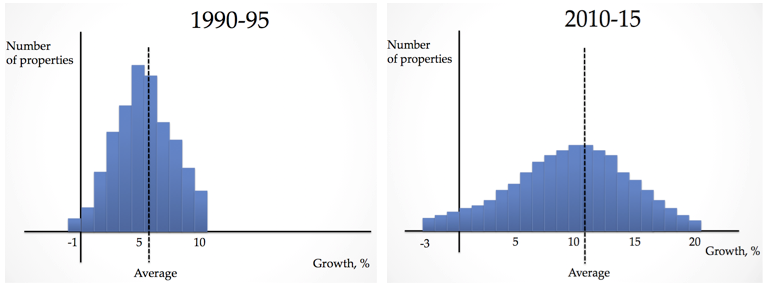

But fast forward twenty years and the spread has doubled. Residex reckon that in the last 5 years, the best performing houses in Sydney grew at 20% per annum. The worst-performing houses fell 3% per annum.

The spread is now up to 23 percentage points.

Now 20% per annum is great. Fantastic. It’s almost feet-up in the Caribbean good. But falls of 3% a year, or 16% over 5 is not good. That’ll hurt. And if you’re a young investor leveraging everything into you first house, it’s really going to suck the wind out of your sales.

And to go backwards that much when Sydney’s in the middle of one of it’s biggest boom runs in recent times..? That’s really going to hurt – your ego if not your bank balance.

The point is that when the spread doubles like it has, there’s a lot more variation in the outcomes the market is going to give you.

In 1990-95, outcomes were clustered around the average. But in 2010-15, it’s a much flatter distribution, and you’re just as likely to get high returns as low returns. And there’s even a chance you’ll lose money.

The other point to note is that when the market is changing like this – when the spread is increasing – the ‘average’ doesn’t tell you all that much.

The average is 2010-15 is much higher than it was 1990-95, but there’s still a lot of properties towards the lower end of the performance spectrum. And there’s even more chance of going backwards.

And so if you were to buy a random property in Sydney back in 1990-95, you probably had a pretty good idea of where you were going to end up. There was a good chance that you’d score yourself returns within a few percentage points of the average.

But in 2010-15 it’s much less predictable. A random property could give you double-digit growth, but it could also lose value. Both boom and bust are possible.

So what’s the implication here?

And by that I mean, when you’re getting such variation in outcomes, doing your research and buying the ‘right’ property becomes much more important. It was less important 20 years ago when outcomes where more closely bundled together.

But now, if you put in the hard yards with your research, not only can you avoid losses of 3% a year, but you can maybe even score yourself 20% a year.

We like that.

The other implication is that in an environment like this, negative gearing becomes a riskier strategy. Even though average growth is higher, there’s more chance of buying a property that goes backwards in value.

A negatively-geared property that’s going backwards in value is a very un-fun way to lose money.

The final implication is that the strategies that I believe in, about manufacturing growth and going after cash-cows, help take some of the gamble out of investing. You bring more of the game inside your sphere of influence, and you’re less at the mercy of the (increasingly unpredictable) market.

The game has changed. You can’t just sit back and expect the market to look after you anymore.

It’s never been more important to get the right strategy going with the right place.

And how do we know what the ‘right’ strategy and ‘right’ place is?

Well it just so happens I’ve written a book…

Any long-time investors feeling like the game has changed?