Just making sure you’ve got the right end of the stick with this headline number

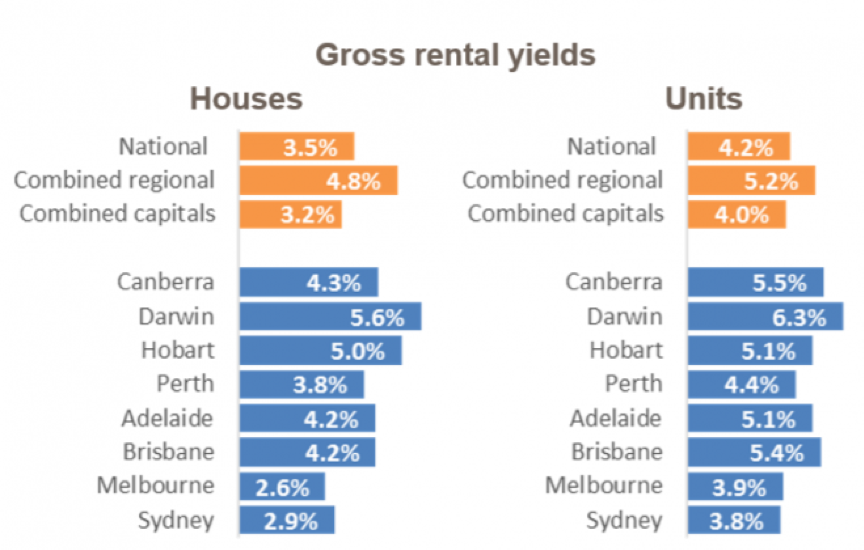

So CoreLogic is reporting that yields are up pretty much across the country.

Whoo-hoo. Awesome news, right?

Some of those yields are looking pretty good. Darwin, 5.6%. Hellooo sexy.

Stronger yields give investors more to work with. There’s more left over after the mortgage is paid.

But is this really a good news story?

Yields are a funny number, and we have to be careful about what they’re telling us. It’s like every time I see one of those reports that says, “Top 20 yielding suburbs in Australia.” I roll my eyes.

Because yields are a ratio. Effectively, it’s the ratio of rents to prices.

So if rents go up, yields go up, and it’s happy days. That’s why it’s generally a good news story.

But increasing rents are not the only way that calculation can look a little better.

For example, if rents were unchanged, but prices fell, yields would go up.

(yes, looking at you Darwin.)

Or if rents fell and prices fell, but prices fell further than rents, then yields would go up.

Definitely not a good news story.

So right now we’re looking at a consolidation-phase lift in yields. Prices are coming back a bit, basically, because they got a little too ‘exuberant’ in some places and especially Sydney.

Rents, however, are holding up, even increasing a little over-all, thanks to ongoing strong rental demand, largely through continued strong population growth.

The net effect is an increase in yields.

So as a backward looking indicator – as a measure of how well the market has performed in recent times – this increase in yields is indicative of the soft patch we’ve just seen.

Nothing we don’t know.

But what does it tell us going forward? What’s it telling us a forward-looking indicator?

Well, a consolidation-phase lift in yields typically precedes an increase in prices.

That is, if rents are rising the returns to property are improving.

Sooner or later, that will be reflected in the price.

Typically, this kind of yield increase will open the way for an increase in prices.

Will that happen this time?

My thought would be, ‘probably’.

The only question there is whether yields actually compressed too far.

When prices are rising quickly, and people are buying just on the expectation of capital gain, they don’t need such strong rental returns. They’ll pick it up on the capital gain.

As a result, yields compress. I mean look at Melbourne. 2.6%. Yowsers.

So if people are not buying on the prospect of immediate capital gain, which they’re probably not right now, we’ll need to see yields correct before we can be confident that we’re pointing to an increase in prices.

That correction will either happen through continued price falls, but more likely through further increases in rents.

So the mostly likely short term scenario from here would have to be stable prices and increasing rents, for maybe another 6 months.

After that, once Sydney and Melbourne get back to around 3%, then I think we’d be looking to see prices start growing again.

So much in just one little number.

Just thought it was worth clearing up. Hearing a lot of chatter about this yield number. Just want to make sure we’ve all got the right end of the stick.