It seems like the popularity of vendor financing has really taken off in the past ten years.

It seemed to go from nowhere to become an important part of every investors tool kit.

But vendor financing has actually been around for ages – at least since the gold rush days. Back in those days, banks actually didn’t like lending for real estate, because the profits were just so much better in business lending (how things change!)

Or take this cute little ad one of my students sent me. It’s for a land release in Kiama, south coast of NSW in the 50s. Note the developer’s offering 3 year terms. Note the awkwardly placed pin-up girl. (Some things never change!)

But in the 1960s, the banks got into mortgages, legislation tightened around developer finance, and vendor financing kind of went out of vogue.

But it never went away. And in the second half of the 2000s, we saw something of a resurgence in vendor financing’s popularity.

In fact, one of my first deals, and one that really set my course into real estate, was partly vendor financed.

In some ways, I actually think its popularity is partly due to the rise of the internet and the information age.

Because vendor financing is a pretty broad concept. We might be talking about seller finance, lease options, rent-to-buy with savings plan, whatever. The point is you can cut vendor financing up anyway you want to.

And that’s the point. You can make it suit your needs.

You don’t need to squeeze yourself into the box the big banks give you.

And we don’t settle for off-the-rack anymore. For anything. We expect that we can tailor and customise. And if one shop doesn’t have exactly what we’re looking for, there’s an entire internet that probably does.

As a result, I think we’re much savvier than we used to be.

And vendor financing really works best when one or both parties are having trouble jumping through the banks’ hoops, and need to get creative.

And banks aren’t breaking their backs to cut deals.

I think we have seen some thawing of the freeze that followed the GFC. Banks got very keen to tighten up their balance sheets, and polish up their mortgage books in case they ended up going the way of their American cousins (to the bottom of the ocean!).

As a result, I saw banks knock back quality investors with no-brainer deals in the years immediately following the GFC.

It seems that those days are behind us now, but I don’t think you’d describe current credit conditions as easy.

There’s been some talk of competition heating up between the banks, but it’s hard to find solid evidence of it yet.

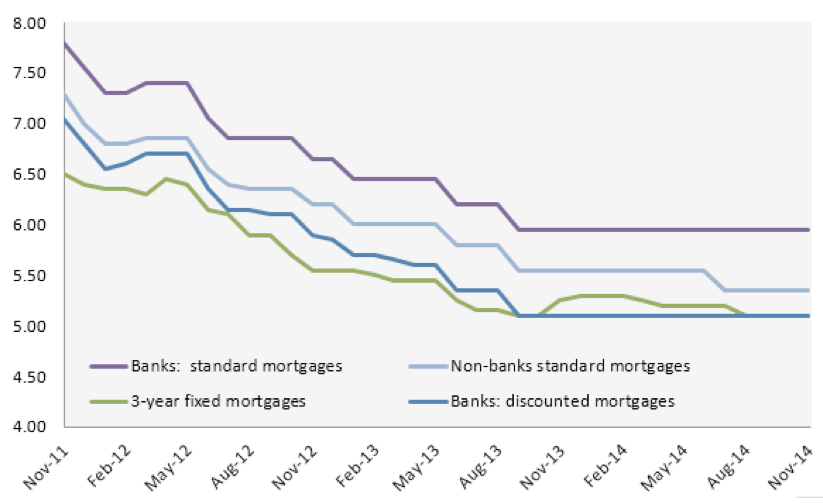

Take comparison lending rates. Maybe banks are cutting deals behind closed doors, but their chalk rates haven’t gone anywhere since the last rate cut (back in the middle of 2013).

RBA INDICATOR LENDING RATES

The exception to that is the non-bank lenders, who dropped rates 25 basis points in June. So maybe there’s a bit more action on the second tier, but it’s not much to write home about.

(Note also that 3-year fixed mortgages are now back in line with variable rate mortgages. Seems the banks are taking an each-way bet right now on whether the next move will be up or down…)

But the point is that credit conditions remain tight, and a lot of good borrowers will continue to find themselves on the wrong side of the banks’ decision rules.

Banks use decision rules – kind of tick-box decision making – because, on average, over a large sample of borrowers, they work.

They’ve identified factors that increase the probability of default – increase it such that across their full mortgage book, it’s not worth taking a risk on.

But as a lot of my students will know, there are a lot of worthy folks who fall foul of these decision rules, and just can’t get a loan, no matter how many references they’ve got, or how dependable they are.

And so this is the territory that these decision rules open up for vendor financing. If you’re an investor starting out, you can add a premium into your payments, and work out a deal with an owner. If you’re an owner, you can find a great buyer, who’s willing to pay a premium to avoid regular banking channels.

There’s many people who will be looking to buy through vendor financing. There’s your low-doc borrowers, with low taxable income. There’s people who’ve a history of bankruptcy. There’s divorcees. There’s young people starting out.

But none of these things in and of themselves mean they’re going to be a risk.

For example, some friends of mine ran a small telco company, as husband and wife team. She had just finished her MBA, and they had written the cost of her study off against business income.

Smart move.

Trouble was that when they went to get a loan, their taxable income was almost nothing. Bank after bank knocked them back.

But they weren’t risky borrowers. Far from it. They were in an excellent financial position.

So as sellers, we can make a deal with solid people who’ve been unfairly lumped in the risky box. And draw out a premium for our trouble (we still need to take the time to separated the unfairly risk-labelled from the genuinely risky).

And in the process give these buyers a window into property they otherwise wouldn’t have had.

It’s win-win for everybody.

Well, maybe not the banks. But who’s going to shed a tear for them?