Forget all the faff being peddled by economists. This is the one thing you need to know to understand property like an expert.

People like stories.

It’s how we process the world. We arrange things in lines of cause and effect, and once we’ve got our little ducks in the row, we feel like we understand the world a bit better.

And that feels nice. It’s a complex and crazy planet, but it’s not so bad if you feel like you’ve got a handle on what’s going on. If you’ve got a story.

Economists like telling stories.

Sure, they have models and statistics and shiny charts that say this and that. But at the end of the day, they’re just telling stories.

Ever wonder why there seem to be 1000s of economists out there, and none of them agree?

They’re all just competing to have the most interesting and compelling story. Being ‘right’ isn’t really the point. It’s about having a nice story.

And it’s always the way with the property market. Pick up the paper on any given day there’ll be hundreds of stories about what’s driving the market in one direction or another.

This year alone we’ve had stories about foreign buyers coming, or foreign buyers going. Self-managed super funds. An apartment boom. An under-supply of housing. Lower interest rates. APRA restrictions.

So many wonderful stories.

And look, these things do matter. The property market is a complex web of interacting forces. Nothing happens in isolation. Even the way I rabbit on here must have some sort of impact on the market at some level.

It’s just never as simple and as straight forward as the story tellers would have you believe.

But if we cut through all this fluff, there is one thing that you have to understand if you want to ‘get’ property. It’s as close to a “fundamental law” as it gets.

When we’re talking about property, we’re really talking about two assets. There is the land, and there is the dwelling. So when you buy a property, you’re really getting two assets for the price of one.

The thing is, that these two assets tend to go in opposite directions.

The dwelling starts depreciating as soon as it goes up. It gets older. It has wear and tear. It starts drifting away from the fashionable cutting edge.

Most times, unless you put some energy into it, your dwelling is losing value.

But land on the other hand, goes up. It appreciates. And this is because land is in fixed supply, while our population grows and grows.

And so if you really want to track property prices, you really want to be looking at land prices.

This is where it gets interesting.

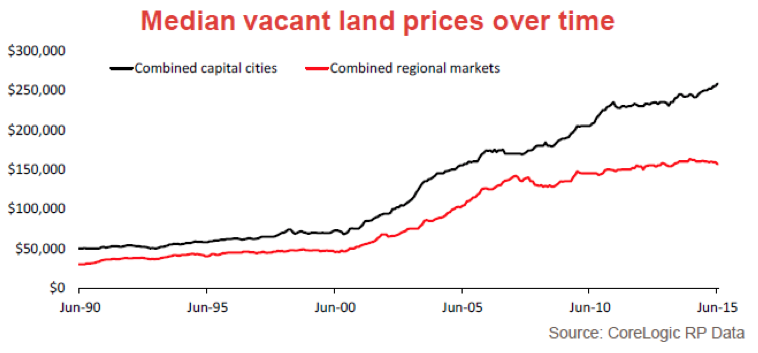

Land values have been booming since 2000, particularly in the capital cities.

What you’ll notice here, particularly with the capitals, is how smooth the growth in prices has been. The GFC, the mining boom, the Chinese buyer frenzy – all these things cause swings and round-abouts in property prices, but land prices have been on a steady march.

This, more than anything, helps us understand the boom in property prices over the past ten years.

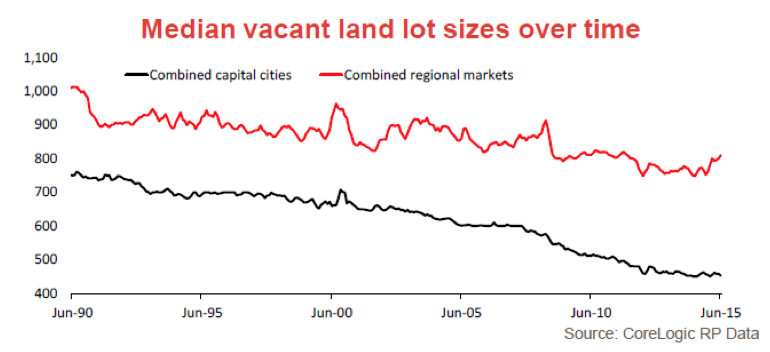

But wait, there’s more. Not only have median lot prices been rising, but the size of the average lot has been falling.

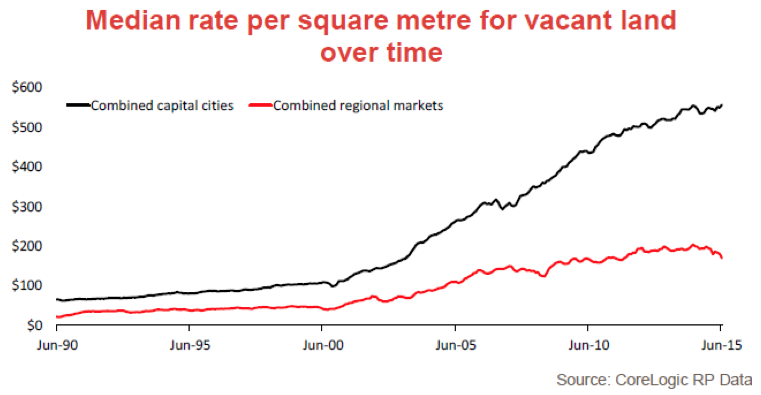

What that means is that on a price per square metre basis, the increase in land values has been even more dramatic.

Twenty-five years ago, the price per sqm for capital city vacant land was $66 and the typical lot size was 750sqm.

Today capital city land costs $557/sqm (an increase of 750%!) and the average lot size is just 450sqm.

This is the story of Australian property. Everything else is a side-show.

It’s all about land.

And so to understand Australian property, we need to dig down and understand what’s driving the explosion in land prices.

This is where it starts to get a little tricky. As Glenn Stevens says, it’s baffling that in an land-abundant country like Australia we’ve somehow managed to engineer and land shortage, but that’s exactly what we’ve done.

Planning laws keep land supply on a drip-feed. With a shortage coming to market, that creates opportunities for speculators to snaffle up land and sit on it until the prices go through the roof. That in turn retards supply even further, and prices do go through the roof.

So here’s the million dollar question for property investors: When will this change?

When will planners and governments open the taps on land supply?

I wouldn’t hold your breath.

And as long as land prices are soaring, what’s going to bring house prices down? A GFC couldn’t do it… what’s it going to take?

This is why, despite all the stories about market swings in the here and now, property remains such a good bet for the long run.

And it will remain that way until we fix our constipated land supply system.

I like those odds.

Can anything turn our land-supply situation around?