Seems that selling farms to foreigners is big business. Isn’t it time for some ‘real’ investment?

I was trying to get a feel for just how big an impact foreign buyers are having in Australia.

We hear a lot of stories. Everyone knows someone who was outbid at an auction by someone speaking a foreign language. Analysts say the inner-city apartment boom is being driven by Asian buyers…

There’s a lot of stories. But sometimes there can be a big difference between ‘anecdotes’ and ‘evidence.’

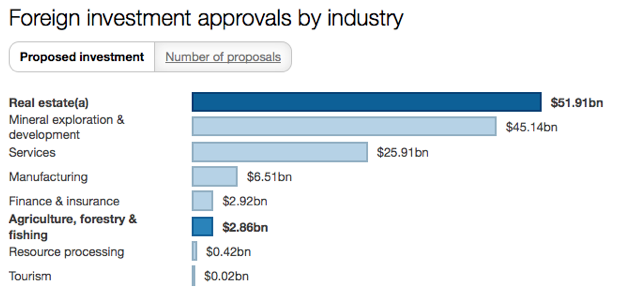

And so I was hunting around. There isn’t much out there. But then I came across this chart from the Foreign Investment Review Board (FIRB). This is the value of investments given the go-ahead by FIRB, by industry.

Look at that. There were $51.9bn in approved real estate investments last year. Seems like a lot, right?

And then you compare it to mining investments at just $45bn and something just doesn’t add up.

Foreigners invested more in real estate than they did in mining..?

That just doesn’t pass the sniff test.

So I dig a little deeper and it turns out that real estate isn’t just houses and apartment towers.

It also includes farms.

So if you buy an Aussie farm, it’s not counted as an investment in agriculture. It’s counted as an investment in real estate.

That’s a bit strange isn’t it? Seems like an odd way to sort your beans to me, but I guess you’ve got to do it some way.

So the question then is, how much of this foreign real estate investment is actually real estate, and how much is farms?

No idea.

Yep. We don’t have data on that. We don’t really have any idea how many Aussie farms foreigners are buying.

Does that make any one else a bit uncomfortable?

Turns out there’s no comprehensive national list of foreign investment in rural land. The only state that keeps records in Queensland. According to those records, foreigners spent $1.7bn on land last year. Those foreigners came from 69 countries across the globe, but the biggest spender was China.

And here we are back in anecdote land.

That all suggests that there’s some big money being spent buying rural land, but we just don’t know how much.

And so all we’ve got to go on is more anecdotes – like this story the other day about Chinese billionaire Xingfa Ma, one of the richest men in China, spending $47m on two cattle stations on the QLD/NT border.

So why does it make me a little nervous?

Well, generally I’d say I’m a big fan of foreign investment. There’s a lot of benefits it brings to the host country. There’s the injection of money, there’s the skills and the expertise that the investing company brings, there’s the potential for new jobs, and there’s the increase in productive capacity, which helps the economy grow.

Take the investment in a new apartment tower. There’s a bunch of construction jobs created. Asian developers probably know a thing or two about building apartments, and at the end of the day, Australia gets a bunch of new homes to house it’s citizens.

But buying a farm is something different. The farm already exists. You’re not creating a new farm. You’re not building something new. You’re just selling the ownership rights to someone else.

In that sense, it’s not really ‘investment’. It’s just selling land.

What about skills and expertise? Well, Xingfa Ma has obviously got some business nous, but Australia’s a pretty unique environment. I’m probably a little biased, but I’m not sure Aussie cattle farmers need anyone coming and telling them what to do…

And what about jobs? Well, that’s the thing about all these new “free” trade agreements, like the one we just signed with China. These agreements allow Chinese companies to bring their own workers on temporary visas for certain projects.

And so it raises the prospect of vertically integrated businesses, with Chinese firms running production, processing and shipping, and employing no locals along the way.

Again, what’s the point? It’s not investment. We’re just selling off the family jewels.

Selling the farm, so to speak.

But let me be clear. This isn’t about China. It was about other countries before and it will be about different countries in the future.

The problem here is the mindset that confuses ‘investment’ with ‘selling off’. I’m all for one and not a fan of the other.

And we have the principle in place in actual real estate. Foreigners can invest in new housing, but not in existing. If they’re going to create something, then great. If not, then no thanks.

The same principle should apply to all foreign ‘investment’.

And I’d like to think that governments through the ages have just been a bit muddle-headed on this point.

But the cynic in me worries that some politicians would sell off their grandmother to the highest bidder. And the realist in me knows that good, honest people find politics very tough going.

We’ve got a system where money talks.

But for it all it’s flaws the system more or less works because the people hold their politicians to account.

And so this is one more case where the people will have to offer their leaders a bit of leadership.

Hold on to the farm and hold out for genuine investment, I say.

Righto. Anyone else want a go on this soapbox?

Is selling farms ‘real estate’? Is it investment?