Should we be worried about the bubble in commercial property?

One of the key concerns last year was that an oversupplied high-rise apartment market might weigh heavy on the market overall.

So far, as much as we’re seeing any fall out from this, it’s been fairly contained. It certainly hasn’t been the house of cards that some people worried it would be. (I wasn’t one of them.)

It is probably true that construction is running ahead of sales, and you wonder how many projects in the pipeline might have to be put on ice.

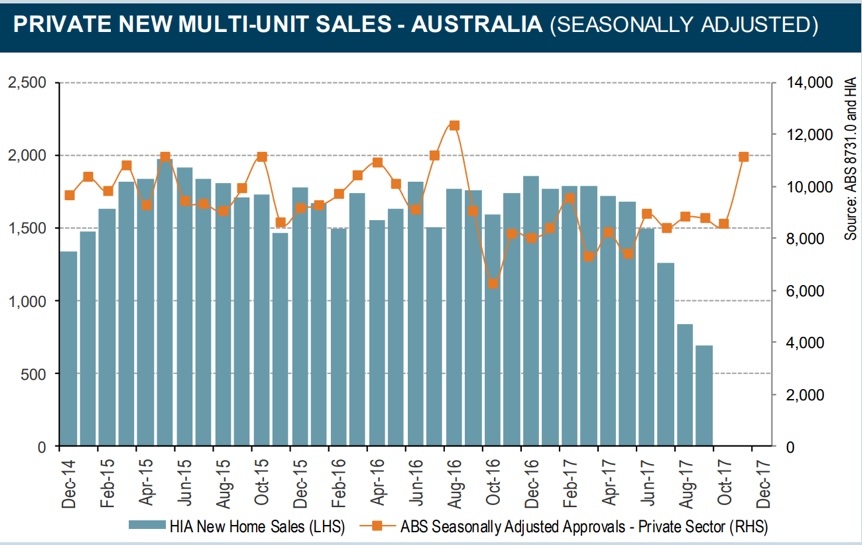

Take a look at this chart here from the Housing Industry Association. High-rise building approvals are the orange line and are still cruising at a decent clip – they even jumped towards the end of last year.

However sales, the blue bars, have tanked.

That seems to have a fair bit to do with restrictions on off-shore and particularly Chinese buying, but whatever the case, with sales tanking and construction holding up, that’s going to put downward pressure on prices.

I still expect this to be fairly contained to the high-rise sector itself, but there are some overlaps that mean the impact could be wider spread. For example, we are hearing stories that rental prices for student accommodation are under pressure in Brisbane, due to a large new stock of entry-level competition.

But we’ll ride it out.

The real danger with all of this is on the development side. If you remember the Irish housing bubble (and I’m not sure bubble is really the right word), but it was a glut of development, and bank exposure to that development, that eventually brought things crashing down.

When the developers went bust, so did their banks. (And by bust, I mean, got lots of money from the government.)

So how are our banks doing?

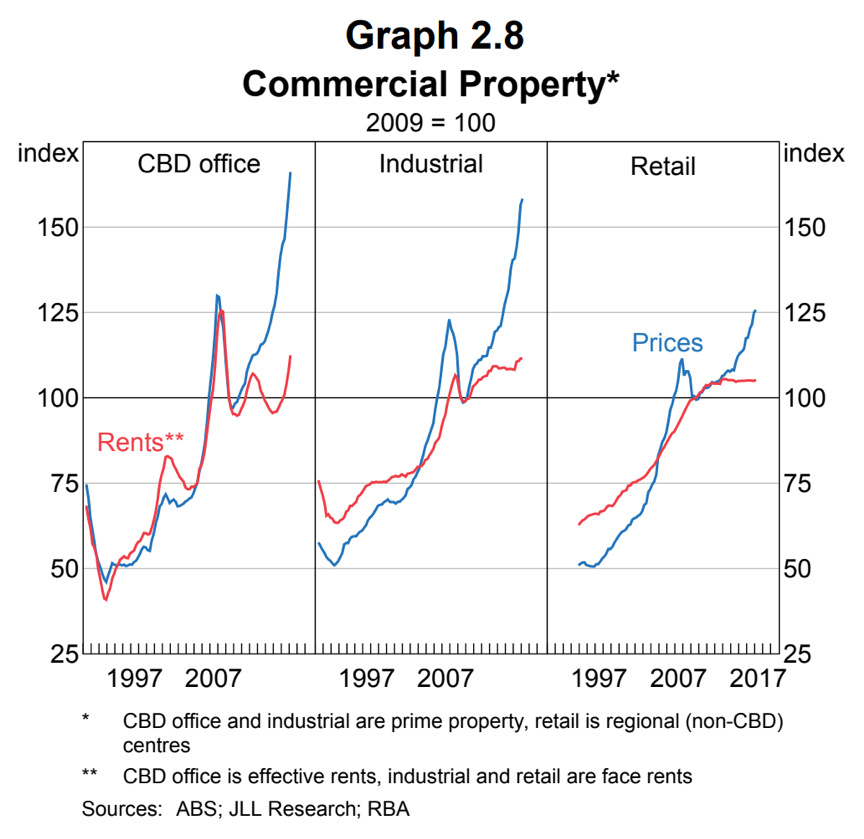

Well, on first blush, there are some signs to make you nervous. I mean take a look at what’s happening in commercial property – where we’re generally talking serious cheese and bank-killer projects.

Prices are booming, and seem pretty astronomical compared to rents. It looks a shade bubbly.

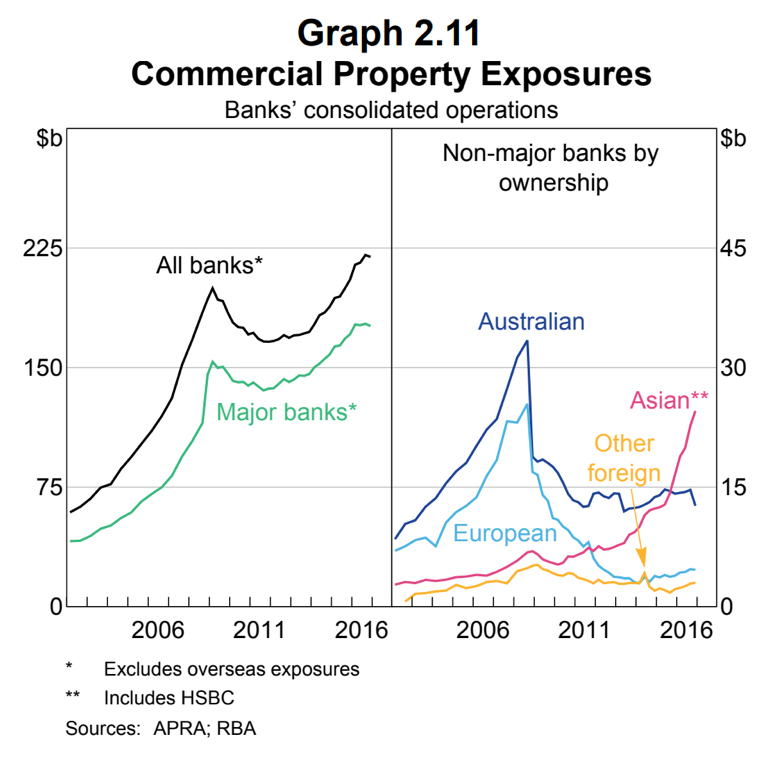

But in the same way that Aussie banks have black-listed certain suburbs for high-rise development, Australian banks have been unwinding their exposure to commercial property.

And if you look at the charts on commercial property, Australian bank exposures are just running around the same levels we’ve seen since the GFC – which is fairly modest given the booming prices we’ve seen.

However, looks who has stepped into the breach – Asian banks, the pink line. They’ve ramped up their exposure.

And so if you’re looking at who is paying the crazy money for large commercial and residential development sites, it tends to be Asian developers financed with Asian money.

Should we be worried about this?

Well, yes and no. It would be a shame if a large Asian development went bust. The local tradies they were employing would find themselves unemployed. That’d be a bummer.

But they’d go bust owing money to their financiers in Asia. That banks creditors may then start to get a little nervous.

But to the extent that the risk gets exported off-shore, Australian banks don’t have all that much to fear. Their exposures are relatively modest, and are not going to get toppled over by a few projects hitting the floor, if they cop any fall out at all.

And so in that sense, even though the big money, top end of town still looks a little glutty and a little shaky, the Australian banking sectors seems fine.

And that means our financial system is safe.

Which means our residential property market is protected.

So sure, sucks to be one of those Asian banks. But it’s not something I’m worried about.